IAS 2 Cost Formulas: Weighted average, FIFO or FOFO?!

During my ACCA studies some years ago I had an amazing tutor. He was very smart, always to the point and on top of that, I simply loved his dry British sense of humor.

When we talked about inventories, he told us a story about an audit assistant performing audit in a big distribution company.

Today, I’m going to write about a few costing methods and this story perfectly fits here, so let me retell it:

This audit assistant was auditing inventories and he just got the excel file with the stock register (list of inventories with their amounts and unit costs).

He looked at the file and noted that there were actually 2 columns for “amount”, so he went straight to CFO and asked:

“Why are there 2 columns with the amount?”

CFO: “Well, the first one is theoretical amount calculated based on movements, and the other one is physical amount counted during the year-end stock count.”

Fair enough, the assistant noted this answer and went back to his room to continue.

Then he noted that indeed, there’s one more column with the differences, so he went back to CFO.

That time, CFO just finished reading the reports from his controller and wanted to get ready for another meeting, but OK, he decided to be polite and invited our assistant to come in.

“What did you do with these differences?”

CFO thought: ‘Well, isn’t that obvious from our trial balance?’, but replied:

“We recognized these differences in profit or loss statement, either as inventory count surpluses or deficits. Deficits within certain pre-determined levels went to cost of sales and remaining deficits went to other expenses.”

Hmmm, the assistant so happy that he didn’t even note that the CFO became slightly annoyed by him coming back and forth and asking simple questions.

Never mind, the assistant studied the inventory records and suddenly, another question popped up.

He immediately ran to CFO’s door, quickly knocked, rushed in and asked:

“What cost formula do you use? FIFO? Weighted average?”

CFO, interrupted at his deserved cup of coffee over another report, went all red and grunted:

“No, we use FOFO.”

“FOFO? What’s that???” puzzled assistant.

“F_CK OFF FIND OUT!!!”

When our tutor finished this story, everybody was laughing out loud. I remember cost formulas very well ever since then.

I really hope that after reading this article, you’ll remember them too!

What are cost formulas?

First, let me describe shortly what the problem is here.

Imagine a company buys 1 000 chocolates for CU 30 each. The journal entry is

-

Debit Inventories: CU 30 000 (1 000*30)

-

Credit Accounts payable: CU 30 000

Then, this company sells 200 chocolates for CU 40 each. The journal entry is:

-

Debit Accounts receivable: CU 8 000 (200*40)

-

Credit Revenues from sale of goods: CU 8 000

Also, the company must reflect the fact that some chocolates left its warehouse. The journal entry is:

-

Debit Cost of sales: CU 6 000 (200*30)

-

Credit Inventories: CU 6 000

In this very basic example, the company knew exactly what amount should have been recognized in cost of sales, because the acquisition cost (purchase price in this case) was CU 30 per chocolate.

But what happens when the company purchases chocolates in batches at different prices?

For example, imagine the company purchased 100 chocolates for CU 31 each, 150 chocolates for CU 32.50 each, then 200 chocolates for CU 29 each, etc.

What is the cost of sales in this case?

That depends on the cost formula selected by the company. So there isn’t just one correct answer.

What does IAS 2 Inventories prescribe?

In fact, the standard IAS 2 Inventories prescribes that when the inventories are:

- Not ordinarily interchangeable; and

- Goods or services are produced and segregated for specific projects,

their cost shall be assigned using specific identification.

This is rather unusual in practice, but it happens, for example when products are exclusive and unique, like jewelry, antiques or some types of automobiles.

When the goods are ordinarily interchangeable (e.g. large volumes of merchandise), then IAS 2 permits using either

- FIFO, i.e. first-in-first-out method; or

- Weighted average method.

The standard IAS 2 Inventories does not permit using LIFO (last-in-first-out). LIFO is permitted by US GAAP though, and maybe also by some other accounting rules.

Now, let’s come back to our chocolates and explain all three cost formulas on chocolate sales and purchases.

Question: Selling Amazing Chocobar

Yummie, candy and chocolate distributor, made the following purchases of new product, Amazing Chocobar during 20X1:

- 10 January 20X1: 1 000 units at CU 28.00 each;

- 14 February 20X1: 1 500 units at CU 28.20 each;

- 17 March 20X1: 3 000 units at CU 28.40 each; and

- 18 June 20X1: 2 500 units at CU 28.55 each.

As Chocobar is a new product and massive advertising campaign is planned after 1 July 20X1, Yummie sold only one batch of 4 200 units of Amazing Chocobar to its biggest customer, for total sales price of CU 159 600. This happened on 2 May 20X1.

