Summary of IAS 40 Investment Property

Last update: July 2023

Many accountants falsely believe that there’s only one standard that deals with long-term tangible assets: IAS 16 Property, Plant and Equipment.

While it’s true that you need to apply IAS 16 for most of your long-term tangible assets, it’s not the one ruling all. I tried to falsify this myth some time ago here.

Except for IAS 16, we have a few other standards arranging the long term assets. IAS 40 Investment Property is one of them.

In today’s article, you’ll learn:

- What the investment property is,

- How you should account for it initially and subsequently,

- You’ll also learn that the fair value model is NOT the same as the revaluation model, and

- The video is waiting for you in the end.

Here’s a little bonus for you:

Before we dive in IAS 40, my good friend Professor Robin Joyce wrote a wonderful piece that teaches you accounting for IAS 40 in 40 seconds. Hope you’ll enjoy!

Accounting for IAS 40 in 40 seconds

The accounting for IAS 40 Investment Property is identical to that of IAS 16 (Property, Plant and Equipment),

EXCEPT

that IAS 40 revaluations (both positive and negative) go to the income statement (not revaluation reserve)

AND

there is no depreciation if revaluations are carried out every year.

DONE!

Any remaining seconds should be spent on learning the classifications and rules of IAS 40 Investment Property.

Now, let’s take Robin’s advice and spend the remaining seconds for learning the rest.

Objective of IAS 40

IAS 40 Investment Property prescribes the accounting treatment and disclosure with respect to investment property.

But, what is investment property?

The investment property is a land, a building (or a part of it), or both, held for the following specific purposes:

- To earn rentals;

- For capital appreciation; or

- Both. (IAS 40.5)

Here, the strong impact in on purpose. If you hold a building or a land for any of the following purposes, then it cannot be classified as investment property:

- For production or supply of goods or services,

- For administrative purposes, or

- For sale in ordinary course of business.

If you’re using your building or land for the first 2 purposes, then you should apply IAS 16; and the standard IAS 2 Inventories fits when you use them for the sale in ordinary course of business.

Examples of investment property

What specifically can be classified as investment property?

Here is a couple of examples (refer to IAS 40.8):

- Land held as an investment for long-term capital appreciation, or for future undetermined use (i.e. you don’t know yet what you’ll use it for).

However, if you buy a land and you intend to build some production hall for your own purposes sometime in the future, then this land is NOT an investment property. - A building owned by the entity and leased out under one or more operating leases. This includes a building that is still vacant, but you plan to lease it out.

- Any property that you actually construct or develop for future use as investment property.

Be careful here again, because when you construct a building for some third party, this is NOT an investment property, but you should apply IFRS 15 Revenue from Contracts with Customers.

When to Recognize investment property

The rules for recognition of investment property are essentially the same as stated in IAS 16 for property, plant and equipment, i.e. you recognize an investment property as an asset only if 2 conditions are met:

- It is probable that future economic benefits associated with the item will flow to the entity; and

- The cost of the item can be measured reliably.

How to measure investment property initially

Investment property shall be initially measured at cost, including the transaction cost.

The cost of investment property includes:

- Its purchase price and

- Any directly attributable expenditure, such as legal fees or professional fees, property taxes, etc.

You should NOT include:

- Start-up expenses whatsoever.

However, if these start-up expenses are directly attributable to the item of investment property, then you can include them. But do NOT include any general start-up expenses. - Operating losses that you incur before planned occupancy level is achieved, and

- Abnormal waste of material, labor or other resources incurred at construction.

When payment for investment property is deferred, then you need to discount it to its present value in order to set the cash price equivalent.

Let me just mention that actually, you can classify assets held under the lease as investment property and in this case, it’s initial cost is calculated in line with IFRS 16 Leases.

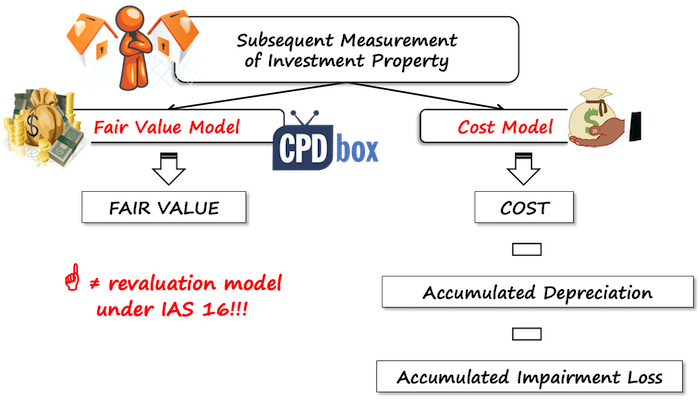

Subsequent measurement of investment property

After initial recognition, you have 2 choices for measuring your investment property (IAS 40.30 and following).

