Impairment Test in the Covid-19 Pandemic

Here we are, another year comes closer to its and – and what a year!

Pandemic entered into our lives in early 2020 and we all must admit it – this was totally new experience, since only older generations can remember similar situation.

Yes, it was and still is hard for all of us.

The pandemic affects (almost) every single aspect of our private and business lives.

Let me bring up one special consideration that you must make prior completing the closing of your 2020 accounts – impairment of assets under IAS 36.

With strong governmental measures to prevent the virus spread, it may well happen that the value of your assets is overstated and you have some impairment in fact.

Just look around you – many businesses are closed, people almost stopped travelling and limited spending, and we can continue listing many affected economic areas.

So what to do?

Should you perform the impairment test?

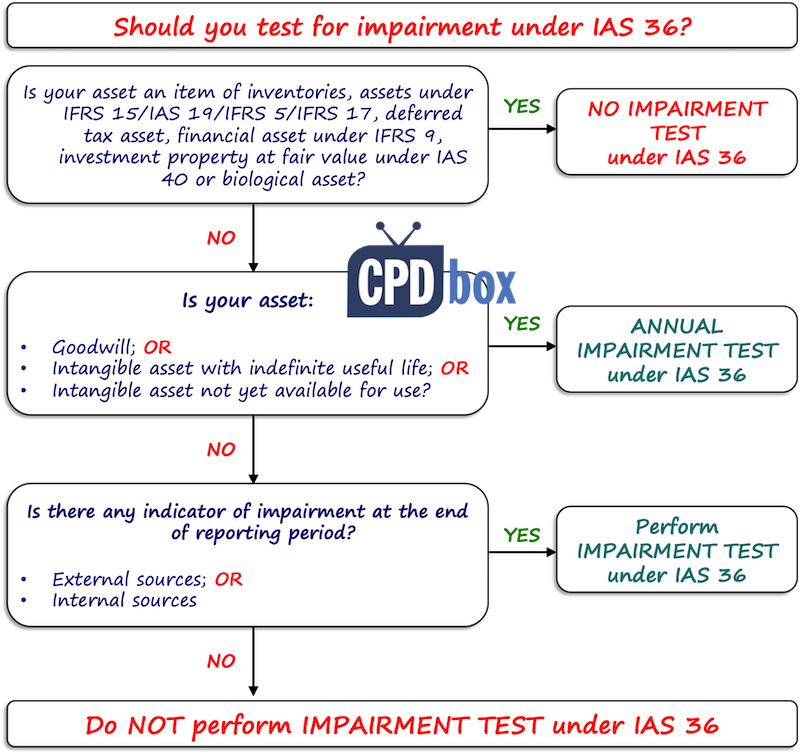

The following picture indicates if you need to perform the impairment test of your assets or not:

Let’s focus on all non-financial assets under the scope of IAS 36.

For most of them, you should perform the impairment test ONLY if indicator of impairment exists.

What are most common indicators of impairment under Covid-19 situation?

The standard IAS 36 lists examples of external and internal sources of information that could indicate impairment.

Specifically in the pandemic situation, I would say that most common indicators are as follows:

I. Limitations to PRODUCE

Here, any factors somehow limiting the ability of your company to produce goods or services and thus complete your operational cycle belong, for example:

- Inefficient functioning of supply chains, e.g. limited availability of transportation, thus interruption of the smooth supplies of raw materials to your company cause idle capacities and lower production;

- Internal obstacles to production, e.g. some of your workforce must stay at home in lockdown or quarantine and there is no one (or lower number of people) to operate machines and run the production. Also, limit of number of people per certain area (e.g. max. 1 person per 15 m2) can affect the production process.

- Increased costs of production, e.g. you need to purchase hygienic equipment like disinfectants, protective masks, respirators, Covid-19 tests, etc. and that lowers the profit margins.

II. Limitations to SELL

Here, any factors somehow limited the ability of your company to distribute and/or sell your goods and services to the end customers fall, for example:

- Closure of business as a result of government measures, e.g. many governments forced restaurants, sport centers, theatres, cinemas to close; limitations to travel caused dramatic decline in number of tourists; airline traffic fell by more than 90% in certain periods, etc.

- Lower profitability as customers force discounts due to their own lower ability to pay the full prices.

III. Market factors

Here, I would categorize the broader situation on the main markets, for example decline in market prices of shares can trigger lower market capitalization and that can be the indicator of an impairment of goodwill.

