Our machines are fully depreciated, but we still use them! What shall we do?

Do you work in the production company? And did you find out that some of your production assets are still in operation but they were fully depreciated?

In this case, the original estimate of machinery’s useful life proved to be incorrect.

Here’s one of the questions I received:

“Dear Silvia, we are a manufacturing company. We use our existing machinery for a longer period than its useful life and therefore, our machinery is fully depreciated. What can we do to correct it?”

What’s wrong with that?

The problem is that as these machines are used beyond their useful life, they are fully depreciated and their carrying amount is zero.

But in this case, what depreciation expense can you recognize in the profit or loss?

None, of course – because the carrying amount of your property, plant and equipment cannot decrease below zero.

So in fact, you use the machines, but you can’t really recognize any depreciation expense, because there’s nothing left. You have fully depreciated these assets in the previous reporting periods.

And as a result, the matching principle does not work here. The expenses simply do not match the benefits gained from these machines.

The problem is in the machines’ useful lives

The standard IAS 16 Property, plant and equipment defines the useful life as either:

- The period over which an asset is expected to be available for use by an entity, or

- The number of production or similar units expected to be obtained from the asset by an entity.

It is not the potential or economic life of the asset. These two will often not be the same!

For example, normal economic life of a car is 4 years, but the company’s policy is to renew car park every 2 years. In this case, car’s useful life is just 2 years.

Or, the economic life of a machine is 6 years, but after 3 years, the company’s experts assess that the machine can be used for another 5 years. In this case, total useful life is 8 years.

Now this is extremely important: Standard IAS 16 requires entities to review assets’ useful lives at least at each financial year-end.

You would not believe how many entities simply forget it!

They just book the annual depreciation charge based on the rates determined for some group of assets and that’s it.

They do not revise the useful lives of their assets and as a result, they end up with using fully depreciated assets in the production process.

How to fix this situation?

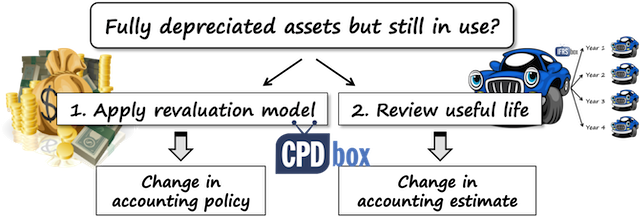

Let me suggest 2 possible corrective actions for this situation.

Solution 1: Review useful lives at each financial year-end.

Useful life is an accounting estimate and if you find out that it is different from what you initially set, you need to book this change in line with the standard IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

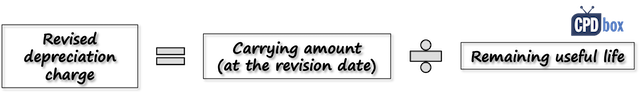

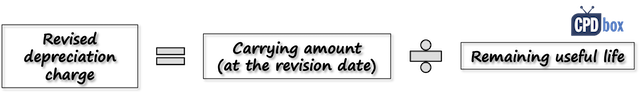

It means that you simply set the new remaining useful life, take the carrying amount and recognize the depreciation charge based on the carrying amount and new remaining useful life.

No restatement of previous periods’ financial statements is permitted. IAS 8 requires recognizing change in accounting estimates prospectively (now and in the future).

Now you might say: OK Silvia, I got it, but what should I do when the carrying amount (net book value) of my assets is zero?

Well, it depends.

If you reviewed the useful lives in the past regularly and during the current reporting period you find out that you’d like to use the assets even longer, then there’s not much to do. Just leave these assets as they are and make sure you avoid this situation in the future.

However, if you really forgot to revise the useful lives in the previous reporting period, this failure to apply IAS 16 results in the accounting error.

If this error is material, then you should correct it retrospectively in line with IAS 8. It means restating the previous periods using the revised estimated useful lives. Huge amount of work!

Solution 2: Revalue your assets to their fair value.

Standard IAS 16 permits 2 models for subsequent measurement of your property, plant and equipment: cost model and revaluation model.

And it is true that if you still plan to use existing machines in the future, their fair value is for sure greater than zero.

Revaluing machines with nil book value would effectively mean that you are changing your accounting policy and here the standard IAS 8 gets the word again.

In line with IAS 8, you shall change the accounting policy only if:

- The change is required by an IFRS. This is definitely not the case.