Once you make your choice, you should stick to it and measure all of your investment property using the same model (there are actually exceptions from that rule).

Option 1: Fair value model

Under fair value model, an investment property is carried at fair value at the reporting date. (IAS 40.33)

The fair value is determined in line with the standard IFRS 13 Fair Value Measurement.

A gain or loss from re-measurement to fair value shall be recognized in profit or loss.

Sometimes, the fair value cannot be reliably measurable after initial recognition. This can happen in absolutely rare circumstances (e.g. active marked ceased existing) and in this case, IAS 40 prescribes (IAS 40.53):

- To measure your investment property at cost, if it’s not yet completed and is under construction; or

- To measure your investment property using cost model, if it’s completed.

Option 2: Cost model

The second choice for subsequent measurement of investment property is a cost model.

Here, IAS 40 does not describe it in details, but refers to the standard IAS 16 Property, Plant and Equipment. It means you need to take the same methodology as in IAS 16.

Switching the models

Can you actually switch from cost model to fair value model or vice versa from fair value model to cost model?

The answer is YES, but only if the change results in the financial statements providing better, more reliable information about company’s financial position, results and other events.

What does it mean in practice?

Switching from cost model to fair value model would probably meet the condition and therefore, you can do it whenever you’re sure that you’ll be able to determine the fair value regularly and the fair value model fits better.

However, the opposite change – switch from fair value model to cost model – is highly unlikely to result in more reliable presentation. Therefore, you should not really do it, and if – rarely and for good reasons.

Transfers from and to investment property

When we speak about transfers related to investment property, we mean the change of classification, for example, you classify a building previously held as property, plant and equipment under IAS 16 to investment property under IAS 40.

The transfers are possible, but only when there’s a change in use or asset’s purpose, for example (refer to IAS 40.57):

- You start renting out the property that you previously used as your headquarters (transfer to investment property from owner-occupied property under IAS 16)

- You stop renting out the building and start using it for yourself

- You held a land for undefined purpose and recently, you decided to construct an apartment house to sell apartments when they are built (transfer from investment property to inventories).

What’s the accounting treatment in this case?

It depends on the type of a transfer and the accounting choice for your investment property.

If you opted to account for your investment property at cost model, then there’s no problem with the transfers, you simply continue with what you did.

However, if you picked up a fair value model, then it’s a bit more complicated:

- When you transfer to investment property, then the deemed cost is a fair value at the date of transfer. Difference between asset’s carrying amount and its fair value is treated in the same way as revaluations under IAS 16.

- When you transfer from investment property, then the deemed cost is also fair value at the date of transfer.

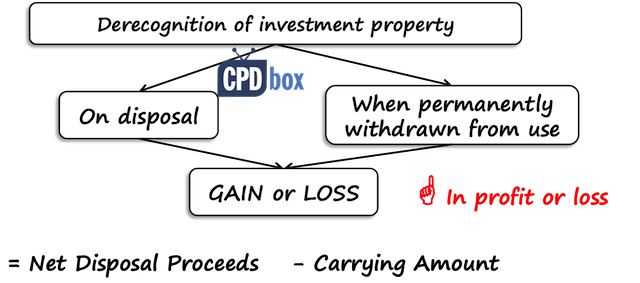

Derecognition of investment property

The derecognition rules (=when you can remove your investment property from your books) in IAS 40 are similar to the rules in IAS 16.

You can derecognize your investment property in two circumstances (IAS 40.66):

- On disposal, or

- When the investment property is permanently withdrawn from use and no future economic benefits are expected.

You need to calculate gain or loss on disposal (IAS 40.69) as a difference between:

- Net disposal proceeds, and

- Asset’s carrying amount.

Gain or loss on disposal is recognized in profit or loss.

Disclosures

IAS 40 Investment property prescribes a lot of disclosures to be presented in the financial statements, including the description of selected model, how the fair value was derived, what the classification criteria for investment property are, movements in investment property during the reporting period (please refer to IAS 40.74 and following for more information).

