2 Steps to Distinguish Other Comprehensive Income from Profit or Loss and Changes in Equity

Update 2023 – please scroll below to download 1-page infographic summing this all up. Totally free.

Some time ago, standard IAS 1 Presentation of Financial Statements significantly changed and introduced the statement of other comprehensive income.

And then it began: lots of confusion, frustration and doubts! Many of us simply did not get the point and started to flounder in the fog. What items belong to OCI? What items belong to P/L?

This situation persists until now. Even in these days when I work with the client I see that she is not sure whether she is dealing with other comprehensive income or profit or loss. And, how do the changes in equity fit in?

What is the difference between other comprehensive income and profit or loss? What is the difference between other comprehensive income and changes in equity?

Let’s bring it some light.

The key is net assets

Surprised? It is as simple as that: the whole thing becomes clear when you focus on the net assets.

First, we need to understand what the net assets are.

Net assets are simply total assets less total liabilities of a company.

It is the same as equity which is the residual interest in the assets of an entity after deducting all of its liabilities.

As you can see above, if total assets are greater than total liabilities, then there is a positive equity or net assets.

In the opaque situation when total assets are lower than total liabilities, there is a negative equity or net assets.

What items belong to net assets?

Well, basically it is share capital, share premium, reserves, retained earnings or losses and some other items, too.

What can cause the change in net assets?

Net assets or equity can increase or decrease as a result of several things, for example:

- shareholders contribute cash to the company

- company makes a profit or loss

- company buys own shares back from the market

- company pays out the dividends to shareholders

- company revalues certain assets directly through equity and not through profit or loss

The key to understand the difference between profit or loss, other comprehensive income and changes in equity is to understand where these changes are coming from.

So which statement to use?

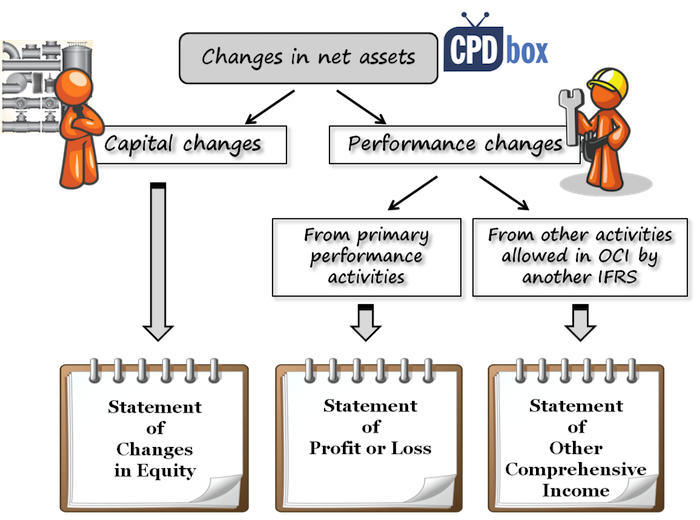

We can classify changes in net assets or equity into 2 main categories:

- Capital changes – these are all changes related to introduction and return of capital to shareholders, such as:

- Issuance of new shares

- Paying out of dividends to shareholders

- Buy-back of own shares from the market

- Performance changes – these are all changes coming from the activities of the company and not from the shareholders.

All capital changes must be reported in the statement of changes in equity.

We can further divide this category into 2 subcategories:

i. Changes resulting from or related to primary performance or main revenue-producing activities of the company that are reported in profit or loss. Here the following items fall:

- Revenue from sales of goods or services

- Expenses incurred to make sales of goods or services

- All other income and expenses, such as finance, administrative, marketing, personnel, etc.

- Gains related to primary performance (sale of property, plant and equipment, etc.)

The main point here is that other IFRS standard does not permit recognition of these changes directly to equity.

All these changes are reported in profit or loss.

ii. Changes resulting from other, non-primary or non-revenue producing activities of the company that are not reported in profit or loss as required or permitted by other IFRS standard.

Here’s the list of them:

- Changes in revaluation surplus related to property, plant and equipment (in line with IAS 16)

- Actuarial gains and losses (in line with IAS 19)

- Gains and losses arising from translating the financial statements of a foreign operation

- The effective portion of gains and losses on hedging instruments in a cash flow hedge

- Gains and losses on remeasuring available-for-sale financial assets (in line with IAS 39)

- For financial liabilities designated as at fair value through profit or loss: fair value changes attributable to changes in the liability’s credit risk (IFRS 9).

This list is quite exhaustive and I really cannot think of other items that should potentially belong here. All these changes are reported in other comprehensive income.

Follow these 2 steps

Step 1: Performance or capital change?

If you are not sure where certain item belongs, then think a while:

Is it performance change or capital change?

The reason for introducing other comprehensive income and merging it with profit or loss into the statement of comprehensive income was to distinguish between capital and performance changes.

The company needs to show clearly why its net assets go up or down – is it due to capital change? Or is it due to performance change?

Step 2: Allowed by other IFRS to OCI?