Calculate the stock value of Amazing Chocobar in Yummie’s warehouse at 30 June 20X1 (ignore other components of acquisition cost).

Solution

As I have indicated above, the answer strongly depends on the cost formula used.

While we clearly know what amount of inventories arrived to the warehouse at purchases, the cost of inventories dispatched from warehouse at sale must be calculated using one of cost formulas mentioned above.

Also, the total sales price of CU 159 600 is here only to trick you. It is NOT relevant for calculating the value of inventories in the warehouse – it’s a sales price, not a cost.

Regardless cost formula used, we can calculate the number of units of Amazing Chocobar in the warehouse:

1 000 + 1 500 + 3 000 + 2 500 – 4 200 = 3 800 units.

Now let’s use various cost formulas to assign some value (cost) to these 3 800 units.

FIFO (First-in-first-out)

I call this method “chronological”.

The reason is that under this method, you are “selling” the goods from the warehouse in the order in which they are purchased.

In our example, when Yummie sold 4 200 units of Chocobar, we assume under FIFO that Yummie dispatched:

- All units purchased on 10 January 20X1 – 1 000 units at 28.00 each

- All units purchased on 14 February 20X1 – 1 500 units at 28.20 each, and

- 1 700 units (total sold of 4 200 – 1 000 – 1 500) from the purchase of 17 March 20X1 at 28.40 each.

You can calculate the cost of sales at the sale, but that was not a question.

The question was what the balance of Amazing Chocobar stock at 30 June 20X1 is.

When you assume that you sold from the oldest purchases, logically, the most recent purchases remain in the warehouse.

Therefore, you need to go backwards here.

There’s 3 800 units in the warehouse, thereof:

- 2 500 units from the purchase of 18 June 20X1 at CU 28.55 each – that’s CU 71 375; and

- Remaining 1 300 units must come from the purchase of 17 March 20X1 at CU 28.40 each – that’s CU 36 920;

Thus, total value of Amazing Chocobar stock under FIFO at 30 June 20X1 is CU 108 295.

LIFO (Last-in-first-out)

This method is quite similar to FIFO, with one big difference: here, you assume that you sell from the most recent purchases.

As a result, the oldest purchases remain in the warehouse until the stock is sold out.

This is closely linked to the main reason why LIFO is prohibited by IAS 2.

IFRS standards focus heavily on the balance sheet numbers. Every single amount in your balance sheet should reflect current market and economic conditions as much as possible and this is NOT what LIFO does.

Why?

Because, when you put the most recent purchases at most recent prices to cost of sales, and you keep the oldest purchases in your warehouse and your balance sheet, the value of your stock in the balance sheet dates back to your oldest purchases.

In other words, the value of inventories is outdated under LIFO – true mainly for rising prices and slowly moving stock.

Also, LIFO tends to inflate cost of sales.

However, let’s solve our chocolate case by LIFO, too.

While you look at the most recent purchases when determining year-end value of inventories under FIFO, here, you look at oldest purchases.

Plus, you have to think about the sale. At sale, the chocobars’s cost was calculated based on the last purchases available in the warehouse.

Therefore, on 2 May 20X1, 4 200 bars came from the following purchases:

- 3 000 units from the purchase of 17 March 20X1 at CU 28.40 each, and

- 1 200 units from the purchase of 14 February 20X1 at CU 28.20 each.

Thus, 3 800 units remaining in the warehouse at 30 June 20X1 come from:

- 1 000 units come from the purchase of 10 January at CU 28.00 each – which is CU 28 000;

- 300 units come from the purchase of 14 February at CU 28.20 each – which is CU 8 460. Remember, you sold 1 200 units of this purchase on 2 May 20X1;

- Remaining 2 500 units come from the purchase of 18 June 20X1 at CU 28.55 each – that’s CU 71 375.

The total value of Amazing Chocobar stock at 30 June 20X1 under LIFO method is CU 107 835.

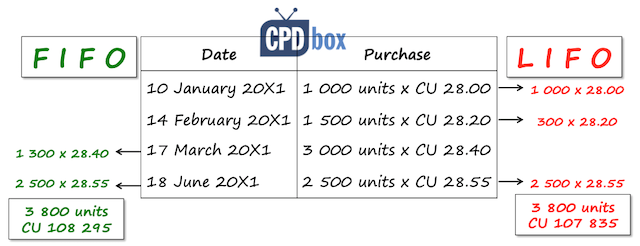

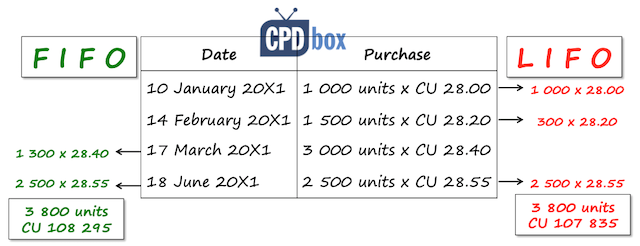

This graphical scheme shows the contrast between FIFO and LIFO:

Weighted average

Under weighted average method, the cost of inventories at sale is calculated as weighted average of previous purchases.

