The Conceptual Framework for Financial Reporting

Update 2019: As the new Framework was issued in 2018, there’s a summary of updated Framework with the new video here on this link.

The Conceptual Framework for the Financial Reporting (I will call it just “IFRS Framework”) serves as a pillar on which the whole IFRS stand. It describes the basic principles for presentation and preparation of financial statements in line with IFRS. In my opinion it’s a “must-read” document prior starting to dig in any other IFRS or IAS standard.

The IFRS Framework underwent certain changes over past years. Previously, it was called “Framework for the Preparation and Presentation of Financial Statements”. IASB, the standard setter body, is in the process of updating it. Last update happened in September 2010, but it was just partial update. Currently, it is a kind of a mix—new text approved in September 2010 plus old text that is to be replaced in the future.

The IFRS Framework itself is not a standard, but it is still very important though, as gives the users some guidance of how the financial statements shall be prepared.

So let’s quickly look inside. IFRS Framework consists of 4 chapters:

Chapter 1: The objective of General Purpose Financial Reporting

Here, IFRS Framework explains who needs information about entity’s financial situation and why—investors, lenders, creditors, but also other parties.

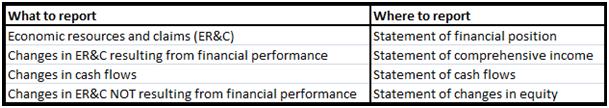

Financial statements shall provide information about a reporting entity’s economic resources and claims, plus their changes. The following small table shows how:

Chapter 2: The Reporting Entity

This chapter is empty as I write this article and will be inserted in the later process of updates. I will let you know when it actually happens.

Chapter 3: Qualitative Characteristics of Useful Financial Information

In this Chapter, IFRS Framework describes 2 types of characteristics for financial information to be useful:

- Fundamental Qualitative Characteristics are relevance and faithful representation.

- Enhancing Qualitative Characteristics are comparability, verifiability, timeliness and understandability.

Chapter 4: The 1989 Framework: The Remaining Text

Here you can see that the IFRS Framework is still in progress. Chapter 4 contains the original text of “old” IFRS Framework before any changes. As IASB adds new text, relevant paragraphs in this older text will be deleted and replaced by the new Chapters.

So what is in? Chapter 4 has 5 main parts:

1. Underlying Assumption

Underlying assumption is so-called going concern. It means that an entity will continue to operate for the foreseeable future (usually 12 months after the reporting date). Well, I will explain this concept together with example in another article.

2. The Elements of Financial Statements

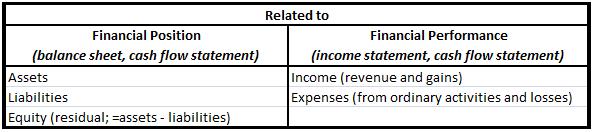

The elements of financial statements are broad classes that group various transactions and items info financial statements. Short classification of the elements is shown in the following table:

3. Recognition of the Elements of Financial Statements

Recognition of asset (or any other element) means simply showing this asset in the balance sheet (or somewhere else in the financial statements). IFRS Framework discusses WHEN to recognize or show certain item in the financial statements.

There are 2 basic criteria for recognition of any item:

- it is probable that any future economic benefit associated with the item will flow to or from the entity; and

- the item’s cost or value can be measured with reliability.

4. Measurement of the Elements of Financial Statements

While recognition means WHEN (or WHETHER) to recognize, measurement means IN WHAT AMOUNT to recognize asset, liability, piece of equity, income or expense.

There are several ways used to measure the items in the financial statements, such as historical cost, current cost, net realizable value or present value. The most common one is historical cost, but also other bases are used in combination.

5. Concept of Capital and Capital Maintenance

The IFRS Framework discusses 2 concepts of capital and capital maintenance: financial and physical.

Based on selected concept of capital, an entity determines basis of measurement and accounting model used in preparation of the financial statements.

IFRS Framework is summarized in the following free video:

Want to know more about basics? Then I’ll refer you to my article What is IFRS. Or, when you are looking for the right approach of studying IFRS, please read article How to learn IFRS.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

42 Comments

Comments are closed.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello Silvia.I heard that there is a new conceptual framework for financial reporting,was looking for it here in the website and in the Kit,any idea,thought or plans about it?thank you.