Please watch the following video with a summary of IAS 40 Investment property:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

if I have acquired a plot of land on which I have built a mall for rent, and I have chosen the cost model as the method of further measurement of the investment property, do I understand correctly that I will calculate depreciation only for the building, the plot of land will not be depreciated?

Thank You in advance.

Yes, correct.

I greatly appreciate your clear and logical explanation of this section, which has been immensely helpful in my understanding of IAS 40. I have a specific case that I’d like your advice on: our shopping mall, classified as investment property under the Fair Value model, has experienced damage to a piece of equipment, its cost was a part of the initial cost of the mall, leading us to decide on its disposal. I would highly value your insights on how to appropriately account for this disposal of part of the investment property cost under IAS 40, as well as recognizing any disposal gain.

Thank you for your guidance!

Hi Silvia, thanks so much for your wonderful article. I have a question:

I understand that if we adopt fair value model, we cannot depreciate the investment property, but I don’t understand that if we adopt cost model, we can depreciate the investment property.

My question is: depreciation should follow “wear & tear” principal, if the investment property has no “wear”, even it is valued at cost model, but why is there a “tear”? many thanks.

Hello, I don’t think that anyone analyzed “wear” separately from “tear”. Maybe you should explain more closely what specifically you mean, because wear and tear principle refers to natural deterioration of asset’s value over time due to its regular use and aging. It is not meant as two separate words.

I understand now, wear also means ageing over time, not only for usage, thank you Silvia!

“Can impairment losses on investment properties recognized under the cost model be reversed? Any guidance, please?”

Yes. IAS 36 applies here, so if the conditions are met, then not a problem.

Dear Silvia,

Thank you very much for the brief explanation about IAS 40. Can you please explain to me: if one organization borrows a loan with below the market interest rate from a Bank, shall we treat the difference as a government grant?

No IAS 20 Deals only with grant or assistance by the govt itself.

We can use and implement the IFRS 20. Accounting and reporting for government grants and disclosure of government assistance

You meant IAS 20.

Hi Silvia,

Can you help me? I’m trying to figure out what kinds of treatments the company would use under International Financial Reporting Standards (IFRS). The company signed a PPA agreement with the developer for two apartments: one for staff and another for rental use in November 2022. The agreement stated the following terms and conditions:

Anticipated Handover Date: Jul 2025

Completion Date: Nov 2028

Effective Date: Nov 2022

Purchase Price: 770000 each

Payment Schedule: 71 equal quarterly installments

Hi Roshan,

I am not sure I understand. PPA agreement is usually Power Purchase Agreement for the long-term supplies of electricity. Did you really mean it? From your text it seems that the agreement is for the construction of apartments. If that is the case, then I would really need to see the conditions stated in the contract to assess at which point the control of apartments is transferred to the buyer.

The developers call it the “Property Purchase Agreement”, which states they will transfer the ownership of those apartments and register the same in the name of the buying company upon the completion of the payment and construction.

Hello,

Does IAS 40 say on how frequently one can revalue the Investment property? if they choose to measure it using the fair value model. is it wrong to revalue the asset from year to year consecutively? thanks for your help.

FV model asks you to measure the investment property at fair value. It implies you need to revalue annually at the reporting date, since the investment property should be always stated at fair value in the financial statements.

Hi Silvia , in case the company has quarterly reporting ,for example due to IPO requirements , does it need to revalue IP at the end of every quarter if there are no significant changes on the market , or are there any exceptions?

Yes At each reporting date revaluation is necessary as you are reporting the financials to public.

Hi Silvia,

Can we convert revaluation surplus into Paid in Capital or R/E?

Not into paid-in capital, since this is not a contribution from shareholders and I am not aware of any legislation that would permit it. When it comes to R/E, you should do the depreciation adjustment to transfer a part of depreciated revaluation surplus to R/E, or when you derecognize revalued asset with some revaluation surplus left, then you should transfer it, but not outside any of these reasons.

Hi Silvia,

If a company owns a regular hotel through a subsidiary and it’s operating the hotel by its own staff. Is the Hotel classified as IP or PPE.

Regards,

Hi Michael,

in the consolidated financial statements, it depends – please see my analysis here: https://www.cpdbox.com/025-is-a-hotel-an-investment-property-under-ias-40/

Hi Silivia,

I have a query in relation to the fair value model in relation to IAS 40. This is because, despite the fact that I do understand that the fair value model which is adopted under IAS 40 is not the same as the revaluation model adopted under IAS 16, I am finding it hard to understand as to why in IAS 40 the we do not use the revaluation model and we therefore do not account for any depreciation after calculating the fair value.

