How to Make Consolidated Statement of Cash Flows with Foreign Currencies

Did you know that many groups prepare their consolidated cash flow statement completely incorrectly? And, if you are well-experienced accountant, you can actually spot the faulty numbers instantly when you look to the statement of cash flows. Sadly, this wrong method is often taught in…

How to Test Goodwill for Impairment

When a company acquires control over another company, then often a goodwill arises, too. You should present it as an intangible asset, but when you think about it carefully, a goodwill is not a typical asset, because unlike other assets, you cannot sell it to…

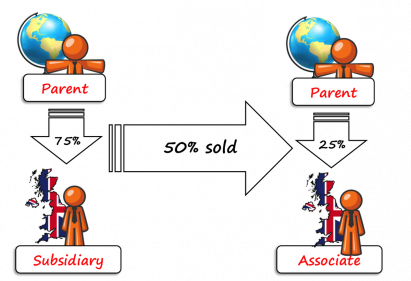

How The Groups Change

Group accounts are a very popular topic and yes, I can understand it as it’s a main topic for many accounting exams. I have written a few articles about it, including: Intro to group accounts and consolidation; Example: How to consolidate; and a few summaries…

Top 5 IFRS Changes Adopted in 2014

The year 2014 brought us some very significant changes in IFRS. While some changes might not give you a hard time to adopt, the other changes can cost you a lot of money and time to make them effective in your company. The year 2014…

IFRS 11 Joint Arrangements

Joint venture or joint operation? What is joint control? How to account for joint arrangements? In our consolidation series, we have already covered investments in subsidiaries (IFRS 3 and IFRS 10), associates (IAS 28) and other financial instruments. Today, we’ll take a look at the…

IAS 28 Investments in Associates and Joint Ventures

Let’s focus on associates, joint ventures, significant influence and equity method today. You have already learned various aspects of having control over some investment: how to identify it, how to account for it and we also learned basic consolidation procedures step by step. It was…

Example: How to Consolidate

Step-by-step solved example of consolidation under IFRS 10 with video and excel. You will learn exactly WHAT you are doing and WHY you are doing this. If you apply this systematic method, your balance sheet will always BALANCE with no errors.

IFRS 3 Business Combinations

When should you apply IFRS 3 and when IFRS 10? What is the difference between IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements? Today, I’d like to continue our “consolidation” series and after the introductory lesson and the summary of IFRS 10, let’s…

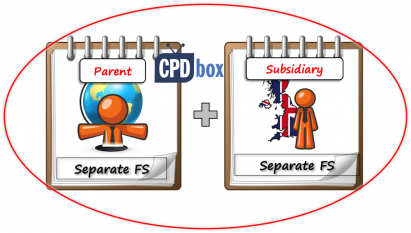

IFRS 10 Consolidated Financial Statements

In my previous article I introduced the world of group accounts and consolidation to you. You learned that there about 6 IFRS dealing with this topic. Here, I’d like to summarize the first “consolidation” standard dealing with the consolidated financial statements: IFRS 10. What is…

Intro To Consolidation And Group Accounts – Which Method For Your Investment?

Update 2023: Please scroll down to download the infographics for your future reference. Buying a foreign company or just some shares, building up an entirely new business or starting mutual venture with somebody else are some basic ways of spreading the business activities. Consolidation goes…

Recent Comments

- Hongyun Xiao on IFRS 2 Share-Based Payment

- Hongyun Xiao on Summary of IAS 40 Investment Property

- Silvia on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Krishna on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Jenny on Summary of IAS 40 Investment Property

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)