However, I need to point out here, that at the time of writing this article, the situation looks very unexpectedly – despite decrease in profitability, market prices of shares and similar assets reach their all time highs.

I am not an investment adviser or expert in trading, but to me this seems very counterintuitive, maybe some sell-off or bigger correction is behind the door (then watch out for the indicator of impairment).

Just follow what FED and other central banks do and learn basics of MMT (modern monetary theory) – anyway, it is out of scope of this topic, so I will leave you with some thought to consider yourself.

If any of these indicators are present in your business, then you should go and perform the impairment test.

And, you HAVE to perform impairment test on goodwill and certain intangibles regardless the factors above.

Leases and impairment test

Here, I would like to draw your attention to the leases.

By now you should have implemented IFRS 16 Leases, as it was mandatory from 1 January 2019.

As a result, you might have seen new assets in your balance sheet – ROU (right-of-use) assets.

Some of ROU assets were not in the balance sheet before IFRS 16, especially if you had operating leases with all expenses recognized straight in profit or loss.

Warning: You MUST test also ROU assets for impairment!

Yes, unfortunately the combined effect of IFRS 16 and pandemic is the need to perform even greater volume of impairment testing.

On the other note – if you add ROU asset to cash-generating unit (CGU), it will NOT in general change CGU’s fair value, but it will change CGU’s carrying amount, hence there is a potential impairment.

How to perform the impairment test

Let me just remind the basics to you very basics of the impairment loss calculation.

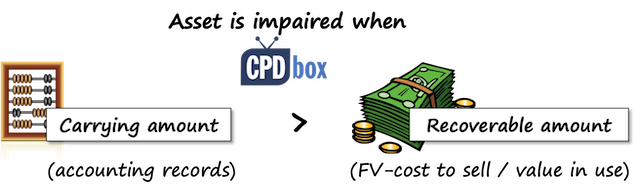

You need to compare the two amounts:

- Carrying amount of the asset under review – that’s the amount sitting in your books, and

- Recoverable amount of the asset under review – that’s higher of:

- Value in use, and

- Fair value less costs of disposal.

Assess going concern prior any testing!

Before you start working on any impairment test, you should really assess if going concern still applies here.

That is – assess whether the company will be able to survive the next 12 months after the end of the reporting period.

The closure of businesses and complete loss of revenues can have devastating effect on the business itself and it is absolutely crucial to assess the ability to survive.

Yes, government may promise compensations, but really – are you going to get them on time?

Will you be able to pay the salaries of your employees from own source of cash without reliance on government? Or will you be forced to lay off some people? Will this lay off jeopardize the ongoing future operations?

This is very frustrating and stressful exercise, I know.

But these are very frustrating and stressful times, so we must critically and realistically think about them.

Let’s say you assess that you are no longer going concern – here’s what you should do.

If you are still a going concern (able to survive), then let me come up with a few considerations related to two critical amounts in the impairment test.

Fair value less costs of disposal

For most non-financial assets under review, companies find it very challenging to determine their fair value and therefore they go for the second number – value in use.

Nevertheless, let me remind you a few points in this regard:

- You should follow the standard IFRS 13 Fair Value Measurement to determine the asset’s fair value;

- This measure is NOT an entity-specific, but reflects the current market conditions.

- Examine the general price level and the prices of similar/identical assets on the market if available – did they go up or down?

However, most companies performing the impairment test will focus on determining value in use as in many cases, the market information about the specific asset is not available.

Value in use

Value in use is basically the present value of cash flows that you expect to derive from the asset under review (or cash-generating unit).

Here, the main challenge is to think of cash flows from your asset and make appropriate cash flow projections.

You can learn more about setting cash flow projections for impairment testing here and see the example here.

When it comes to pandemic of Covid-19, the situation is very unstable and uncertain and you need to take that into account when making your projections.

For this reason, you should consider multiple scenarios in your projections with probabilities of occurrence as weights, NOT single scenario.

In your cash flow projections, you should particularly consider the things, like:

- Effect of government measures to prevent the spread – closures and their length, severity of closures, limitations on operational capacity…

- Increased cost of operations – you might need to purchase new hygienic tools, hire new medical personnel…

- Expected compensations of lost revenue by government, if any

- Strength of your competitors – will they survive?

- Changed demand on the market – if you are a food producer, you are perhaps OK as everyone needs to eat. But, if you run an airline…

Now, let me give you a short illustration of calculating value in use (inspired by the reality in our country):

Example of calculating VIU: Multiple scenarios

Let’s say your government monitors the situation with the spread of the virus and makes short-term plans of closure of non-essential businesses.