Hi Kyle, the main reason for this is the fact that the purpose of holding property under IAS 40 is capital appreciation/rentals; not own use as under IAS 16.

Hi Silvia, Can you please elaborate it more as the purpose for holding property under IAS 40 and IAS 16 is different under cost model too but the accounting treatment is same. Cost less accumulated depreciation. Why?

This was so helpful… Thanks Alot…

Hi Silvia

If a company rents out some of it’s properties to its staff members (paying market rates), is the property owner occupied or it’s an investment property. The standard is not clear on this one.

Regards

I would say you should look at the purpose of that rental. If the staff actually lives there (not executing business activities in the property), then it is not owner occupied.

Hi Silvia,

Thank you very much for such useful content.

Well I have a small query as There is a multiple story building erected on a piece of land. The Entity has rented out 2nd floor out of remaining floors to its Subsidiary and shows this [single floor + “piece of land on which the whole building is erected”] as Investment property.

I believe this land should not be classified as Investment property as it cant be separated / leased out separately, I mean who would buy the rights of a land which is wholly used for a constructed structure (which won’t benefit the prospective buyer by itself).

Thanks in Advance

Osama

Please guide me that the entity’s treatment is correct ?

Hi Osama,

I think I agree with you to some extent – definitely not the whole land is an investment property since it carries the building that is mostly owner-occupied (own use). The question is – is the rental contract for 2nd floor mentioning something about the land? If not, would it be possible to sell a portion of a land together with the second floor? That depends on the legislation of your country. In our country, when someone buys an apartment, he/she always buys a portion of the land beneath it. In this case, you could treat the portion of a land beneath the building related to 2nd floor as an investment property (calculate it in proportion). To avoid valuation issues, if you apply fair value model on investment property, you can decide to apply revaluation model on your lands and in this case, valuation of that land would be more-less the same regardless its classification as either PPE or investment property.

Thank you very much Maam,

May God reward you for the good work you do.

Again thanks a lot for the reply.

Hi Silvia

Thank you for making IFRS/IAS easy for us. Wonderful insight into the standards.

A Holding company owns entire land and buildings for all its group companies and has created a subsidiary that manages all its land and buildings. The subsidiary charges rent from all group companies and treat it as its income. The rental income sits in that subsidiary books alone. From the Holding company perspective, would the land & building be treated under IAS 40 or IAS 16?

Thanking you

Hi Arshad,

thank you! In the separate financial statements of a holding company yes, the land and buildings are investment property, because holding company uses them to earn rentals (does not matter if from related parties). In this case, subsidiary is an agent and a holding company is a principal, but the substance is getting the rentals from the land (not sure about how the contract between subsidiary and holding is done). From the group perspective, land and buildings are own-use, so apply IAS 16. I think the easiest way is to apply cost model for your investment property as a choice under IAS 40. This is possible and it will save you recalculations for the consolidation purposes (although presentation is in a separate line and also, you still need to disclose the fair value in the notes). I hope it helps. S.

Hello,

Thanks for your good notes; I have a question, not on the topic.

How briefly should anyone starting and wanting to understand IASs look at them?

Hi Silvis, Thanks for your amazing notes; i have a question outside this topic if possible. What is the best accounting treatment when a company receives a PDC (post dated cheque) from a customer? Thanks

Hi

why does under ias 40 increase in fair value recognized in pl although itis unrealized gain

and in ias 16 increase in fair value recognized in OCI

Many thanks for you Selvia

But I have a problem here that I still Can t see a different between Cost Model and recogniIng with property in cost

May I have miss understanding

The cost model under IAS 40 is the same as the cost model under IAS 16, if that’s what you are asking.

Hello Silvia,

I really appreciate the detailed explanations to IFRS and practical examples. I found it really helpful on a number of occasions.

I have a question regarding the transition from the F.V model to Cost model. Assuming the reasons for the transition are solid and better presentation would be achieved from the Cost model, how should I make such a transition?

Should I account for the change retrospectively as per IAS 8? or a simple reversal of the net Fair Value gain/loss in the year would be enough?

Also, what disclosures are necessary for such a transition?

Keep up the good work,

Best regards from Cyprus,

Christos

Hello, Silvia!

First, I wanna thank you for making awesome videos and articles that explains accounting standards in a simplier manner.