Practically, you need to recalculate weighted average at each purchase. Then, when you make a sale, you dispatch the inventories at the most recent weighted average price.

This is illustrated on our example in the following table:

| Date | Purchase | Sale | Stock | Unit cost |

| 10-Jan | 1 000*28.00 = 28 000 | – | 28 000 | 28.00 |

| 14-Feb | 1 500*28.20 = 42 300 | – | 70 300 (28 000+42 300) | 28.12 (70 300/(1 000+1 500) |

| 17-Mar | 3 000*28.40 = 85 200 | – | 155 500 (70 300+85 200) | 28.27 (155 500/5 500) |

| 2-May | – | 4 200*28.27 | 36 751 (1 300*28.27) | 28.27 (as above) |

| 18-Jun | 2 500*28.55 = 71 375 | – | 108 126 (36 751+71 375) | 28.45 (108 126/3 800) |

Please note that:

- The average cost per unit is calculated in the last column. It changes after each purchase.

- After sale on 2 May 20X1, the average cost remains the same. This is logical, as there’s no new purchase affecting average cost.

To sum it up…

We calculated 3 different balances of stock at 30 June 20X1 based on different cost formulas. The results are:

- Under FIFO: CU 108 295

- Under LIFO: CU 107 835

- Under weighted average: CU 108 126

I just remind you that IAS 2 does not permit LIFO.

Just one audit point: it’s much easier to verify the balances of stock when FIFO method is used, as compared to weighted average.

The reason is that while you are able to track latest purchases of certain stock for calculating the value of inventories under FIFO, it can be quite difficult to track all purchases for weighted average.

Do you have any interesting story about your inventories? Please share with us in the comment below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thank you Silvia,

Does the reason of account for inventory at lower of cost and NRV is Conservatism principle? since the inventory make be effected by obsolescence and damage.

Thank you Silvia,

If an entity decides to change its accounting policy regarding the raw materials from Weighted-average to FIFO, are all inventory components ( raw-materials, work-in process and finished goods) should be accounted for FIFO or just Raw materials ?

Wow what a good article

Hi Szilvia, hope you’re well.

How would we go about calculating the cost of inventories that are a part of a sales return? I assume the answer will differ whether we use FIFO or AVCO.

Thanks in advance.

The explanation was just magical.Thanks Sylvia

PURCHASES SALE

10 January 20X1: 1 000 units at CU 28.00 each; 800 units @ 36 CU each

14 February 20X1: 1 500 units at CU 28.20 each; 1200 units @ 33 CU

17 March 20X1: 3 000 units at CU 28.40 each; 1000 units @ 31 CU

18 June 20X1: 2 500 units at CU 28.55 each. 1200 unit @ 34 CU

Supposing your data is amended to include the daily sales at the various prices as above and that on average the cost to sell is 10% of selling price. What will be the value of inventory at 30 June 20×1? Which inventories will be used in calculating the NRV?

Hi Silvia,

You have mentioned that “LIFO tends to inflate cost of sales.”. Could you please explain how it increases the cost of sales? Thank you for the interesting explanation of the three valuation methods.

Thanks, Sachin

Hi Sachen

LIFO lowers closing stock value in BS whihc means differential impact will be borne by COGS.

A simple formlue to remember is

COGS and closing inventory valuation has a reverse relationship.

Hi Silvia

I’ve been an auditor as well as head of finance on the current role, I presume weighted average method is quite easier when you have good ERP system where you can track all your in and outbound and when you drill down complete transactions you will have solid reporting, however FIFO costing method would be obsoleted if the prices are volatile given the current economic conditions. I believe it’s to be applied what is best for the industry. Another point Is that although costing is weighted average, inventory management can be still FIFO.

Thanks

Thanks for this beautiful article but this is very very simple example which i solved in a jiffy.

Hi July,

My gratitude for all you’ve done, does IFRS allows the above methods? Why UK does allow the inventory at the lower of cost market?

Hi Olivier,

I am Silvia, not July, and IFRS allows weighted average and FIFO basically, not LIFO.