Hi Njabulo, I am working on it and it will be available the next week 🙂 You are just on the right time!

Thank You Silvia

I live in Venezuela, a real economic and political disaster and We’re in diapers (like a baby child) in IFRS’ matters, but I always trie to follow You, despite my lower english level . This information is very useful for me.

Thank you Igor and I wish you good luck!

Hi Sylvia,

Thank you for your educational articles helping us to understand IFRS.

I have questions to do with Fair Value Accounting that is; what are the components of Fair Value Accounting? What are difficulties for countries in the Pacific to adopt FVA? I understand Pacific Island Countries economies are not similar to countries like USA, Australia and the European countries.

Thanks.

Audrey

Cheers,

Audrey

Am so impressed about the presentation. Can you explian to me why accounting students srudy accounting theory. Thanks

thanks selvia for all your efforts to make ifrs understandable. my question relates to the meaning of capital maintenance concepts particularly physical maintenance and productive capacity. and how its important for income determination and choosing accounting models. kindly give example. best regards and thanks again. mohammad

Hi Silva, would you please highlight for me pillars of conceptual framework am stuck,,,,,

Hi Silva, is there reason why we don’t have a universally accepted framework in financial accounting

COULD YOU EXPLAIN OR SHOW HOW ONE CAN USE THE CONCEPTUAL FRAMEWORK TO ANSWER THE MIXED OR INDUSTRY (IFRS OR IAS)QUESTIONS IN ACCA P2 EXAMS.

Dear David,

the conceptual framework is applied when there is no specific guidance in the individual IFRS standards for the particular situation. Therefore, you should always explore whether some IFRS standard is applicable and if not, then you should develop your own accounting policy while complying with the framework. Good luck! S.

please show me how to use the conceptual framework to answer industry questions in the p2 exams.

Or is there a format to follow to answer the industry questions?

hello is there any difference between FOR THE YEAR ENDED and AT THE YEAR ENDED

Hello,

yes, there is.

For the year ended = covers all period and it says about processes or transactions during the year. It’s used for P/L statement, cash flow statement.

At the year ended = it’s a snapshot of your assets/liabilities at the point of time. Used for the statement of financial position.

Hope this helps

S.

don’t sponsor students from developing countries (Zambia) i need the knowledge of accountancy. Im pursuing Msc (Accounts & Finance)but i need pure accountancy, hindered by scarce resources

i adimre yo concept and need to learn more from Zambia. Need to do accountancy

Due to impairment indicators, a asset is impaired by a big amount when comparing to carrying value of the asset. please analyse this scene under faithful representation characteristic?

Asset carrying amount before impairment test 250 million

Impairment charge recommended 175 million

Please help

Not realy much information, but if the impairment loss really is that big, well then you need to recognize it. I have no idea what you want to analyze here. S.

Pls can make me understand the more treatment of revaluation items in the SCFP and SCIE

Dear Silvia M. How can I get free online Certified Public Accountant or ACCA or ACA. I am Investigation Senior Auditor In Ethiopian Revenues and Customs Authority, Large Tax Payers Branch office, Because I haven’t money to learn CPA OR ACCA OR ACA. Thank you. Hailu Deme From Ethiopia.

Cho mình hỏi theo frameword chapter 4 chi phí phát hành cổ phiếu trái phiếu xử lý như thế nào?

Dear, try English next time, otherwise I’ll delete your comments. S.

Awesome work silvia, you have made IFRS a fun learning thing by simplifying all of it in a easy and understandable language 🙂 thank you soo much 🙂

Hello Silvia.

Thank you for relevant clarifications.

Kindly help here:

Under conceptual framework ‘income’ is defined as …enhancements of assets or decreases of liabilities that result in increases in equity other than those relating to contributions from equity holders. The ways liabilities could decrease are revaluation/ restatement or repayment. It is stated that revaluation meets definition of income but are excluded from income statement. Why is this so considering the definition above.

