The Unconventional Guide To IAS 12 Tax Bases

Last week I published an article with summary of the standard IAS 12 on Income taxes. It’s not an easy text to read and some definitions in IAS 12 are so obscure that many people grope in the fog unsure what to do.

When it comes to setting the tax base of assets or liabilities, the issue becomes even more painful because it’s very hard to understand the definitions in IAS 12.

In this article I would like to explain a concept of a tax base and give you some useful hints how to determine it.

This Is What You Should Ask First

Before trying to set a tax base of any asset or liability, ask yourself these questions:

What happens when in the future I recover this asset or settle this liability and remove it from my balance sheet? Will this removal affect my tax payments in the period of recovery or settlement? In other words, will I have to make some adjustment to my accounting profit in order to arrive to taxable profit?

If the answer is yes, then the tax base of this asset or liability is for sure different from its carrying amount.

If not, then the tax base of this asset or liability equals to its carrying amount.

Now let’s break it down.

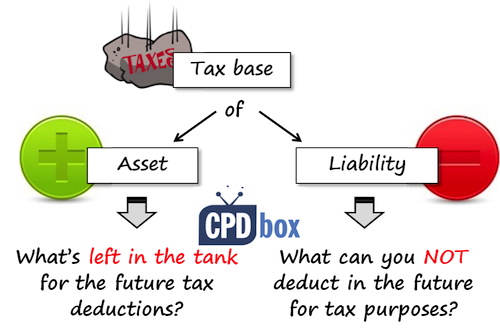

Setting the tax base of assets

“Tax base of an asset is the amount that will be deductible for tax purposes against any taxable economic benefits that will flow to an entity when it recovers the carrying amount of the asset.”

That’s the definition from IAS 12 Income Taxes.

However, I look at tax base of an asset as at something “what’s left in the tank” to deduct for tax purposes in the future.

Let me show you 2 examples. From the “tax base” point of view, there are 2 types of assets. No matter what type you’re dealing with, setting the tax base is the same.

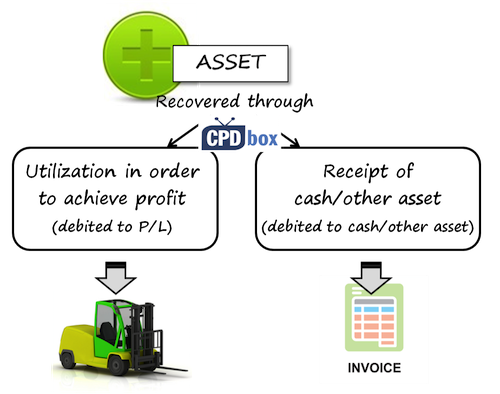

- Assets that will be recovered through their usage

As you will recover the carrying amount of these assets by their usage in order to achieve profit, you will probably charge them to your profit or loss in the future. The examples of these assets are property, plant and equipment or prepaid expenses.

Let’s say you have a machine with a cost of 1 000 and you charged depreciation of 200. However, for tax purposes, you can deduct only 150 this year.

Clearly, carrying amount of this asset is 800 which is 1 000 less 200.

What is a tax base?What’s left in the tank for future tax deductions?

Since you have already deducted 150, you will be able to deduct 850 in the future (1000 less 150), so the machine’s tax base is 850.

Now you can work out temporary difference and deferred tax yourself.

- Assets that will be recovered through receipt of cash or other asset

In this case, you will not charge a carrying amount to profit or loss. Instead, you will credit a carrying amount against any cash or other consideration received in exchange. The examples of these assets are receivables.

Let’s say you have an interest receivable of 500. However, you did not include this receivable into taxable profit calculation because in your country interest received is taxed when cash is received.

What’s left in the tank for future tax deductions when you recover this receivable?

The answer is zero. Nil. Why?

Because when you recover the receivable in the future by receiving the cash, then you need to include it in your tax return. How much can you deduct for tax purposes in the time of taxing? Zero. You must tax it in full.

