Tax Incentives – IAS 12 or IAS 20?

In my previous article about accounting for government grants I asked you to give me some feedback and write me about some problems or issues in this area.

Surprisingly, most of your responses asked one and the same question:

How to account for tax incentives of various kinds? Are they a government grant or not?

Therefore today, we’ll take a look at accounting guidance for various types of government support via tax system.

Forms of tax incentives

Except for providing cash (or other forms) grants or other assistance, governments often support businesses via taxes.

How?

Generally speaking, either via reduction of taxable profit or entity’s income tax liability.

The most common forms of tax incentives are tax credits (including general tax credits and investment tax credits) and tax holidays.

How shall we account for these incentives?

The standard IAS 20 Accounting for government grants and disclosure of government assistance does NOT apply to the government assistance in the form of tax incentives. This is clearly written in the paragraph 2 of IAS 20.

Therefore, we need to look to standard IAS 12 Income Taxes for appropriate guidance in most cases.

But there’s one exception – investment tax credits.

Let’s not hurry too much and outline the accounting treatment one by one.

Tax holidays

Although tax holidays are not specifically defined in IFRS, they mean that the company will pay reduced, or even zero income tax for some period of time.

Governments often use tax holidays as a great incentive to attract new investors into their country.

As tax holidays are provided for a limited period of time (e.g. 3-5 years), companies must apply the standard IAS 12.

What does it practically mean?

Well, as a company will not pay any income tax during the tax holiday period, there’s obviously neither current tax expense nor the current income tax liability, so there’s nothing to recognize (or recognize with the reduced income tax rate if that applies).

However, be very careful with the deferred tax.

The basic rule for measuring deferred tax is to apply the tax rate expected to apply in the period when the asset is realized or liability settled (IAS 12.46).

If you expect that some temporary differences will reverse exactly during the tax holiday period, then you need to measure your deferred tax using zero tax rate (or reduced tax rate, depending on the terms of the specific tax holidays).

Here’s a short illustration:

Tax holidays – question:

ABC plans to build a new plant in the region with high unemployment. To support this investment plan, a local government agreed that ABC would pay the income tax for 20X2 at the reduced income tax rate of 10%. Enacted tax rate applicable for 20X1 and beyond is 30%.

In 20X1, ABC recognized the interest income accrued on term deposits amounting to CU 100 000. The cash will be received in March 20X2 and under local legislation, interest income is taxable when cash is received.

How should ABC account for related income taxes?

Tax holidays –solution:

With regard to the current income tax implications, ABC will simply recognize current income tax expense and liability at 30% for 20X1 and at 10% for 20X2. Of course, the appropriate disclosures are necessary.

How about deferred tax?

There’s a temporary difference of CU 100 000 related to the interest receivable, as its carrying amount is CU 100 000 and the tax base is 0.

As the difference will be reversed in 20X2, ABC needs to apply the tax rate expected to apply in 20X2 – 10% for deferred tax measurement.

The resulting deferred tax is a liability of CU 10 000 (CU 100 000*10%).

If there are any other temporary differences, ABC needs to examine closely whether they will reverse in 20X2 or later and apply the appropriate tax rate based on the timing of the reversal.

Tax credits

Similarly as tax holidays, tax credits are not defined in IFRS, but we can simply say that they are sums that can be offset against tax liabilities.

Accounting for tax credits is excluded from the scope of IAS 20 Accounting for government grants and disclosure of government assistance.

Therefore, we need to look to IAS 12 Income taxes.

But there’s one problem – IAS 12 specifically excludes investment tax credits from its scope, too.

What does it mean?

IFRS do not provide any guidance about investment tax credits, because they are excluded from both IAS 20 and IAS 12.

What are investment tax credits?

I am going to repeat myself again. Investment tax credits are NOT defined in IFRS and as a result, they may be difficult to identify.

We can say that investment tax credits are some tax allowances or similar tax incentives given for the specific kinds of investment, for example – for investing into research and development, or for maintaining certain number of employees in the region.

However, it’s always much better to look at the specific terms of the arrangement to conclude whether you deal with investment tax credit or not.

How to account for investment tax credits?