LIFO (Last-in, First-Out) is not allowed under IFRS. Additionally, in certain circumstance, the only specific cost is capitalized that falls outside ‘date criteria’. Also, as referenced, IAS 2, states emphatically that management may not arbitrarily use weighted-average or FIFO to serve net income purposes. In other words, maintain consistent treatment for inventory with similar use and nature.

Hi, how should we account for the cost of renovation of inventory (lets say we are selling house). In this case, company failed to sell the inventory due to change in market/customer preference. Then the company opt to renovate the house to attract the buyer. Should we allocate the cost to the individual unit?

Well, in the case of unique pieces of inventories and not big amount of items of similar or same value, it is more appropriate to allocate directly attributable cost to the specific unit. S.

Thank you so much for the article. It has helped me alot

tanks so much its was interesting reading this

Hi

Thanks for the illustrated refresher. Just to point out one typo error:

Date Purchase Sale Stock Unit cost

14 Feb 20X1 1 500*28.20 = 42 300 – 70 300 (28 000+42 000) 28.12 (70 300/(1 000+1 500) you wrote 42000 stock where you are summing up 70,300 (28000+42000) instead of 42300.

This may confuse some reader.

Thank you, yes it was a typo, I have corrected it.

HI

Can you give us an example how can we manage shipping costs & allocated to inventory items, as Inventory is purchased from one supplier and shipped by other supplier? so it’s difficult to allocate shipping costs to inventory items?

Thank you

Dear Silvia, could you please advise if it is allowed to put materials in stock inventory with zero value if value of materials cannot be found/assessed. I could not find any reference in ias 2. thank you

I don’t know the circumstances of how you acquired inventories with zero value, but in general – please read this article. S.

Silvia thank you for your feedback. We have some leftover materials from constriction of plant. Value of this materials were initially included in the value of assets, but original value of materials is unknown (due to EPC contracts with supplier/vendor). these leftovers can be used for future business process and we need to put them into stock. can we value them at zero value or it Is required to assess them and credit value of assets in order to put into stock? than k you

Hi Silviya

Do you have any lectures on Accounting for cryptocurrency.?

Thank you

Not yet! Maybe I’ll publish something later this year.

Finally, yes, here it is.

Hi Silvia , A large corporation holding stock of Printing & Stationery / Groceries etc not in held for sale though need to be recorded and controlled for internal control purpose, how should we record & present it. Can we say it may not be material amount so just track the movement & consider under other assets.

Hi Abhay, yes, that is acceptable as soon as the aggregate amount is not material. S.

Hi Silvia! Could you please advise if it is acceptable to put in stock inventory materials with zero value? we gave some leftover materials which original value is unknown, but total cost of purchase was included in the cost of assets. is it mandatory to valuate the materials in order to put them into stock or zero value is acceptable from ifrs point of view?

Hi Sylvia;

I am convinced I may have asked this question before, but can’t seem to find it to view your response. Hence sorry if this is a duplication. IAS 2 indicates measurement exceptions pertaining to minerals and mineral products measured at NRV. I want to know is measuring mineral products at NRV an optional selection, i.e you can choose to measure mineral products at cost as well should you so wish (provided this is lower than NRV). Or is it obligatory for mineral producers to measure at NRV?

Thanks

Elizabeth

Hi Elizabeth,

if you cannot find your question then it means you never asked it (I always publish every question). The standard refers to inventories that are normally measured at NRV at the specific stages of the production – e.g. “minerals have been extracted and sale is assured under a forward contract or a government guarantee, or when an active market exists and there is a negligible risk of failure to sell.”. In these cases you need to measure them at NRV (not an option). S.

Dear Silvia

Your material is very valuable. I’m a partner in local firm in KSA. IFRS for SMEs implemented in KSA starting from year ended 31 December 2018. Do you have temples to be used for the application of section 35 of the standard.

Worm regard

Hi Omar, yes, sure, we do have some materials. You might consider signing up for our Helpline service here and our consultants will help. S.

Thanks a lot Silvia for you article

Do we have IFRS for small SME and for bigger companies

Hi Peter, yes, there is IFRS for SMEs – condensed and simplified IFRS, and then full IFRS applied by anyone else.

Great work. Thanks for this. CA for many year, but still love reading your simple explanation of things.

Thank you! 🙂

Hi Silvia!

My prayer is that you will not get tired in impacting knowledge as accounting information continues to enjoy unified global standard

Hi,

Though many people feel that a sale transaction does not affect the weighted average cost, I strongly believe that it has an impact on the weighted average cost of the inventory. So in addition to the purchase price and purchase quantity, sales quantity is also a factor which affects the weighted average cost of inventory though its not obvious.

Do you agree with this?

With regards,

Arun Augustine

kunnelarun6@gmail.com