You run a network of fitness centers and as of 31 October 2020, they had been closed for 4 weeks already and the government plans to reopen them depending on the infection cases.

Based on previous experience over past 4-5 months, you can reasonably assume the following:

- In a best-case scenario, the government will re-open the fitness centers right after 1 January 2021, however, the maximum number of visitors is limited to 50% of capacity. You will be able to return to the full capacity only after the vaccine is available and at least 60% of people take it – which is not probable before the year 2022. The probability is 20%.

- In a neutral scenario, the government will re-open the fitness centers on 1 March 2021, when the vaccine and/or cure is available. However, you assume here that there will be restrictions and condition for people to visit the centers and as a result, you will still operate 50% capacity until the end of 2021. The probability is 70%.

- In a worst-case scenario, the government will re-open the fitness centers only after 60% of people takes the vaccine, which will not happen before 2022. The probability is 10%.

Additional information:

- Average monthly revenue of your network is CU 70 000, average monthly fixed costs are CU 35 000, average monthly variable costs are CU 15 000;

- The government promised a compensation of 20% of lost revenue as a result of complete closure and you are reasonable sure that you are entitled to it.

The following table sums up using multiple-case scenario for cash flow projection for 2021. In reality, you should split the calculation to individual cash-generating units, but let’s keep it simple here and illustrate using of multiple scenarios in discounted cash flow models:

| Cash flow | Best-case scenario | Neutral scenario | Worst-case scenario |

| Revenues in 2021 | 420 000 (50%*70 000*12) |

350 000 (50%*70 000*10) |

0 |

| Costs in 2021 | -510 000 (35 000+15 000*50%)*12 |

-495 000 (35 000*12+15 000*50%*10) |

-420 000 (35 000*12) |

| Compensation from government | 0 (no complete closure in 2021) |

28 000 (20%*2*70 000) |

168 000 (20%*12*70 000) |

| Net CF in 2021 | -90 000 | -117 000 | -252 000 |

| Probability | 20% | 70% | 10% |

| Weighted amount | -18 000 | -81 900 | -25 200 |

Thus, the expected value of net cash flows in 2021 based on multiple scenarios is – 125 100 (-18 000-81 900-25 200).

Warning – this is NOT a value in use.

Just cash flow projection for 2021.

You would still need to make cash flow projections for the next 4 years, add terminal value and then calculate value in use.

A few notes:

- Forecast period:Remember not to project your cash flows for more than 5 years.

- Terminal value: This is the estimate of the cash flows that you would get from the asset or CGU beyond forecasted period of 5 years. Learn more here and here. Bear in mind that if there is a sharp decline in market prices, that can hugely affect your terminal value.

- Discount rate: Use the same discount rate for each scenario. The reason is that if you use different discount rates, these would reflect the same risks as were reflected in the cash flow projections and you would be double counting.

- Restructurings: I can’t stress this enough – do NOT include the costs and revenues being the effects of future restructurings to which your company has not been committed!

- Market information and statistics: If you ever need to use certain market data or statistics in your forecasts or cash flow projections, there are many sources, both paid and free. I can only recommend the free source, website by Professor Damodaran, loads of valuable data and free knowledge there.

Finally…

Do not forget loads of disclosures related to impairment test to describe uncertainties you are facing, probabilities, weighting, assumptions, how you determined discount rate, etc.

I would love to hear from you – has your business been affected by Covid-19? Will you perform the impairment test at the year-end? Please let me know in the comments below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

7 Comments

Leave a Reply Cancel reply

Recent Comments

- Silvia on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Silvia on How to account for financial guarantees under IFRS 9?

- Silvia on Top 4 Changes in Profit or Loss Statement under IFRS 18 (with video)

- Silvia on IAS 21 The Effects of Changes in Foreign Exchange Rates

- N Magne on IAS 21 The Effects of Changes in Foreign Exchange Rates

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (74) 74

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (55) 55

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (26) 26

- Uncategorized (1) 1

Thank a lot for sharing such a great article. You are always most valuable resource of IFRS for me. Thanks alot

Thank you so much.

But what abou fixed assets under IAS 16?

I consider it as a best gift for the new year. Received with thanks.

Thank you Legesse for being here. I appreciate loyalty and kind words very much!

Bundles of thanks for such valuable article.

thanks so much from Yemen

You are a valuable source for me as an accountant student ..thanks a million