Top 3 Questions about IAS 41 Agriculture

I rarely publish articles about specific sectors, but this time, I decided to make an exception.

Why?

The reason is that although most of you do NOT deal with agriculture, it is still one of the most important industries in the world.

It is so important and so different from other industries that it has its own standard – IAS 41 Agriculture.

In many developing countries, agricultural activities represent one of the most important sources of income.

After all – we all need to eat (unless you’re breatharian). This tells it all about the importance of agriculture.

Unlike other industries, agriculture works with living animals and plants. By definition, living animals and plants are born, grow and die.

Therefore, a few problems arise when it comes to accounting for and reporting the results of agricultural businesses.

So, if you’re into agricultural business, or you just need to familiarize yourself, keep on reading. Maybe you’ll be surprised to find out that agriculture can hide in very improbable places!

Question #1: Is it agriculture?

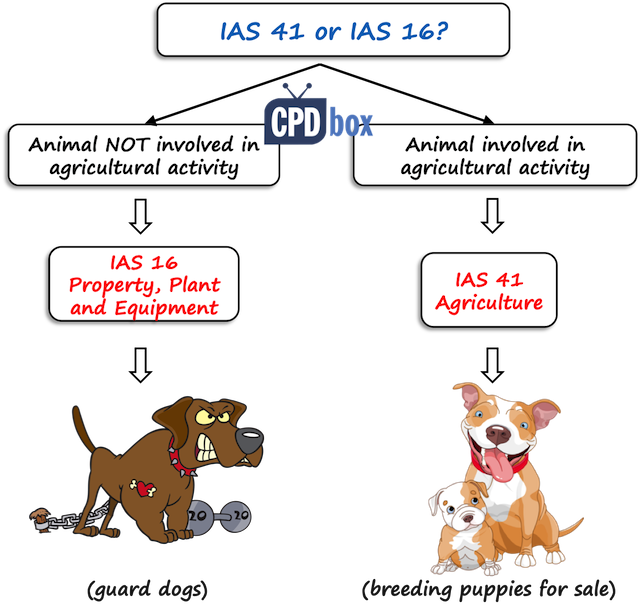

The first and primary question when dealing with living plants and animals is – what is agricultural activity?

It is the management of the biological transformation (e.g. growth) of biological assets for (IAS 41.5):

- Sale, or

- into agricultural produce, or

- into additional biological assets.

You have to make your best effort to answer that question correctly, because the accounting and reporting depends on it.

Why?

Imagine you have a dog.

Logically, it is a living animal, and therefore it is a biological asset. You might think: “well, biological assets are governed by IAS 41, so I need to measure the dog at fair value at the end of each year”.

Not so fast.

Why do you have that dog?

Is it a guard dog, protecting your property and barking at everyone passing by?

If yes, then you should NOT apply IAS 41, but IAS 16 Property, plant and equipment and measure the dog at cost less accumulated depreciation.

The reason is that protecting the property is NOT an agricultural activity and IAS 41 does NOT apply.

Or, do you have that dog in order to produce and raise puppies and sell the puppies?

In this case, IAS 41 applies, because breeding and selling puppies is an agricultural activity.

So, if you think that OK, I’m not a farmer, so I don’t need to bother with IAS 41, you might be surprised where the agriculture can hide.

Just a few examples:

- Pharmaceutical companies

Some pharma companies grow their own plants in order to produce drugs. Yes, this is an agricultural activity and IAS 41 applies. - Diary producers

If a company grows its own bacteria and cultures and then adds them to its yoghurts, well – this is an agricultural activity and IAS 41 applies. - Jewelry producers

Some big jewelry producers produce their own pearls by planting foreign objects (such as pieces of shells or parasites) into the soft bodies of living oysters. Then, the oyster produces a pearl by secreting crystalline substance around the object to protect itself. Yes, this is an agricultural activity and IAS 41 applies.

On the other hand, not everything involving living plants or animals is agricultural activity.

Again, few examples:

- ZOO

The main purpose of the ZOO (and safari, recreational park, riding hall, etc.) is to make money from showing the animals off to the public – this is NOT an agricultural activity and IAS 41 does NOT apply (IAS 16 does).Yes, animals living in the ZOO sometimes pair and produce a baby – but if it’s a natural process, not managed by the ZOO, it is NOT an agricultural activity.