As the carrying amount of this interest receivable is 500 and tax base is 0, you can work out the temporary difference and a deferred tax.

Setting the tax base of liabilities

The definition of a tax base of a liability coming from IAS 12 Income Taxes is:

“Tax base of a liability is its carrying amount, less any amount that will be deductible for tax purposes in respect of that liability in future periods.”

However, I look at tax base of a liability as everything you are NOT going to deduct in the future for tax purposes.

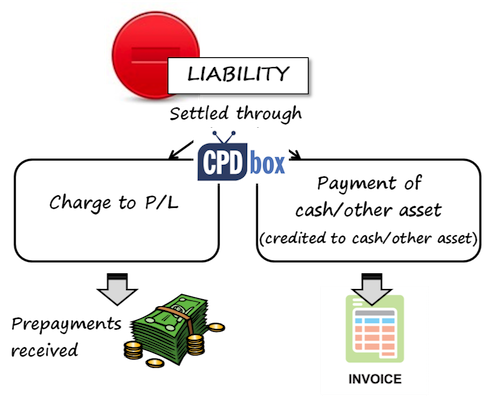

From the “tax base” point of view, there are 2 types of liabilities:

- Liabilities that will be settled through profit or loss

These are the liabilities that you will derecognize by charging them to profit or loss, for example, unearned income or various revenues where the cash is received in advance.

Let’s say you received the prepayment of 200 from a client for the services you’ll provide the next year. Revenue is taxable based on the time of generating it (=provision of services) and not in the time of receiving the payment.

What is a tax base of the liability from prepayment received?

In other words – what are you NOT going to deduct in the future?

In this case, when you provide the services and thus settle the liability from prepayment by charging it as revenue to profit or loss – can you deduct something from that revenue for tax purposes in the next year?

No, you cannot. You must tax your revenue in full, there’s NO deduction and it means that the tax base of your liability is equal to its carrying amount. As there’s no temporary difference, there’s no deferred tax.

However if you need to tax your revenues at the time of cash receipt instead of time of providing the service, the situation becomes different. In such a case, you tax the revenue when you receive the prepayment and in the next period of settling the liability, you can deduct full amount from taxable profit. So the amount that you are NOT going to deduct in the future becomes zero which would be the tax base of your liability.

- Liabilities that will be settled through delivery of cash or other asset

Here, you will settle the liability by giving away some cash or other asset. The examples of these liabilities are payables or provisions.

Let’s say you recognized a provision for employee benefits of 800. According to tax rules in your country you cannot deduct costs for creating that provision for tax purposes until you actually pay these benefits.

What is a tax base of the provision?

What are you NOT going to deduct in the future?

The answer is zero. Why?

Because when you pay the benefits to the employees and thus settle the liability, you can deduct the full amount for tax purposes in that time. Therefore the amount that you are NOT going to deduct in the future becomes zero which is the tax base of your liability.

If you’d like to know how to calculate deferred tax step by step, please read my guest post here.

Want to dive deeper into IFRS? I’ve created the free report “Top 7 IFRS mistakes that you should avoid”. Sign up for email updates, right here, and you’ll get this report as well as free IFRS mini-course.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

53 Comments

Leave a Reply Cancel reply

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thanks Sylvia, for your absolutely unconventional ideas of explanation!

this was awesome thanks 🙂

Thank you very much for clearing my concepts for IAS 12.

I have a “similar-but-different” way of calculating tax base values for assets and liabilities (mainly assets for which capital allowances are given, prepaid/ accrued items and leases). It consists of a set of rules and goes as follows:

* If the item receives capital allowances, the tax base is the tax written down value. This covers plant/ machinery and (at least in Ireland) certain intangibles. For certain assets (e.g. in Ireland, cars over certain values are restricted to capped amounts for capital allowance purposes), you need to deduct the ‘adjusted permanent difference’ (this allows for the impact of depreciation of the asset, so the ‘permanent difference’ needs to be scaled down) from the asset’s carrying value so that you don’t create a difference due to the ‘permanent’ difference amount.