I have a question. I just want to know what is the better subsequent measurement when dealing with investment property? Is it the Cost model or fair value model? And what is the reason behind it. Thank you!

I am still confused on how to account for improvements especially Work in Progress (WIP) Cost. If we were to begin construction on a vacant land that was originally classified as investment property and at reporting date there was a WIP balance for the improvements. Is it allowable under IAS 40 for the improvements to be excluded from FV valuations. If not what are the implications?

If we construct a building for rental to others, but it is not completed (WIP) yet.

How can we pass an accounting transaction for it?

Hi

What is the purpose of the cost model in IAS 40? If the intention is to see growth in these properties then why have cost model as a measurement basis?

Hi Sylvia,

if the investment property measured at Fair Vlaue is given as a gift, how would this be accounted. Thank you very much

Hi Josie, please read this article about the free assets, maybe it will help!

Hi Sylvia,

Thanks a lot for your help. In my case, we are the one gifting the investment propertyto the shareholder, i shall credit P/L -the expense account right? Thanks a lot.

Unless there is a different substance (like repayment of a loan by investment property or similar), then yes.

Thank you very much for your help.

Hello Silvia,

Thank you very much for the great work please keep it up.

My question is that, Why we do not charge depreciation when we record a property using Fair value model?

What is the logic behind ?

Waiting for your reply thank you

Hi Silvia,

First let me say that I am loving your summaries and videos. I have a question I was not able to answer after I reviewed the guidance. In 2019 we adopted IFRS and now all of our store leases are finance leases. We sub-lease part of one of our finance lease. According to IFRS 16 the sub-lease is an operating lease. Would the asset under the operating sub-lease be considered investment property? Would it make a difference if the sub-lease was a finance lease?

Hi Silvia,

If an investment property under fair value model is sold off, what are the necessary accounting entries required? Thank you in advance 🙂

Hi Silvia! I have one question. For property investment should we separate from PPE chart of account or put it in the same chart of account ? Thank you in advanced.

I would strongly advise to separate, because you need to show investment property separately from PPE in your balance sheet.

Hi Silvia, if i have a chillers on my investment properties (Building) which was included when purchased the property, however if the chillier is require to be changed, the new cost of the chillers whether it should be capitalized and depreciate over its life or should be an addition amount to the investment properties?

Dear Silvia

Thanks for sharing the details about IAS40 which is easy to comprehend. We have a manufacturing company which produces and sells the products. last year due to market condition and competition, we had to shut down one of our manufacturing unit and we reclassified the plant and machinery of that unit as Asset Held for Sale. Later after few months we gave that manufacturing unit on lease with a one year lease agreement on renewable basis. Can you please let me know in such circumstances, would the plant and machinery given on lease be reclassified to “Asset Held for Investment” ( which was previously considered as Asset Held for Sale) at book value and effective the lease agreement should we start depreciating those assets. We also have an existing warehouse property which is classified as “Asset held for Investment” since long valued at Fair Value each year. So can we have two different type of Assets valued differently, one at fair value and second one at Cost value shown in our financials.

Any reply on this?

OK, let me reply. First of all, there are strict conditions to classify asset as held for sale under IFRS 5, so the question is if you met the conditions to classify since you did not sell.

Secondly, revise the following article that gives quite a good response: https://www.cpdbox.com/question/ifrs5-asset-held-for-sale-not-sold-after-1-year/

Thirdly, yes, you can have two same kinds of assets, each valued differently, depending on the purpose of their holding.

Are you saying that depreciation method for investment property aside from the straight-line method would be applicable? If yes, can you suggest other methods?

Is it specifically stated to revalue investment property annually by the standard?

You can apply any suitable depreciation methods for investment property, if you measure it under cost model, because IAS 40 directly refers to IAS 16. So you can apply diminishing balance, or any other systematic methods that would reflect the usage of the property.

As for revaluations – it is not explicitly stated using these words, but if you apply fair value model, then you need to keep your investment property at fair value at the reporting date, hence if your reporting period is 1 year, there you go. If you do not revalue to FV at the end of the reporting date, but you keep it in the older fair value, then your investment property might NOT be at fair value at the reporting date. Of course, if you report quarterly, then you need to revalue each quarter. You get the point.

And, even if you apply cost model, you still need the fair value for the disclosure purposes (because under cost model, you do NOT keep investment property at fair value!).

Thank you. This is quite helpful

Helpful response. Thank you