The situation would be different when the ZOO would implement an active program of reproduction and managed that program. In this case, breeding animals would NOT be an incidental and ZOO would have to apply IAS 41.

- Fishing

All fishermen catching fish in the ocean can breathe with relief. If you are NOT actively farming fish, but you’re merely harvesting the fish from the ocean, it’s NOT an agricultural activity.The reason is that fish grew naturally in the ocean, which was NOT an agricultural activity.

The same applies for hunting and other similar activities of harvesting biological assets from nature.

- “Working animals”

When you hold an animal primarily to do some work, such as cart-horses, guard dogs, elephant taxis, etc., then you do NOT apply IAS 41, because all these activities do NOT represent biological transformation.Instead, IAS 16 is the right way to go.

Question #2: Is it a biological asset?

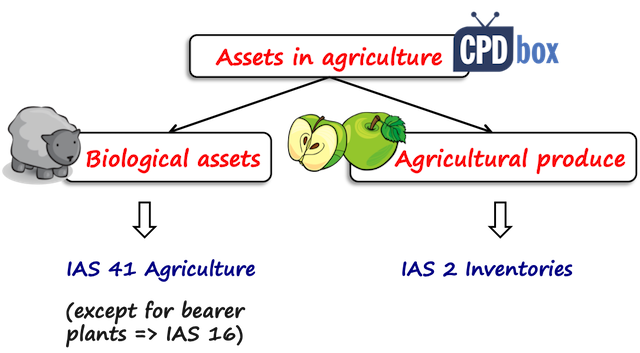

Very common misconception in the agriculture accounting is the belief that everything coming out of agriculture is a biological asset.

Not true.

Biological assets are only living plants and animals.

The harvested products of biological assets are agricultural produce.

Apples, palm oil, pearls, milk, coffee beans, tea leaves – all this is agricultural produce.

Why do we bother?

Well, once you detach the agricultural produce from a biological asset, in other words – once you harvest the produce, it becomes your inventories and you apply IAS 2 Inventories.

At the moment of harvest, you should measure your new inventories at their fair value less costs to sell and subsequently, you measure them under IAS 2 at lower of cost and net realizable value.

You do NOT remeasure agricultural produce to fair value less cost to sell.

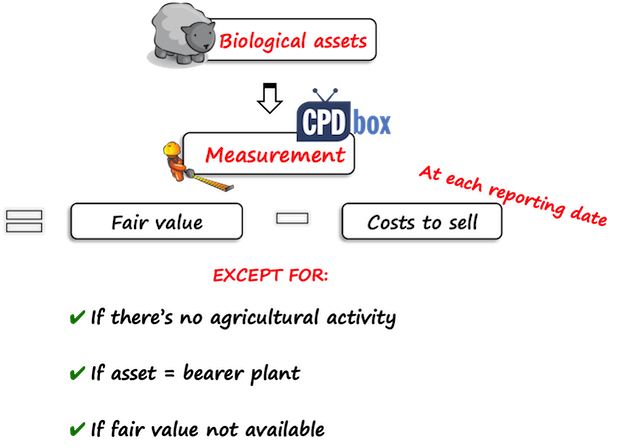

Question #3: Are biological assets always measured at fair value less costs to sell?

No, they are not.

It is true that the general rule in IAS 41 Agriculture is to measure all biological assets at fair value less costs to sell.

However, there are few exceptions:

- The biological asset is NOT a part of agricultural activity.

I’ve explained it above – guard dogs, fish caught in the ocean, etc.

- The biological asset is a bearer plant.

This is a relatively new thing in both IAS 41 and IAS 16 adopted in 2014.

A bearer plant is a living plant used in production or supply of agricultural produce that is expected to produce for more than 1 period.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

The examples are fruit trees, oil palms, vines etc.As it was difficult and impractical to set the fair value of these assets at the end of each reporting period, they were taken out of IAS 41’s scope.

So, you can keep these assets at cost less accumulated depreciation under IAS 16.

Careful – this is only about plants, not animals. So, if you own expensive dogs and use them to breed new dogs, then sorry, it’s NOT a bearer plant.

- The fair value is not reliably measurable

When the fair value cannot be measurable, you can measure the asset at its cost less accumulated depreciation.