- The change results in the financial statements providing reliable and more relevant information about the effects of transactions, other events or conditions on the entity’s financial position, financial performance or cash flows.

You (and your auditors) can argue that point 2 exactly reflects your situation. But does it really?

It definitely solves nil book value at the end of the current reporting period. Like a pill provides immediate relief from headaches.

But the accounting policy represents some rules and standards setting how you will report certain transactions in the financial statements – not only now, but also in the future.

It’s not like a pill providing immediate relief. It is like a remedy treating the route cause and making you healthy for a long time, so that you don’t need to take pills anymore. But what if you apply the wrong pill?

So, do you think that changing your accounting policy from cost model to revaluation model would make you provide better information about your machinery, not only now but also in the future?

Before you answer that question to yourself, please consider this:

- You need to apply the standard IFRS 13 Fair Value Measurement in order to determine the fair value of your machines. It’s very difficult and impracticable.

How can you set the market value of used production machines (mainly if they are so specific to your company)? - Revaluation model is used for buildings and land in 99.9% of cases, because it’s easy to set the market value of these assets regularly.

Is it the case for used production machines, with some specialized nature that only a few similar companies can use them? - You need to revalue your machinery with the sufficient regularity. Can you set the fair value let’s say annually?

- You need to revalue the entire class of assets, not on an individual basis. Can you really set the fair value of all machinery? How practical is it?

If after considering all these aspects you still want to switch from cost model to revaluation model, then IAS 8 makes it easy for you. You don’t need to apply the new policy retrospectively, just prospectively – so no restatement of previous periods.

What solution should we select?

It depends, really.

In my opinion, it’s much better to review estimated useful lives at each financial year-end and recognize the change in accounting estimate, rather than opt to change the accounting policy just for the purpose of curing immediate headaches.

From the long-term point of view, revaluation model is not really suitable for machines used in the production process, especially when they have a specialized nature and their main recovery lies in the production of other assets and not in the capital gains resulting from the movements of their market prices.

Yes, I understand that the potential correction of error resulting from failure to review useful lives in the past can be quite painful process, because you need to make lots of calculations. But you do it JUST ONCE.

Please watch the following video with the STEP BY STEP illustration of treating this problem:

Did this explanation help you? Or, do you have a different opinion?

I would really love to hear that! Please leave a comment right below this post. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Dear Silvia

Thanks for these updates and they help me so much.

maam, thank your very much for your very comprehensive explanation

This very helpful, thank you so much especially the assets that have come to the end of their useful life. This is our current problem.

Hi – I am calculating the OCF of a 7 year project using the MACRS calculation. Since the project is for 7 years and there is an additional year left in the depreciation of the machine… do I add that value to the Terminal cash flow although it is a non-cash?

Silvia, what happens if Volvo discovered fully depreciated assets let’s say 5 years ago, still in use, and they considered it as material? Shall all 5 years to be recalculated or only the last two reporting years ? (btw: is there excel spreasheet for the video somewhere available?)

According to IAS 8, only the last comparative period presented, and the cumulative effect of previous periods is reported in the equity of a comparative period. Excel is available in the IFRS Kit.

This is really helpful. Thank you Silvia

It’s really helpful and useful.

Looking to sell my business and we have around 40 machines that would have cost around $2000000 to buy new but we make our own so only coast around $500000 to build ourselves. They have now depreciated almost to zero but have many years life left in them. For a selling purpose do I add them in as the value of what they cost us to build or what they would cost to purchase? Thanks

thank you Selvia

i read it in article in Q&A but here more clear

you still make it better – you still make us LOVE it

still follow you

still waiting for more and more

God Pleased you

Thank you 🙂

Hi Slvia

I know the requirements of the standard that we need to review useful lives for fully depreciated assets. But where do you start? Is there maybe a process to follow?

Hi Martha, ideally, you should revise the useful lives of assets every single year during their operation, not just when they are fully depreciated. You should really set the schedule for doing that. Now, each company designs its own process. For example, you might perform the revision while performing the physical count of your fixed assets (which you should do anyway as a part of closing works).

Thank you Silva for a simplified write-up. I learnt a lot from it.

Amazing that after 8 years, we can still go back and read these articles.

@Silvia, you are amazing! I hope your legacy continues……..