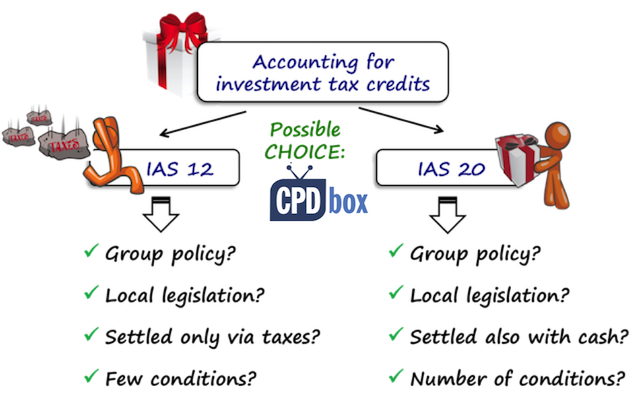

Once you identified the investment tax credit, you need to select the appropriate accounting policy for its accounting, because investment tax credits are scoped out from both IAS 12 and IAS 20.

The fact that both IAS 12 and IAS 20 exclude investment tax credits does not prohibit you from applying these standards.

In fact, you can select either IAS 12 or IAS 20 for the investment tax credits, besides other options. Your choice is a matter of judgement and should be based on more factors:

- Is there some worldwide group policy for accounting for investment tax credits?

If yes, I would strongly recommend following this policy, as it will ease your life during consolidation. - Is there some local accounting legislation or practice for treatment of investment tax credits?

If yes, you can select your own accounting policy based upon local rules. - What are the specific terms of investment tax credits?

- Are they settled directly in cash (or is there an option to settle in cash)? Or only as a reduction in income taxes payable?

A cash settlement points out to the application of IAS 20, while settlement via income tax payable reduction with no cash option points to IAS 12. - Are there some conditions not related to taxes for receiving the investment tax credit (e.g. minimum investment into new assets, etc.)?

If yes, then it points to IAS 20, if not, then it indicates IAS 12 treatment.

- Are they settled directly in cash (or is there an option to settle in cash)? Or only as a reduction in income taxes payable?

As you can see, there’s no right or wrong answer with regard to investment tax credits and before you make a choice, you need to assess the specific situation very carefully.

If you liked this article, please help me spread the word about it and share it with your friends/colleagues. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

12 Comments

Leave a Reply Cancel reply

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

How do we value fixed asset having import duty tax incentives on conditions unless the tax will be paid back?

Very good article. What happens if you have an ITC accounted for under IAS 12, and after 3 years, you manage to negotiate with the government authority to have some of the remaining ITC converted into cash as support. Should I account for this under IAS 12 or IAS 20?

Hi Silvia,

If the tax credit is settled with future taxes, you mentioned it’s more likely IAS12 can be used. If a company gets the credit in Year 2(the credit is based on the year1 R&D expenditure) and it will be used for future tax payable, then in year 2 when the tax credit granted, if the company has taxable profit, what the entry should be, should it be DR: deferred tax asset CR:Income tax expense? if so, doesn’t it mean the income tax expense for year 2 will be reduced greatly, the accounting profit and tax will not match? or in year 1, estimate should be made to reduce the year 1 income taxes expense?

thanks!

Hi. I really like the simple way you explain things.

Relating to the topic of tax incentives – how do you treat a reduction in tax payable by the government (one off) on condition of asset investment for business into the future ? It’s sort of in the middle of IAS 12 and IAS 20! Also does the credit go against tax cause you can’t gross up in other income etc….

Dear Sylivia,

I am working for a government institution which generates revenue and make some profit but we

got exemption from income tax payment. We report in accordance with IFRS. How could we treat the income tax? Could we take it as a government grant?

Regards,

Ziade

Dear Ziade,

everything about income taxes is excluded from the scope of IAS 20, so you should present it under IAS 12 as tax exemption or so. S.

Hi Silvia,

Is right to impair a deferred tax asset balance? If this is possible, how do you go about this?

Thank u very much for the work done to help us

Dear Silvia

Surely you will be doing great.

Please tell me if an education institute (Non Profit Organization-NPO) gets a grant against performance of technical education services. In this project the whole amount is not utilized although the amount would be as per budget allocated for this. After completion of this project, how to account for this fund saving?

(IAS-20 is applicable on profit oriented organizations only but if i apply IAS-20 in NPO then elaborate the treatment.)

Dear Silvia

Please let me know the accounting treatment under IAS-20 if we get grant against construction of asset and that asset gets fully destroyed due to natural disastrous when it is near to complete?

Silvia, how about reduction in import duty of a long term asset? Is that government grant?

Samir,

first let me say that import duty is NOT an income tax, therefore it does NOT fall under the scope of IAS 12.

Secondly – it all depends on the terms attached to the reduction. Are there some conditions for getting the reduction? What happens when the conditions are breached – will the company need to pay import duty in full amount? S.