However, this is almost never relevant and IAS 41 says that the fair value CAN be measured reliably for biological assets.

Also, this exemption is available ONLY at initial recognition, never later. So, if you received the biological asset as a gift and market prices are not available, you would be able to use cost model.

Other situations are highly unlikely.

Further reading

In this article, I outlined just a few critical questions related to the correct reporting of agricultural activities.

We haven’t even touched other things, like how to set the fair value of biological assets and harvested produce, or example of accounting for agricultural activity from the beginning to the end.

Here’s the list of a few articles on CPDbox that I strongly recommend to read (and watch the attached video) to educate yourself about agriculture:

- Summary of IAS 41 Agriculture (with video included)

- How to account for expenses related to agricultural activity?

- How to measure fair value in agriculture

Until then, please leave a comment right below this video and let me know your own agricultural issues. I’ll try to help out!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (74) 74

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (56) 56

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (27) 27

- Uncategorized (1) 1

Hi Silvia, thanks so much for the good work.

I will like to know, when you periodically feed fishes in a river to increase their yield before harvesting, will that be considered an agricultural activity.

Also how will you accounts for plants that are cultivated for example vegetable plants in a snails farm as feed.

Thank you.

hi selvia can you explain more about this

Hi Silvia

Great article and simple explanation.

I work at a University and we have animals (i.e. laboratory rats) for experimentation.

Would this fall within the scope of IAS41?

Interesting question. If you are using the rats for experiments that are NOT an agricultural activity (e.g. not for their reproduction), then they are treated as inventories.

This is simple, straight to the point explanation and well understood. Well done Silvia. You have always added value to Standards either new or old.

Hi Silvia – Thank you very much for this great explanation. There are certainly a lot of thought provoking issues to deal with the handling the various circumstances. I look forward to reading additional support information you have made available.

Well Explained, Appreciate your articles and its simplicity.

Now the standers IAS 41 More clear but after i read tow article for you selvia i can say that IFRS 13

become the master of fair value in the world – Not for the accountant Only

i make arabice version from all your free article if any of your people around need it It is avilable

thank you selvia thank you for everything you do for us

Hi Sylvia. Thank you for the article. I would like to ask if a Company should book cats under IAS 16 if the cats are being used for stress relief. I am not sure if they generate economic benefit. It is widely agreed that office pets do raise morale and improve efficiency. Also if the cats are given as gifts should we estimate the fair value of cats at initial recognition?

Hi, first of all thanks for this valuable paper.

I have a question, just to understand if I’m right with the standard.

When the standard talks about fair value for agricultural products, it is essentially saying that fair value coincides with the “lower of cost and net realizable value” (if IAS 2 applies), right?

I am conducting research and therefore I need the opinion of a person more experienced than me…

Thank you in advance for your reply

Fabio

Now the standers IAS 41 More clear but after i read tow article for you selvia i can say that IFRS 13

become the master of fair value in the world – Not for the accountant Only

i make arabice version from all your free article if any of your people around need it It is avilable

thank you selvia thank you for everything you do for us

Hi Silvia, I have read this paper with a passion and i cleared much confusing that i couldn’t clear when i took p2, but now thanks to your amazing paper, and i am expecting the next one of IAS 41 regarding that you plan to cover to be more interesting and easy to understand

Really appreciate, nice, and simple explanation,

Hi there , how do I value semen (for selling to farmers) extracted from Bull ?

Very interesting question. I would say at fair value at the point of harvest.

Thanks for this wonderful Article

Hi,

My question is if the biological asset is classified at cost model. E.g poultry – parent birds. Now if they die what will be the accounting treatment? Will it be a de recognition of asset or impairment loss? What will be the accounting entry?

Hi Kamal,

first of all, I cannot see why you are not measuring biological assets at fair value less cost to sell, as required by IAS 41. Cost model is not an option here, only when fair value cannot be reliably estimated – and, it should not be the case for poultry (it is not a unique biological asset). Anyway, if you keep that asset at cost model anyway for very good reasons, then you need to derecognize it upon death. It is not the impairment – it is derecognition. So the entry is Debit Loss on derecognition of biological asset in profit or loss / Credit Carrying amount of that asset. S.

When an asset is classified as biological assets and inventory? When an assets is transferred from IAS 41 to IAS 2?

