How to Consolidate Special Purpose Entity

Last update: 2023

I lost my first serious job in Arthur Andersen in 2001.

I was devastated, because I really loved that job.

Yes, it was full of hard work and long overtimes, but it was the best accounting and auditing school ever.

How did I lose my job?

Well, Arthur Andersed died after the big accounting scandal of Enron.

I feel it’s very unfair that about 85 000 employees of Arthur Andersen worldwide (including me!) lost their jobs just due to fraudulent actions of few audit managers in Chicago.

On the other hand, if an auditor fails to do her job properly and then she shreds her working papers to hide evidence, then she deserves nothing else than losing her reputation and going out of business – I understand that.

Why am I writing about it?

Well, because Enron’s accounting scandals has something to do with special purpose entities (SPE) and it is a great life example of what happens when you do NOT consolidate them.

In today’s article, I will try to shed some light on special purpose entities and show you how to consolidate them.

What is special purpose entity?

Special purpose entity (SPE), sometimes called “Special purpose vehicle (SPV)”, is a legal entity or company created to fulfil special purpose or objective.

For example, multinational group may created SPE to perform research and development activities.

Or, banks create SPE for the loan securitization purposes, to collect the debts, to avoid certain legal risks in specific countries, to transfer assets and sometimes to avoid high taxes.

Special purpose entities are often designed to attract the source with lower cost of financing.

If you are interested in detailed explanation, you are very welcome to check out my IFRS Kit in which I fully explain the loan securitization schemes, too.

Very important factor is that often the special purpose entity is not formally owned by its creator for various reasons.

There are some other equity investors who don’t behave like true owners – they don’t make any decisions, they often get fixed return on their investment (not dividend based on profits), etc.

A great example is – you guessed it – Enron.

Enron set up lots of these special purpose entities to hide debts and in fact, Enron’s ownerhip in SPE was close to zero.

What happened in Enron?

Enron was an America energy corporation which employed about 20 000 people right before its bankruptcy in 2001.

But, Enron’s leaders played with their financial results and issued confusing and untrue financial statements.

On top of it, Enron generated huge debts and therefore it set up hundreds of special purpose entities to hide the debt.

How was that possible?

To make the long story short, Enron did NOT consolidate these special purpose entities and therefore, no one could see the debts in the Enron’s consolidated financial statements.

Why did not Enron consolidate special purpose entities?

Because, the accounting rules for consolidation were not as strict those days as they are now.

Should you consolidate special purpose entity?

To avoid similar accounting scandals as Enron, the standard IFRS 10 prescribes to assess the need of consolidation based on control, not on legal ownership.

If the parent or creator controls SPE, then yes, SPE must be consolidated even if the parent owns zero percent share.

The standard IFRS 10 gives us extensive guidance on assessing the existence of control, but we will not deal with it in this article.

Here I’d like to focus on the consolidation itself.

How are you going to consolidate if parent owns 0%? How are we going to calculate goodwill and non-controlling interest?

If a parent controls special purpose entity, then SPE is a subsidiary.

And, you should apply the same consolidation principles as for any other subsidiary with “normal” percentual share.

Let me show you.

Example: Consolidation of special purpose entity

Mommy Corp. wishes to take cheap financing from country A and therefore, it makes an agreement with Baby Ltd. Baby is incorporated in country A, fully owned by the third parties, currently not performing any activities.

The banks in country A provide loans with lower interest rates to companies owned by local entrepreneurs. Therefore, Mommy decides not to buy any share in Baby to get the cheaper loan.

Instead, the following agreement is in place:

- Mommy sends CU 10 000 to Baby in order to cover all expenses related to negotiating of the loan;

- Mommy will guarantee all Baby’s debts;

- Mommy’s managers will take over the decision making in Baby including the voting rights.