Hi Gerard, the reason for introducing other comprehensive income was to distinguish the income from primary performance activities from other income. I have written more about it in my article here: http://www.cpdbox.com/how-to-distinguish-other-comprehensive-income-from-profit-or-loss-and-changes-in-equity/

Kind regards

Silvia

WOW!! Am thoroughly impressed with the website. You are a Godsend. I will be definitely informing some of my classmates of this brilliant find I discovered tonight.

Thank you! Glad to have you here 🙂

Dear Silvia,

You are a brilliant professor and your articles on IFRSs are excellent and we acknowledge you for your brilliant work.It’s simple, understandable, well researched, useful and applicable our place of work, class and in businesses.

Thank you and keep it up.

Thank you so much! S.

Hi Silvia

Please help me with the following question.

At the date of the revaluation of the office building the following were provided.

Gross carrying amount: 1200 000 (by the sworn appraiser)

Gross carrying amount: 1207 000 (determined by the company’s accountant based on IAS16 par 35(a)).

Which carrying amount should be presented on the financial statement? (Please give reference to the relevant sources to support your answer.)

Hi Reginald,

I guess your sworn appraiser gave you the fair value at the date of revaluation, didn’t he? Otherwise I don’t understand this question fully.

So if 1 200 000 is the fair value provided by your appraiser, then this should be asset’s carrying amount (net) – para 31 of IAS 16.

Paragraph 35a of IAS 16 just states how to determine gross carrying amount (before accumulated depreciation) and accumulated depreciation – the difference between these 2 should be asset’s net carrying amount = fair value. So if you accountant determined gross carrying amount at 1 207 000 and accumulated depreciation at 7 000, then the net carrying amount would be 1 200 000 (fair value).

If I understood it in the wrong way – sorry for that, maybe you need to clarify that a bit. S.

Hello Silvia, i appreciate all these tutorials. Pls can you help on the concept of capital maintanace.

Hi Ahmed, what specifically do you need to explain?

I would like to know how to record this transaction,it seems so complicated regardless of my knowledge in accounting;

a machine is bought at a cost price of R150000 but only 10% is paid the rest is paid on delivery,it is supposed to be trading stock but the owner rather doesn’t unpack it for more than a year,it took the machine 8 months to be delivered,how wil this be recorded,bearing in mind that each event happens in its own day

Hi rose,

You don’t say anything about the contract provisions, such as – who is the owner of asset at the moment of the first payment? When does your company take risks associated with this machine (at 10% payment? after delivery?). But for me, it seems you are just paying advance payment and the ownership comes at delivery. If this is the case, then the entries would be:

1) Purchase of machine (contract+payment of 10%) – just book the advance payment for the asset. There are probably no liabilities resulting from the contract, although I have not seen it.

2) Delivery of a machine plus payment of 90% – this is the moment to book the acquisition of asset. But this is NOT the moment of starting the depreciation, because the machine will be unpacked for more than 1 year.

3) When owner unpacks and starts using the machine – start recognizing depreciation.

Hope it helps – let me know!

Have a nice day!

Dear Sylivia,

I would like to be educated more about elements of financial statements. I thought that when you are asked to mention elements of financial statements, you would be expected to mention the following three sets:-

1. Statement of Comprehensive Income

2. Statement of Fianancial Position as well as

3. Statement of Cashflow

However in your article you have mentioned that there are five elements of financial statements to include income , expenses, assets , liabilities, and equity. I would love to understand better that if some one asks me what are the elements of financial statements? which one should be the correct answer?

Kindest regards,

Goodhope Mkaro

Hello, Goodhope,

in fact, you need to be careful about terminology in the IFRS, because elements and components of the financial statements is not the same thing. So let me clarify:

Elements of the financial statements = assets, liabilities, equity, income, expenses => these are defined in the Conceptual Framework for the Financial Statements

Components of the financial statements = statement of FP, statement of PL and OCI, statement of CF, statement of changes in equity and notes => these are defined in IAS 1 Presentation of Financial Statements.

Hope it helped. Best regards,

Silvia, IFRSbox.com

Excellent !

Fabulous silvia.

Howdy! Would you mind if I share your blog with

my zynga group? There’s a lot of folks that I think would really appreciate your content. Please let me know. Thanks

Hello, I don’t mind sharing my blogs as soon as given full credits to ifrsbox.com. Silvia

good work…