How to calculate deferred tax with step-by-step example (IAS 12)

Deferred tax is not a new concept – however, it is the concept quite misunderstood by many. Well, first of all – deferred tax is NOT a tax to be paid. Instead, it is an accrual for tax, working similarly as any other accrual or…

IAS 12 Income Taxes

Benjamin Franklin once wrote: “In this world nothing can be said to be certain, except death and taxes“. Income tax is something that can hardly be avoided by a profit-making company. You might find filling-in the tax return a demanding task because everything must be…

Global Minimum Tax – Who? How? Any IFRS Impact?

when it comes to taxes, the world can sometimes feel like a vast and intricate puzzle. Different countries, different rules and different rates. Hmmm, that sounds like a good scope for tax planning departments of huge corporations, isn’t it? Why not designing some nice and…

Monetary or Non-Monetary?

Updated: 2023 – please scroll below to download the infographics for your future reference, it is free. When you need to translate your items denominated in foreign currency to your own functional currency, then there’s one little problem: Is that item monetary or non-monetary? If…

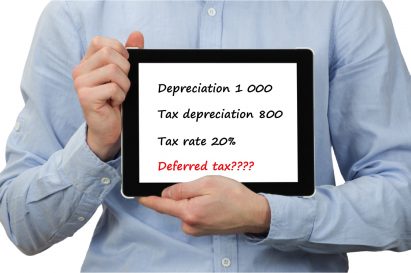

Deferred tax when different tax rates apply

What if the tax rate on capital gains is different from the tax rate on profit? How to calculate deferred tax on assets that will be recovered via both use and sale? Learn here!

IFRS 2019 Update: Major changes you should be aware of

Here we go again – another year has started and a number of changes or amendments of IFRS came into effect. I am pretty sure that you are aware of the biggest ones like new IFRS 16, but let me sum up all the new…

Tax Reconciliation under IAS 12 + Example

When I was an audit freshman, my least favorite task was to prepare the income tax reconciliation. I frankly hated it. Why? The main reason was that I did not understand the purpose of it. For me, it seemed like a bunch of numbers and…

When to start depreciation?

After graduating from a university I started my career in a famous, then Big 5 audit company. If you work in auditing I bet you got the worst tasks and assignments during your first year at work! Just as I did. I remember taking part…

Tax Incentives – IAS 12 or IAS 20?

In my previous article about accounting for government grants I asked you to give me some feedback and write me about some problems or issues in this area. Surprisingly, most of your responses asked one and the same question: How to account for tax incentives…

Deferred Tax: The Only Way to Learn It

Deferred tax is neither deferred, nor tax: it is an accounting measure, more specifically an accrual for tax. I’m very proud to publish the first guest post ever in this website, written by Professor Robin Joyce FCCA who will explain you, in a detail, how…

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)