* If the item is deductible for tax purposes on an ‘accruals basis’, the tax base equals the carrying value. This covers typical expenses such as accrued rent/ wages etc

* If the item is deductible on a ‘payments basis’ (i.e. only when the actual cash is paid) then the tax base is zero. This covers leases, warranties, royalties.

* If the item is not deductible (which in Ireland could refer to penalties, entertainment expenses) then the tax base equals the carrying value. For accrued income / income receivable, if it’s not taxable (such as government grants receivable), the same rule applies.

* For Balance Sheet items such as inventory, debtors & creditors, the tax base matches the carrying value.

In general, I find the above rules work pretty well for solutions 🙂

Hi Silvia,

I have a question regarding deferred tax on revalued depreciable assets. In the year of revaluation the deferred tax will be computed simply as the revaluation surplus multiplied by the tax rate( I have assumed a tax base of nil) . How then will the deferred tax be computed in the second year. Will it revaluation reserve less dtax for year one multiplied by the tax rate or will the deferred tax be computed on a straight line basis?

Dear Hachi,

I really do not like this way of computing deferred tax – it is almost the same as if you would have computed DT based on income or expenses. Instead – and this is also what I teach in this article and everywhere in my materials – use carrying amount and tax base. Thus, in the 2nd year, take the carrying amount of your revalued asset less subsequent depreciation charges and its tax base. S.

Thanks Silvia, you are doing a great job. What I would like to understand is that do I include the Tax Asset balance from prior year when I do my table of Assets and Liabilities?

If you mean the table with calculations of temporary differences, then no – you are including only year-end balances of assets and liabilities, plus a few other items like tax loss. Beginning balance of DTA will be the basis for calculating actual deferred tax charge where you make a difference between the closing deferred tax and beginning deferred tax. Please revise this article, maybe it helps.

What is tax base of leased assets and finance obligation created for leased assets? Normally tax dep only allow lease rentals

Hi Silvia,

This is one of the best sources to learn IFRS. I have query :

Development expenditure has a carrying amount of USD 1000k that was claimed as a deduction when paid. For accounting purposes the development expenditure is amortised over 5 years.

My query is what will be the future taxable amount and what will be future deductible amount while determining Tax Base.

It will be very helpful if you explain the above two.

You have a deferred tax liability here, because the tax base is zero and the carrying amount is 1 000. Future deductible amount is zero, because you have already deducted it all in the past. S.

Thanks a lot for prompt response Silvia ?,

But What will be the future taxable amount in this case.

Generally I use your method to identify tax base but in this case i.e. expense, I have to follow another method. In which I will be able to calculate tax base when I know future deductible and future taxable amount.

Well, you can always use my method, also in this case. You have an asset here at the balance sheet (capitalized development cost) and you can ask: what amount is there available for future tax deductions? And I repeat, zero, because you deducted all of it in the past. That’s why its tax base is zero. Other than that I think I don’t understand your question.

Thanks! It is very clear!

Thanks for your great work. It clears my concept. It’s much better than any lecturers and textbooks available elsewhere.

Quiet simple and easy writing! thank you for making the concept easy for understanding.

Mayur

Hi, thanks for sharing.

For a non-qualifying asset, carrying amount is say $100. But for tax purpose, the asset is non-qualifying. What then is the tax base? If it is $0, this will lead to a temporary difference and deferred tax. But rightfully, there should be no temporary difference. Does this then mean that the tax base is also $100?

A bit confused here. Hope someone can help. Thanks!

Can i get a powerpoint presentation on Income Taxes?

Thanks in Advance!!

mukundsarda06@gmail.com

silvia thank you so much…. you explain very well. it helped me a lot to clear my concepts…good work:-) keep sharing

Silvia,thanks for your clarity painstaking efforts in educating people Online through video clips and others.

I am your student and leave in Nigeria.

I would like to have your IFRSBOX Kits.