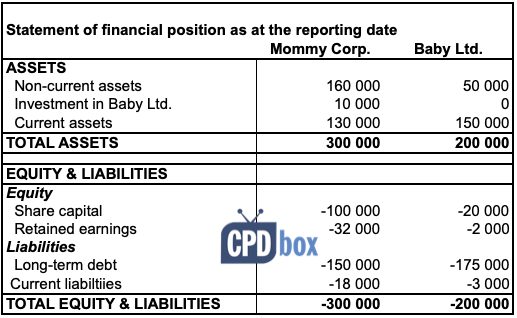

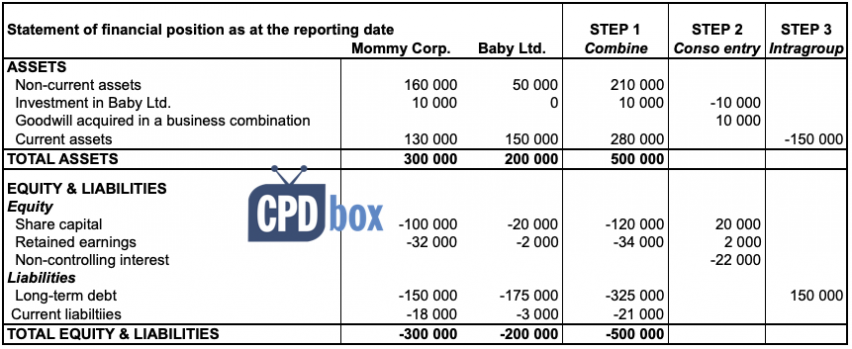

Mommy’s and Baby’s balance sheets at the reporting date as as follows:

Notes:

- Baby’s retained earnings at the date of the agreement were CU 1 000.

- At the reporting date, Mommy’s financing via Baby was CU 150 000.

It seems that Mommy takes control of Baby despite having 0% share.

Let’s consolidate. We will use the proportional share method for valuing non-controlling interest.

3 Steps in Consolidation Procedures

I have described the consolidation procedures number of times on this website and in my IFRS Kit, so you can check them out here or here.

It’s not going to be any different with consolidating SPE.

We will take all three steps:

- Combine

- Eliminate parent’s investment and parent’s share in subsidiary (+ goodwill)

- Eliminate intragroup transactions.

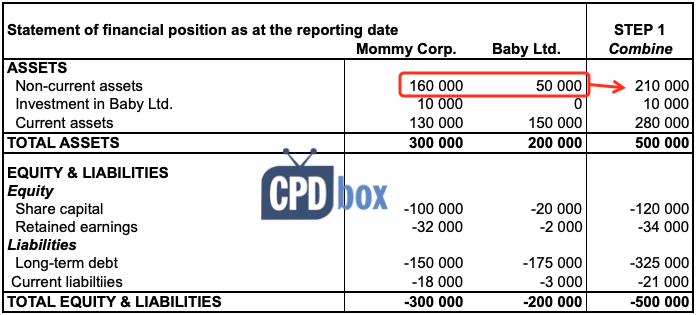

Step 1: Combine

Just like with any other consolidation, let’s add up all like-items, line by line.

The combined amounts are here:

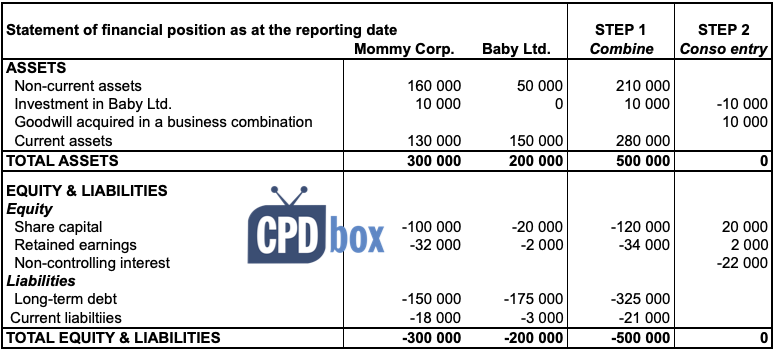

Step 2: Eliminate

We can now eliminate:

- The carrying amount of the parent’s investment in the special purpose entity, and

- The parent’s portion of equity in the special purpose entity;

and recognize any non-controlling interest and goodwill.

This time, it will be a little bit different, because the parent did not make any direct investment in the subsidiary’s shares.

Instead, Mommy just paid CU 10 000 to Baby to cover the expenses related to the financing. This transfer is Mommy’s investment in special purpose entity.