Thanks for a good article,

Our company buy 4 of palm trees are just for garden which is not related to agriculture activity. And I think palm tree should be recorded under IAS 16 as a part of ” land improvement” . I am correct? And can I say that palm tree is Bearer Plant?

Many thanks for you selvia

You make me waiting for your next articles about how to set the fair value of biological assets and harvested produce, or example of accounting for agricultural activity from the beginning to the end.

Thank you for sharing you knowledge

God Blees you my teacher

Hi Silvia

it has been short period that I am following your enriched lectures having read this I wanna ask how would be accounting treatment at cost initially (will it be going SOFP Dr/Cr) and then FV (SOFP Dr and PL Cr)

Hi Silvia

I just wanna need your advice on this question

In 2015, ABC Limited established and commenced operation of an Flower business in Suva. The trees were

planted in 2007, and began producing saleable flowers in 2016.

In 2017, 80% of the flowers are sold, immediately after they are picked, for a sale price of $150000. Selling

costs are assumed to be immaterial. The remaining 20% of the picked flowers are recognized as

inventories at the end of the reporting period.

The fair value less the estimated point of sale costs of the flower trees at 30th June 2016 ( the end of the

previous reporting period) was $95000 and at 30th June 2017, $115000. During the reporting period

ending 30th June 2017, employee expenses, fertilizers, lease expense and other expenses amount to

$50000.

The fair value less estimated point of sale costs of the flowers immediately after picking and packing

amount to $100000. Picking and packaging costs amount to $25000.

Required: Prepare the journal entries to record:

a) The changes in the fair value of the biological assets between ends of the two reporting periods.

Thank you Silvia for your article on IAS 41. A lot of examples are given for understanding the topics. It is your quality that you simply explain the critical topics with easiest example and way. Hope this communication will continue in future.

How can I separate if I grew fish, left some to reproduce and at the same time sell them in the same month?

I could present both elements in my financial statements. inventories and biological assets

Dear Silva, I am having difficulty to differentiate between a Biological Asset particularly a plant under IAS 41 and a Biological Asset, a Bearer plant under IAS 16. Can you please give more vivid examples that differentiate the two Biological Assets – Plant type to be treated under IAS 41 vS IAS 16

Hi Albert – this is the right question on the right time! My next article will be about it, so please watch out

Dear Silvia, Thanks for your response. I am eagerly looking forward to your next article. I will appreciate if you can include me in your mailing list. Please copy me on my email albertmkongwa@gmail.com

Dear Silvia,

Thank you for the article on this important issue. I am from Ethiopia and working in a beverage industry, specifically winery company. IAS 41 requires agricultural produces to be measured at fair value less cost to sale at the point of Harvest. However we have neither primary nor secondary market for Grape. Further more, there are only two companies working in the Winery industry which they produce their own unique Grape for further processing to produce wine. Given the above facts, do we have the option to measure the Grape at cost?

Dear Sylvia, Good morning from Greece,

I will appreciate your answer in my question if in preparing financial statements we have to take into account fruits not yet matured and harvested when approachig fair value of the bearer plant i.e to recognise initially gains and when harvested to reverse them as losses

Again a very helpful article!

My question is what is the journal entry if you capitalise a new baby animal under 41? Thank you

Thanks for sharing your knowledge on this topic.

Hi Sylvia! Thank you for this article. I am currently working in a horse breeding and racing business. Based on my understanding of this article, our horses should be classified as follows:

* race horses – a PPE and should be accounted at cost and to be depreciated (IAS 16)

* breeding horses – biological asset to be valued at fair value less cost to sell (IAS 41). These is no option to value at cost since the 3rd exemption is not relevant. I assume that this applies to female horses and its foals. Is this understanding correct?

How about the male horses that provides coverings to female horses (owned by other owners)? We generate a revenue from this through the service fees. IAS 16 or IAS 41?

Thank you.

That is a very interesting question. However, the question is whether this is agricultural activity or not. The definition is: “Agricultural activity is the management by an entity of the biological transformation and harvest of biological assets for sale or for conversion into agricultural produce or into additional biological assets.” Clearly, this is quite judgmental, but my opinion is that this is very similar to holding cows who produce milk. Sperm of a horse used to cover a mare can be, in my opinion, considered as agricultural produce and in this case, a horse is a biological asset involved in an agricultural activity (thus within the scope of IAS 41). Regardless of whose mares are being covered. By the way – just to make it precise – race horses are also biological assets, because they are living animals, but they do not fall within the scope of IAS 41 as they are not primarily involved in an agricultural activity.