And then, if it is a performance change, is it from primary activity? Can we report it directly to equity in other comprehensive income – is it allowed by some IFRS standard or not?

If you answer these questions I’m sure you’ll never fall into trap of the wrong reporting and messing up individual components of your IFRS financial statements.

Download for you

I have summarized it all in ONE-PAGE infographics. Click here to download it and use for your reference. Totally free!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thanking you so much, and its well clarified.

Thanks a lot

very useful

Great explanation!

Thank You Sylvia, I am lucky to learn from this platform

Dear Silvia,

Your concised presentation of the what goes into OCI and PorL is perfectly absorbable on the first go by all. You kit has abundant solution to all financial reporting confusions. Appreciated.

The distinction is now quite clear. My take home here is that OCI arise from performance of non core business activities of the entity.

Hi Silvia,

I have a company, whereby shareholders had contributed capital and no shares were allotted for those contributions. Recently the shareholders decided to waive those capital contributions, i.e. the company will not be liable to return any money to the shareholder.

The double entries will be as follows:-

Dr Capital Contribution from shareholders

Cr Statement of changes in equity – reserve

please confirm.

Really awesome, so nicely explained in a simplistic way. Silvia, you are a fantastic teacher, guide on IFRS and accounting.

hi silvia

i just started with you as CPT Student , many standards ( IFRS & IAS ) i didn’t find it in the list , i think you have merged them together for instance : IAS 23 ( borrowing Cost ), IFRS 5 ( Exploration For meniral resources , & lastly Thank you for your dailly Articles that really Helping Me alot to become CFO in the very Near Future hopefully.

your student Abdulgalil

Thank you Sylvia

Clearly expressed.

Thoroughly clear.

Thanks Sylvia

Excellent explanation Madam Silvia!

Thank you so much. This is great.

how to account for donation and grant

If a gain on PPE is recorded, let’s say last year end, does it still appear in other comprehensive income the following year? And, does this amount appear in the balance sheet? what heading in the balance sheet?

Do you mean gain from revaluation of PPE if yes so its accumulated balance under equity called revaluation surplus

Fair value of investment – Can we elect to

(i) classify as fair value through profit or loss; or

(ii) classify as fair value through OCI

In case of (i) if company is profitable – we can declare dividend and in case of (ii) we cannot declare dividend

If you own any shares in another company, that’s not your task to declare dividends – it is the company that declares that. I see no reason why your classification of shares would impact the dividend declaration.

Thank you so much Silvia. Simple & well explained.

Where shall I present OCI (arising from actuarial gain) in balance sheet?

One doubt… how the OCI is rolled forward from one year to another? Are the single OCI components accumulating as any equity account? Or should we foresee a sort of “Retained Other Comprehensive Income” whose opening balance is resulting from the prior year OCI?

You need to be consistent, so yes, they roll forward as the components of OCI.

Hello Silvia, at school we were told that OCI gained from revaluation under IAS 16 can be either turned to retained earnings by:

a) selling the revalued asset, or

b) through the difference in depreciation of the asset valued at historical cost and fair value

Could you please explain the second option? I have no idea how higher depreciation costs could turn OCI to retained earnings…

Very straight to the point. That’s splendid. Thanks Silvia.

Dear Silvia, Thanks a lot for this useful lesson. Keep us posted on IFRS knowledge. Stay blessed

THIS IS WONDERFUL, THANKS A MILLION

Do you believe if an entity chooses the revaluation model under IAS 16 that the revaluation gains/loss should still go through OCI to a reserve in equity, or do you think this is this outdated thinking and IAS 16 should be revised to require FV movements to go through the P&L (under the revaluation model?

No, for one simple reason – it is assumed that you are using your PPE for own business purposes, not for obtaining gains from movement in prices on the market and thus any revaluation gain is not shown via profit or loss.

Thanks so much .

The graphical illustration drives it home so simply.

Amazing

Thank you for taking time to help others

Do we classify loss on redemption of participating shares under the OCI of the P&L? I am a bit confused about that

Guys,

Question please. What if you transfer a property from IAS 16 to IAS 40 say after two years depreciation, and after the date of transfer you stop depreciating the asset as it is with the other party who uses it for say 3 years. The asset having a useful live of 9 years, you want now to take it back under IAS 16 and continue depreciation. Depreciation will be based on which value? It will be depreciated over how many years?

Thanks for feedback

Hello Silvia, Thanks for this detailed explanation. I have only one query here. If A company’s primary performance is to provide port services and company is cash rich company having lots of idle fund and hence management has decided to put this money into Mutual funds, Fixed deposits and other short term investment which is not primary business of the company. so where we can present interest accrue from Fixed deposit and dividend arise from mutual fund ??

That would be under Finance income/expense, net; out of primary activities.

Why not under OCI ? This is non primary performance.

Yes, but it is a performance change, and it is not a by-product of any revaluation. As I wrote up in the article – this is just a general guidance, not the rule of thumb. IFRS 9 requires so.