Also, here’s one very interesting point about the non-controlling interest.

How much is it in this case?

Well, 100% – you guessed it.

It’s because Mommy does not own any share and everything is owned by non-controlling interest.

This is possible, because Mommy gained control over Baby by the contractual arrangement, and NOT by ownership of shares.

The goodwill calculation is as follows:

- Fair value of Mommy’s investment: CU 10 000

- Add non-controlling interest at acquisition (Baby’s share capital of CU 20 000 plus Baby’s pre-acquisition retained earnings of CU 1 000, all multiplied with NCI’s share of 100%): CU 21 000*100% = CU 21 000

- Less Baby’s net assets at acquisition (see above): CU 21 000

- Goodwill= CU 10 000

It should not surprise you that the goodwill is equal exactly to parent’s investment in SPE.

No wonder – parent paid CU 10 000 for acquiring zero share!

We also need to recognize non-controlling interest at the reporting date, which is 100% of Baby’s net assets at the reporting date – CU 22 000.

Here’s the journal entry to make:

| Description | Amount | Debit | Credit |

| Remove Mommy’s investment in Baby | -10 000 | FP – Investment in Baby | |

| Remove Baby’s share capital in full | +20 000 | FP – Baby’s share capital | |

| Remove 100% (NCI) of Baby’s post-acquisition retained earnings | +2 000 | FP – Retained earnings | |

| Recognize non-controlling interest at the rep. date | -22 000 | FP – Non-controlling interest | |

| Recognize goodwill acquired in a business combination | +10 000 | FP – Intangible assets (goodwill) | |

| Check | 0 |

Our step 2 is shown in the following table:

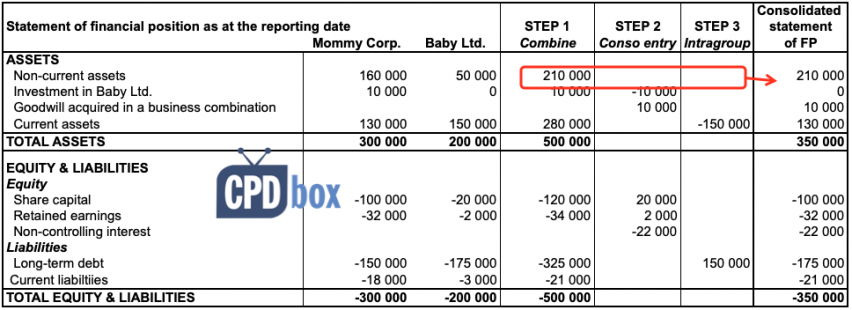

Eliminate intragroup transactions

The last step is to eliminate intragroup transactions.

This is very often omitted with special purpose entities, since they are not typical subsidiaries – however, once you apply the full consolidation method, you need to eliminate in full.

In this case, Mommy has a long-term payable of CU 150 000 to Baby and vice-versa, Baby has a receivable to Mommy in the same amount.

These amounts represent a loan transfer from Baby to Mommy.

Elimination entry is shown here:

Add it up

Now, we can add up the combined numbers with all the adjustments and thus get the consolidated statement of financial position:

The interesting fact is that there’s huge non-controlling interest and the consolidated retained earnings show only those of Mommy, because there’s no share in Baby at all.

Well, there are many ways how parents transfer the profits from special purpose entities outside dividends, such as charging various license or service fees, etc.

Why is it important to consolidate SPE?

Indeed, why is it so important to show huge non-controlling interest and the same retained earnings as in the separate financial statements of a parent?

The meaning of consolidating SPE lies in showing combined assets and liabilities.

If some parent wants to hide huge debts in SPE, consolidation makes it impossible because debts of SPE are shown within consolidated liabilities.

If Enron would have had consolidated its SPEs and shown huge debts, then probably it could prevent its catastrophic bankruptcy and the management would not be able to be so greedy and continue in dirty practices ruining the company.

And, I would have not lost my job.

Any comments? Please share them below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

59 Comments

Leave a Reply Cancel reply

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Where can I download the excel file for my personal practice??

We offer that to the subscribers to the IFRS Kit.