Please Cost my bill in Nigeria Naira

I need discount because we are passing through economic recession.

Thank you ma.

Hi Pius, I’m happy that you like my training. For the specific enquiries about the IFRS Kit, please contact us here. Thanks! S.

A very simple and clear explanation. Thanks

Hi Silvia,

Thank you for your post!! Can I ask a question, say a Company purchase equity shares of another company at 1.00 per share for 100 shares. Measuring the shares as Available for Sale. At end of the year, the market value of per share increased to 1.1. How would this case of an asset fit into the two scenarios you have highlighted? I note that from the two scenario that you shared, in both case, P/L is actually affected, one is as depreciation exp and the other as a rev recognition. However, in my example, the p/l or OCI effect is only a portion, the difference of change in fair value. How is tax base measured here?

Thank you!!

Hi Silvia,

Regarding the ‘what’s left in the tank to deduct’ for assets, does that work for Loan Receivable and Cash at Bank accounts? It does not appear to be so.

Both the assets above have a tax base = carrying amount. Loan Receivable and Cash don’t have any tax consequences, so …

Any comments?

Thanks Silvia

Danny,

here, the logic is a bit more difficult to apply, but it still works. Please read “Assets that will be recovered through receipt of cash or other asset” once again. For cash, it’s tax base is 500 as it will not be taxed in the future (therefore, you can “deduct” 500). It’s carrying amount is 500. For any loan receivable, it’s the same. S.

Hey Silvia,Thanx for making it so simple and straight forward,you are a genius!

Hi Silvia,

I understand the DTA and DTL but i donot understand what is the Defered Tax Income and defered Tax Expense

And what are their relation with Current Tax Income

Thanks

Hi Raouf,

deferred tax income/expense are here to make sure your DTL/DTA is OK. They are simply “the other side” of the journal entry. S.

Dear Silvia,

First u are doing a great job.

Do u teach the CPA Australia (Financial Reporting) and can u send me your email.

Thanks

Hi Raouf,

no sorry, I don’t teach CPA Australia specifically, but the IFRS Kit covers a lot. S.

I would like to have more of the IFRS courses to stay in touch with latest developments in the field of accounting. I am an ACCA affiliate and these courses would be ideal for my CPD requirements.

I hope to continue getting these from you and greatly value your assistance in desire to keep us informed of what’s happening in the world of accounting.

Regards

Samson

Dear Silvia M.

Please reply my query (related to IAS-12) dated August 12, 2015.

My query relates to paragraph 15(b) of IAS-12 [IFRS]. Please tell me how can a transaction affect accounting profit or taxable profit (if it could in any way) on initial recognition of asset. Also tell me how could a transaction may not affect either accounting profit or taxable profit.

Reply me soon, keenly waiting for your response.

Thanks in advance

The determination of the tax base will depend on the applicable tax laws and the entity’s expectations as to recovery and settlement of its assets and liabilities.

Receivables. If receiving payment of the receivable has no tax consequences, its tax base is equal to its carrying amount

I have a very specific query on the concept of IRE (Initial recognition exemption) – we have a building on which depreciation is charged in the books. However, no tax depreciation can be claimed and intention of he company is to use the asset for the foreseeable future. Because no deduction can be claimed for tax in future periods, tax base would be nil, giving rise to taxable temporary difference and consequently to huge DTL in the year of initial recognition. if we apply the condition “neither affecting accounting profit nor taxable profit on the initial recognition”, we might say it is affecting accounting profit as we would be charging depreciation. Should we say in these circumstances, IRE does not apply? and if we conclude to recognize DTL, where should that be placed? I/S or equity?

Of course, it is not acquired as part of a business combination.

If i have trade receivables of 100. The related revenue has already been included in taxable profit. What is the tax base here? Also clarify your rule WHAT IS LEFT IN THE TANK applies here.

Tax base = 100. It means, that in the future, when you actually get the payment, you will not tax this payment as “what’s left in the tank for the future tax deductions” is 100.