HI Silvia,

I just joined as Accountant in the public sector and applying IPSAS. I have 2 vehicles which had been stated Zero Carrying amount in the FS. However, the vehicles are still in use. An Assessment has now been made by an independent surveyor and the current fair value has been estimated. Kindly advise on the accounting treatment, please. Thanking you.

Amal

ACCA Member, Mauritius

Hi Silvia, i don’t have a word to appreciate your paper excellence while i want to say you Thankyou very much for your best presentation

Thank you 🙂

Thanks for the write up

Thank you Silvia for your illustration,

Please I want your professional opinion,

I have seen entities record some non-current assets(such as chairs and tables) in the financial statements at $1, when I asked for the reason they told me that although its fully depreciated but they still exist in the company so its like a internal control procedure to keep the Asset in the accounting records.

Is this treatment in line with IFRS?

Thanks in advance,

Regards,

Mohammad

That’s the same issue as I am describing here in the whole article. It does not matter that they are carried at 0 USD or 1 USD – they have close to nil carrying amount and still being used. Thus please read above how to go about that.

Thank you for a clear and concise article. In the property pool of assets in our register, we have things like lease negotiation fees, inspection fees and project management fees etc that are now fully depreciated. Should these items be on the balance sheet? In some cases items have been ‘sitting’ there for 12 years! How do we deal with these kinds of items?

Well, I think I did not fully understood – you have negotiation fees, etc. like a separate item of PPE? Or intangible? Or are they attributed and allocated to item of PPE? If they are allocated, then they no longer are negotiation fees themselves, they entered into the cost of that PPE.

Thank you so much Silvia for the IAS summaries!!

Your articles are informative, thank you for taking the time to explain. Was wondering if there is link for schedule of depreciation rates and useful life for PPE and Motor Vehicles.

Hi Silvia.

Thank you for the great work in making IFRS so interesting to learn.

Please items like vehicle and computers were purchased specifically for a project and captured in the contract price of the project. The project could took 2years to complete and transferred to Fixed Assets. The items of fixed asset nature – vehicles and computers are still in good condition, and so used in the organization. What should be the treatment on such assets.

1. Should the total cost of a motor van bought specifically for a project be expensed to the project?

2. Do you estimate the remaining life of the van after the project?

3. How do you ascertain the value of the project motor van that has more useful life and actually used in the business.

3. How do you depreciate such project residual assets which have their cost fully charged to the project?

Thank you

Hi Silvia,

I have taken training on IFRS standards a week ago which was delivered by the university lecturers and found it interesting. Besides, I am following and reading your very useful continuous lectures via email. Thanks for that! Currently, I am working in the Risk Management Department of a local Development BANK in which lending is one of its main activities. So, which IFRS standards should I focus on?

Regards

Hello Sirak, great, I am glad that you took the training and on top of that, that you like my emails! As for risk management – just focus on IFRS 9, more specifically expected credit loss and related issues, plus supplement that with IFRS 7 and IAS 32.

dear SILVIA, thank you very much, really I’m too late to sharing your video, courses and graphics, but I have a chance thank’s god. I would explain to you my grateful thanks for your pretty graphics and easy courses.

I am a finance inspector, I want to improve my knowledge. Thank’s again Miss SILVIA.

Thank you 🙂

Thanks, for your detailed explanation!!

Sorry Silvia but IAS 08 requires retrospective application of change in accounting policy so if someone adopts Revaluation model shifting from cost model then why you said he has not to restate previous periods?

Kindly elaborate

I think I have already explained this somewhere about. It is explicitely stated in IAS 8 that in this particular situation, you do not account retrospectively.

Yes after this comment i tried to read again IAS-08 and I’ve found this exception in IAs-08 but just want to confirm that either i got right para or not. I read this exception in para 17 of IAS 8.

Were you also refering to that para ma’am?

Yes, exactly.

Hi Silvia, thank you for this lectures. What is the assets are many fully depreciated, how do I treat them

Dear Silvia,

Great article here.

But i’m a bit curious with the requirement of IAS16.79(b).

If accounting standards requires us to review our estimation of useful lives, why they also encourage preparer to disclose cost of fully depreciated assets [IAS16.79(b)]?

By disclosing this, would this implied that their useful live is not reviewed and non compliance to the requirement to revise estimation of useful life?

Would love to hear your views on this.

Thank you.

That’s my question to Silvia as well.

Thank you in advance for the response.