IAS 12 Income Taxes

Benjamin Franklin once wrote: “In this world nothing can be said to be certain, except death and taxes“. Income tax is something that can hardly be avoided by a profit-making company. You might find filling-in the tax return a demanding task because everything must be…

Global Minimum Tax – Who? How? Any IFRS Impact?

when it comes to taxes, the world can sometimes feel like a vast and intricate puzzle. Different countries, different rules and different rates. Hmmm, that sounds like a good scope for tax planning departments of huge corporations, isn’t it? Why not designing some nice and…

Deferred tax when different tax rates apply

What if the tax rate on capital gains is different from the tax rate on profit? How to calculate deferred tax on assets that will be recovered via both use and sale? Learn here!

Tax Reconciliation under IAS 12 + Example

When I was an audit freshman, my least favorite task was to prepare the income tax reconciliation. I frankly hated it. Why? The main reason was that I did not understand the purpose of it. For me, it seemed like a bunch of numbers and…

Tax Incentives – IAS 12 or IAS 20?

In my previous article about accounting for government grants I asked you to give me some feedback and write me about some problems or issues in this area. Surprisingly, most of your responses asked one and the same question: How to account for tax incentives…

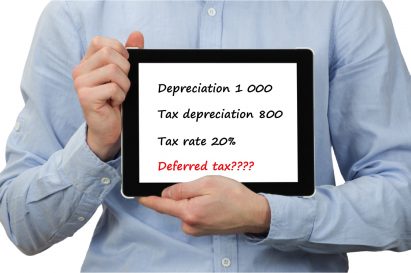

Deferred Tax: The Only Way to Learn It

Deferred tax is neither deferred, nor tax: it is an accounting measure, more specifically an accrual for tax. I’m very proud to publish the first guest post ever in this website, written by Professor Robin Joyce FCCA who will explain you, in a detail, how…

The Unconventional Guide To IAS 12 Tax Bases

Last week I published an article with summary of the standard IAS 12 on Income taxes. It’s not an easy text to read and some definitions in IAS 12 are so obscure that many people grope in the fog unsure what to do. When it…

Recent Comments

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)