If that would have been zero, you would need to tax the receipt of 100 in the future. S.

In continuation to my recent query [trade receivables] of Rs. 100; how much am i going to deduct in future? i do not understand it. As it will be my tax base.

100

There was a trade receivables of 100. The journal entry for the current period would be: debit Trade receivables 100, credit Revenue 100. ‘The related revenue has already been included in taxable profit’ means the revenue of 100 is taxed in current period.

When the trade receivables of 100 are recovered in future period, the journal entry would be: debit Cash 100, credit Trade receivables 100. The cash of 100 is the future economic benefit flow into the entity.

Now you see two things,

1. Current period, revenue of 100 is taxed.

2. Future period, cash of 100 will flow into the entity.

Using the concept of ‘What’s left in the tank for future tax deductions when you recover this receivable’, In future period, do you still need to tax the cash of 100? No, because you have already taxed the revenue of 100 in current period. So there will be amount of 100 (related to the cash) deductible for tax purpose. So the tax base would be 100.

Using the concept of ‘What’s left in the tank for future tax deductions when you recover this receivable’, In future period, do you still need to tax the cash of 100? No, because you have already taxed the revenue of 100 in current period. So there will be amount of 100 (related to the cash) deductible for tax purpose.

How is 100(Related to cash) Deductible for tax purpose ? What do u mean by deductible for tax purpose ?

So the main thing is looking at the effect on Income statement profit

Thank you Silivia M, you made it so simple where it is hard to understand in IAS 12.

Silvia M. Thank you so much for the knowledge you share.

Kudos to You

Thank you 🙂

dear Silvia, your explanation of the tax treatment is awesome indeed. But i’m still confused with the definition.. In case of a provision for doubtful debts, tax base of an asset = future deductible amount = recivables + provision…but if there is no provision, tax base of an asset = receivables…in this case it is equal to carrying amount because economic benefits are not taxable

Dear Katerina,

I’ll try to break this one for you. Let’s say the expense for doubtful debt provision is tax non-deductible, OK? So receivable = 100, provision for doubtful debt = 30.

Carrying amount = 100 – 30 = 70.

Tax base of receivables = 100. Why? When you recover this receivable in the future by cashing 100, how much will you tax? Nothing, because you have already taxed the revenue. No adjustment to tax return from recovery, therefore its tax base = 100.

In this case, temporary difference = 100 – 70 = 30.

What if the expense for the provision is tax deductible?

Carrying amount = 100 – 70 = 30.

Tax base = 70. Why? Because when you realize the asset by cashing 100, you need to reverse your provision and tax it (as you deducted in from tax return when it was created).

Therefore, there’s no temporary difference.

Does it make sense now? 🙂

Silvia, can I continue in Katerina°s question, respectively in your answer:

“I’ll try to break this one for you. Let’s say the expense for doubtful debt provision is tax non-deductible, OK? So receivable = 100, provision for doubtful debt = 30.

Carrying amount = 100 – 30 = 70.

Tax base of receivables = 100. Why? When you recover this receivable in the future by cashing 100, how much will you tax? Nothing, because you have already taxed the revenue. No adjustment to tax return from recovery, therefore its tax base = 100.

In this case, temporary difference = 100 – 70 = 30.”

If I accept the fact, that doubtful debt provision 30 is tax non-deductible and I add that also its write-off will have no deductible effect, what is the tax base of this receivable? 70? or 0 and the difference 70 is not temporary? thank you.

if both the provision for doubtful debts and its actual write-offs are non-tax deductibles, then there is Nil temporary difference on receivables.

Dear Silvia,

Thank you so much for providing us with such useful information!

Silvia u r a gift

Good explanation in regard to deferred tax this is really good stuff it has opened my mind in regard to the calculation of tax bases of both an assets and liabilities. I hope the same can be done for financial instruments IFRS 9 and IAS 32, 39. Thanks for this its really great.

Thank you! 🙂