Dear Ms Silvia. If I follow your steps, I would say fair value gain from Investment properties should be classified as Other Comprehensive Income. This is the case when the company use its property to earn rentals. So, it is not what IAS 40 said. My concern is the different between gain from Fair Value Model in IAS 40 and Revaluation Model in IAS 16. Could you please explain the reason why IASB suggest to record gain from FV the IP to P&L, other than OCI?

Thank you very much.

Dear Thuyen,I don’t think so. IAS 40 clearly says that FV change is in P/L and IAS 16 in OCI – so these 2 steps say (listen to the standard). For reason of IAS 40, I recommend reading the basis for conclusion.

As for difference between revaluation model under IAS 16 and FV model under IAS 40 – yes, it might seem confusing, but mostly – under IAS 40 => land and buildings; under IAS 16 => other long-term assets (and sometimes land/building used for own purposes, not meeting the definition of an investment property).

Dear Ms Silvia, Let me clarify more. I understand what IASB requires in IAS 16 and IAS 40. My concern is the reason why. I also understand why Revaluation gain in PPE should be recognized in OCI. But for Investment Property, I still not understand why.

Let’s check this example: a twin towers with the same specification (location, size, number of rooms….

The first tower has rental income only. So, it is Investment Property under IAS 40. Of course, the gain from Fair Value shall come to P&L.

For the second tower, the Company decided to run it as a Hotel. Under IAS 16, it is PPE and it’s revaluation gain shall come to OCI.

The amount of fair value of these 2 towers might be different, but the technique used and fair value level hierarchy is the same, let’s say: level 3 DCF.

It is believed that the 2 towers shall be used to earn income and the fair value might never realize, because the Company has not intention to disposal them. Let’s ignore the accounting classification of the 2 properties.

My question is, why there is 2 accounting treatments with the same properties and the same flow of economic benefits?

Thank you.

As I have already said – please check out the basis for conclusion of the both standards and I am sure IASB explained its decisions there. I fully understand your concerns, but I am not the one who drafts the rules of the standards – only IASB can explain its decision (that’s why they also issue Basis for conclusion for each standard they publish).

Thank you very much for introducing me the Basis for conclusion. Honestly, I did not know the existence of it before.

I found some ideas for my concern in the Basis. The reason might came from the relationship between economic benefits (rental income) flow to the company and the property itself. The different using purpose of property shall lead to different relationship, and therefore, different treatment should be made.

After reading this Basis, I finally have 1 new question. Why there is no depreciation for FV model? I may appreciate very much if you can give for opinion.

Thank you.

Hi Thuyen,

this is great, I am glad you read it. Under FV model there is no need for depreciation charge because you have to revalue to FV each reporting period and thus its carrying amount always reflects fair value. Under revaluation model under IAS 16 you do charge depreciation, because revaluations are less frequent (once per 3-5 years) and you somehow must reflect the 1-year usage. That’s very simplistic explanation.

Dear Thuyen,

The reason is in the purpose of the use of asset – if you are keeping the asset to earn a rental revenue or revenue from sales of InvProp later on, then that earning should be in recognised in PL, as what you would do with revenue from sale of goods.

BUT in case of IAS 16 the main aim of keeping the PPE is not the direct earning from its usage,

I think this way of thinking helps in all PL or OCI classification matters – PL: aim is earning, while OCI: there is no aim to earn.

Regards,

Subhan GASIMLI

Great explanation here.

Many thanks.

Thanks for this article. Simple and easy to understand!

Thanks Silvia

Thank you so much Siliva..

I really love the way you explain concepts in easier way…

From where can i get your e material ?

Hi Zahira, thanks a lot for your kind words! Please check out https://www.cpdbox.com/ifrs-kit/

Hello Silvia Ma’am,

Thank you so much for clearing our confusion relating to IFRS.

The way you explain it with such an ease is simply remarkable.

Your articles and videos has really helped me in conceptual clarity and office works.

With regards,

Amit Shrestha

Institute of Chartered Accountants Nepal (ICAN)

Dear Amit, thanks a lot for your kind words, I really appreciate!

Thank you silvia. It is a great explanation.

If you have time please explain with journal entries for share buy back.Further is it possible to have benefit to the share holders due to the share buy back

Kind Regards

Ranjith

Thank Very much!

I have a question when a portion of the revaluation surplus is transferred to retained earnings to compensate for the difference in depreciation, it is an equity transaction or comprehensive income transaction. Thanks

Thanks very much dear. I owe u much….

Regrads.

You,re awesome. The concept is clearer the way you explained visual and theoretical is something different.

Thank you silvia. It is so useful presentation.

Amazing Silivia….I am from India…I haven’t met any Faculty who could explain IFRS in such a simplified manner..u r superb…it would have been little more beneficial if I could get these Articles in PDF form..

Silvia…u r amazing…how beautifully u explained..it. hat’s off 2 u

Many Thanks Dear

thanks for the clear distinction of the two (2) approaches

Thank you Sylvia.

This is an amazing presentation which clears me some doubt in financial reporting.

Good one Sylvia. You explained it as simple as ABC. This is Financial Accounting made simple. Thank you.

Joseph