Thank you Silvia for your illustration,

I have question regarding the Retained earnings, the reason of eliminating the post-acquisition Retained earnings due to percentage of ownership in the subsidiary( 0% ownership) ?

Thanks in advance

Sorry for that question, the answer in the example above,

I want to ask another question regarding the purpose of SPE, you mentioned it could be for “to avoid certain legal risks in specific countries, to transfer assets and sometimes to avoid high taxes, could you please give example about these situations?

Thanks in advance

Hi Silvia, if an entity formed a special purpose vehicle (“SPV”) and transfer the inventories to the SPV, is the transfer of inventories to the SPV a deemed disposal?

No, it is not. Inventories still stay within the group at the consolidated level.

Hi Silvia, your articles are superb as usual! Also, how to consolidate an “ILLEGAL” SPE when a local country’s law prohibits foreign investments and creation of foreign subsidiaries. However, shareholders require such fully owned foreign subsidiaries to be consolidated, as a major part of the operations and profits are reflected in such foreign subsidiaries. However, such foreign subsidiaries cannot be shown in the financial statements, as the local country government may put the shareholders in jail for violating the local county’s laws. Please advise on how to overcome this dilemma.

Interesting situation, but I really don’t know – because, it seems that first of all, shareholders broke the law when they established a foreign subsidiary. So this is going to be their business decision. If you are their advisor, just CYA (cover your ass as we used to say when I was an auditor) – write them an official note informing them about risks.

Hi Silvia I am from india .

Modi country .

Your article is very useful. you are very nice teacher.

Question

1 / When Mommy Ltd owns 100% shares in Baby Ltd, no consolidation report is done by Mommy Ltd. Can it be Okay?Can it be allowed in accounting rules & regulations?

Remarks

A/ Mommy Ltd & Baby Ltd are not public listed companies.

B/ Mommy Ltd & Baby Ltd are only private companies

Question

1 / How should Baby record this CU 10000 transaction? Dr Bank Cr AP?

2 / Why cant see any record for this CU 10000 in financial statement?

3/Why is there No Eliminate for that CU 10 000 in the intragroup transactions?

Hi Silvia,

What is the benefit of consolidation here, without consolidation also mummy is showing liability of CU 150000

Well, in this case, Baby’s equity was positive, but when it is negative and lots of debt is hidden there… also please note that consolidated liabilities are 175 000, not 150 000 in this case.

Hello!

This article is amazing. Silvia! Can you explain if we sold some part of subsidiary but still hold the control over subsidiary then the sale proceeds of subsidiary will be treated in consolidation?

If you sell subsidiary some part but still holding controlling interest then you should increase your NCI equal to fv of sell part or PSNA

Hi Silvia, Many countries require the preparation of Separate Financial Statements. In your experience, should SPE’s be consolidated within the Separate Financial Statements, or should they be accounted for just as any other subsidiary (i.e. at cost, fair value, or equity method) as required by IAS 27? Thank you.

Hi Silvia,

Two questions please: what about the share of results or the remaining profit after distributing to shareholders? my copany plan to etablish an foreign SPV and we will have a voting share and other shareholders non voting! do still have to consolidate?

Hi Ahmad, as soon as you have control given by your voting share, then yes, you do need to consolidate. As for the remaining profit – well, this goes to NCI if your share is zero. That’s why I wrote above that parents take profits from SPE in a different way (different scheme) – but I am not teaching here how!

Hi Silvia, if i want to establish SPV and invest in it with others shareholders, do still i have goodwill?. Thank you

No, there should not be. Goodwill arises when you actually acquire subsidiary from someone else.

Hi Silvia,

What about the share of results next year? How i will record it? It will appear in NCI same above? And plz what remaining profit after distributing to shareholder?

Hi siliva

how can i down load your worthable excel sheet example for conciliation

If you are my IFRS Kit subscriber, please write me an e-mail.

Thanks Silvia for the clear explanation. I think with this knowledge I can pass my ICAG Professional exams.

Thanks and good luck!

Thank you very much Sylvia. Very informative article

Thank you so much Silvia about clearing of SPE.

That is why i will ever be reading your articles. Well researched article.

Thanks for sharing kwonledge with us.

You are great!