Thank you Sylvia. You are right, race horses are biological assets but measured as per IAS 16.

Thanks so much Sylvia, the Great. What does the term HARVEST mean under IAS 41 ?. Supposing, I have Sugar cane farm and I cut the sugar cane and sell them. Does the cutting fall under HARVEST? Does IAS 41 apply ?

Hi Clement, yes, I would say that cutting the sugar cane meets the definition of harvest and since that moment, you do apply IAS 2 to your sugar canes.

thanks silvia , really from all my heart you are an amazing doctor ……. wish you learn us tax regulation with this simplicity hhhhhhhhhhhhhhhhhhh

Hi Silvia,

Thanks for the easy-to-follow explanations. I would like to know if it’ll be incorrect for a zoo to apply IAS 40 for animals in the zoo, since they are used to generate income.

Hi Sighan, well the primary activity in which these animals are involved is NOT an agriculture, but to be displayed and observed – thus I believe IAS 41 is not applicable here.

Thanks for the quick response – but i’m talking about IAS 40 – Investment Property if that would be more applicable instead of IAS 16 – Property, plant and equipment.

I thought you made a typo, since this article is about IAS 41. Well, by no means they are investment property – IAS 40 limits its scope to buildings, lands and parts of it only, not animals.

Hi Sylvia, may I know how to account for dairy cattle, is It under MFRS 114 OR MFRS 116? and what is included in cost to sell a slaughtered cattle

Hi Rose, well, I have no idea what standards you are referring to, because this site is about IFRS. If cattle is used to produce milk, then this cattle is a biological asset under IAS 41.

Hi Sylvia,

I work for a farm that breeds cattle for sale, i face a challenge especially when preparing statement of profit or loss because if i have not made sales then what revenue will i recognize in the SOPL or i prepare my statement after making a sale?

Dear Silvia,

Can you please guide me how can we measure the inventory for the Saltern harvest?

where we should post all the expenses related to saltern such as salary/cleaning charges/etc?

BR,

Hi Abinesh, I think this might help. S.

Dear Silvia, thank you so very much.

Dear Silvia! I can’t thank you enough for this outstanding work.

My question is How can you measure the fish that are caught in open ocean? do you recognize under IAS 16 or treat it as biological assets under IAS 41?

It’s measured under IAS16…

Dear Silvia,

Could you please clarify which type of costs should be included at initial recognition of agricultural produce, in case the company rebutted FX measurement and accounting policy for agricultural produce is cost model.

Thank you in advance!

Hello, I wrote a similar article and podcast here. S.

Dear Silvia,

Can you please clarify, in what situation loss can arise on initial recognition of biological asset. And if there is any liability to be recognised in such cases ?

Hello Silvia

My company started producing strawberries in a greenhouse, we keep most of the plant more than a year or two and its almost impossible to control mother plant quantity and replacement them with new runner plants. what is the practice with this situations. Should I apply IAS 41 or IAS16 with strawberries?

Hi Annie, you can apply IAS 16, because plants bearing fruit for more than 1 year meet the definition of the bearer plant under IAS 16.

Hi Silvia,

Assuming we have a dog for guard our properties(We need to account under IAS 16).After few years we decided to sell the dog.When i take this decision,which standard do i use to accounting treatment ? IFRS 05 or IAS 41 ?

Hi Dasun, OK, to be very prudent – IFRS 5, but I doubt that selling the dog would need some formal decision and actively looking for a customer, so just treat it as disposal under IAS 16. It is also likely not to be material.

I am not working in this field but i think it,s very interesting standard

thanks for your easy explanation

Hi Silvia,

I have some questions: my company grows marijuana(that will be legal in Canada starting oct): the company has some mother plants(which will be used to create clones out of them, the clones will be used to grow and harvest), then some clones will be used as mother plants later, all the plants can grow only one year. now the company doesn’t show the mother plants in the ledger at all(the quantify of those plants are small compared with the plants will be used for harvesting though). I wonder is this treatment correct? I think it could be right, because since those mother plant can only grow within a year, even if they were counted under PPE, they will be fully expense into P/L within a year. the company doesnt allocate any cost into mother plant(although they do need water and fertilizer to grow)

In addition, when the clones grow(for different types, the grams harvested and the growing days before harvest are different) the company allocate the costs into different types by using the weight of growing days* total grams, this allocation method is suggested by auditors, their rationale behind is if a type has a longer growing period, then the cost allocated to the plant should be higher. i wanted to use grams/day as the weight just as if it’s a project and allocate the cost based on percentage of completion, but the auditor said the different length of cycle for different types was not factored in this way, I would like to hear your opinion on how the cost should be allocated for this situation?

Thanks!

Thanks Silva. You’re an awesome teacher.

Hi Sylvia and thank you so much for this perfect article, my questions is, how can we treat the raised puppies? under IAS 16 or IAS 41? Thank you so much

It depends on what you want to do with the puppies. Are you going to sell them? Then they are inventories under IAS 2. Are you going to raise them into adult dogs and raise new puppies? Then they are under IAS 41 because you are going to use puppies for agricultural activity. Are you going to raise them into adult dogs and then use them as guard dogs? Then they are under IAS 16 as they are not used for agricultural activities.

Well explained Silvia. I was particularly interested in this standard because I obtained a degree in Agriculture before studying for ACCA.

One question for you, How can you estimate the useful life of a dog and how easy will it be to choose either a straight line or a reducing balance depreciation policy if treating a guard dog under IAS 16. ?

Thanks

Miriam,

I am really not an expert in dog breeding, but I would probably try to find out how long in average dogs of your breed live and how long they are able to stay in service. I don’t know because I have never had any. Also, guarding is very steady activity, I don’t think there’s a reason to apply reducing balance method, but the straight line is more appropriate.

Thankyou so much for this wonderful article,extremes grateful.

Dear, Silvia, for i am working as accountant at Horizon Plantation PLC, i am really facing some accounting challenges for sure. Please, Should I capitalize up-rooting cost of coffee tree and infilling or re-planting cost of coffee too? Impairment is too new for company.

How can i recognize the accumulated cost of Young coffee if young coffee died before bearing first fruit?? Example, Suppose, Total accumulated cost of young coffee incurred for 5000USD for three years before get died. If three years of half of young Coffee died, how could i recognize the cost of death coffee??

Hi Deme,

as for capitalizing costs/ subsequent costs, maybe this article will help.

But, you should bear in mind that the coffee tree is a bearer plant and therefore you do NOT apply IAS 41, but IAS 16. So, you capitalize all the costs and then you depreciate the plant.

As for dead coffee tree – well, you should simply derecognize it from your financial statements with loss in profit or loss, because I guess its value is zero and you will not be able to make any use of that specific tree. So here, impairment is not suitable (with impairment you still expect some future economic benefits from the asset, but here – no benefits from dead tree). S.

Hello Sylvia Thank you very much for this fantastic ariticle. We have a rose farm and after planting there are fertilizers and chemical costs along with labor until the first harvest comes out after nine month. How should we treat these costs

Hi Sushant,

I think this podcast episode will give you the answer. Best, S.

Dear Sylvia,

how to account for joint production agreements on production of cucumber and strawberries? The company buys materials, gives them to the other party which handles the production, and buys the agricultural produce back at the price the company can determine with great extent. The company is reselling the agriculture produce to other buyers, and has no biological assets in its financial statements recognized.

Thank you!

Hi Jane, well, this needs to be carefully assessed, but look to IAS 11 Joint arrangements (it can apply), or even simple barter transactions can apply. I really can’t say from this short info.

Silvia, could you please clarify: Working animals – Working dogs and horses on farms

It is an agri business and they are biological assets but the biological transformation doesn’t relate to the dog or horse but to the sheep or cattle.

Thank you

Hi Ally, it’s PPE, because exactly as you wrote – dogs themselves are not the subject of biological transformation.

Thanks Silvia, much appreciated.

Hi Silvia,

Could you explain why animals can be regarded as PPE? Under what conditions they can be regarded as PPE? Thank you

I think I explained it many times here, but in short: if animals are not involved in agricultural activities, but serve different purpose (e.g. guard dog), then they are PPE rather than biological asset under IAS 41.