Thank you very much. The section is very informative and interesting. This is my first time of coming across this type of consolidation.

Hi Silvia,

This is awesome! I am studying for my examination this coming Friday and this is one of the topics that will be covered in the exam that worth a lot of marks. I appreciate this informative example and for your information, I have followed through this as my revision as well. Just a request if you can also provide an example on the inter-group transaction (consolidation worksheet) in terms of inventories. I believe this would as well to my revision. Thanks

Hi Silvia,

I must appreciate you for this educative post.

My question:

What if the parent entity had expense the CU10,000 sent to the SPE to cover loan negotiation expenses, how would the computation of goodwill be practically possible for consolidation especially where there are no official documentations and the parent decide to use its own judgement by expensing the 10k through SPL

You make IFRS easy to understand & I love it.

Thank you because you are a strong woman in IFRS Industry.

Take care

Thank you.

Thanks for your article it was really interesting.

I’ve got 3 questions:

1) Why are the 150k transfer from Baby to Mommy is registered as long term liability in Mommy and Current Asset in Baby? Shouldn’t it rather be a Non-current asset?

2) I don’t think that in your example the individual financial statements of Mommy are substantial misrepresentations. After all Mommy is showing the 150k debt in their accounts. What was Enron doing differently as to hide the debt?

3) How would Baby show in in their individual financial statements the 10k investment? Would it be a revenue or would it appear as a part of equity?

Hi Marc,

thanks for your questions.

1) Yes, it could be – depending on the documentation. Please see more about some long-term and short-term loan classification issues here. Maybe there’s no loan documentation between a parent and a subsidiary at all.

2) Well, Enron did different way of hiding debt. Very simply speaking – original debt was taken directly by SPE and never appeared in Enron’s accounts.

3) Either way – it really depends on the contractual agreement between parent and subsidiary.

S.

wonder way to teach.

very much interesting and easy to digest . I wouldn’t be able to figure out non-controlling interest!!! thank for your great help

I find your articles very educative and informative being a Chartered Accountant in practice. Good work.

Thank you Silvia for the simplified approach to demonstrating the consolidation concept. Very apt indeed. May I suggest that you look into ways to partner with ACCA to recognize your IFRSBox and courses to count towards members annual CPD. I think it will be a good idea.

Hi Aminu, thank you! Actually, you can use my courses for your CPDs for ACCA as you can print out the certificates of completion for your proof. 🙂 Best, S.

Your articles are eye-opening. Thank you. From Kenya.

Thank so much for the ease with which you elaborate the IFRS which otherwise are so difficult to understand. Great work

Thanks Silvia for your elaboration, which makes us understand IFRS 10 better, you are resourceful person to the accountancy profession

Thank you. I love the way you simplify each topic.

Thank u soooo much for sending me this Artical, i by my self working z an Auditor.

Your every single email help me alot.

Thank you for another great article Silvia. They are keeping me sane during maternity leave 🙂

Thank you Silvia, for your courageous and generous efforts to provide valuable insights over complex and more demanding areas in accounting and finance discipline. I really enjoying reading these articles, these assists me to arrest complex arrangements in day to day transactions.

Thanks. Really this article is very much informative for those members who are interest in proper accounting practice and interest to know definition of Control as per IFRS 10.

You never fail to make things look way much easier.

Thank you a lot silvia

Thank you, Elias, I know you have been following me for some time – grateful for that!

I really like your articles on IFRS, have been following them since 2014 or even earlier, could not remember the exact year 🙂 Thank you!!

I thank you, Linda, for being my loyal subscriber (my daugther’s name is Linda, too!) 🙂

thank you very much for the excellent example of didactic way¡¡

Thank you for sending me full articles of consolidation and groups, Financial Statements and others. I have recognized it very important for my current and future career. Thank you very much.

Best regards.

You are welcome, I’m glad to help! 🙂

Hello

can I have the excel file of this useful example of consolidation.

Thank You

Hi Silvia, Many thanks for this article. JUst wondering. Ive read ‘the smartest people in the room’ wich was on the Enron scandal. any other books on specifically Enron or related to other accounting scandals that you might no of that might be worth a read?

Many thanks

*know of