Tax Reconciliation under IAS 12 + Example

When I was an audit freshman, my least favorite task was to prepare the income tax reconciliation. I frankly hated it.

Why?

The main reason was that I did not understand the purpose of it. For me, it seemed like a bunch of numbers and percentages that never add up and the magic table never gets balanced.

Our clients hated it too, especially if their transactions were complex, or there was a change in the tax rate or whatever happened.

Let me tell you my own story about the tax reconciliations. Sure, if not interested, then skip it and go straight to theory and example below.

Here’s the story…

Many years ago I was assigned to an audit team lead by very competent, but strict audit senior. Let’s call her Jess (not her real name!).

Jess was very hard working, clever and pedantic senior. Her working papers just looked great – all clean and neat. It was big pleasure to review them.

However, she was moody, vague, unpredictable and sometimes very unpleasant. She literally loved some audit assistants and praised them a lot and on the other hand, she could really dislike the other assistants and make their lives difficult.

You could never know in which category you were.

I was unlucky to end up in the second category. I have no idea why.

To this day, when we occasionally meet, we could barely look at each other and I even gave up greeting her, because she just never responded and looked straight through me like I was the air.

So, when I learned I would be in her audit team in a big manufacturing company with even bigger mess in the books, I instantly knew what would happen. And yes, it happened.

I was swamped in the worst and nastiest tasks you could ever imagine. I had to attend the inventory count in the cold freezing midnight of the New Years Eve (no dancing and having fun that year!). And yes, you guessed it – I had to check the client’s tax reconciliation and propose corrections.

That was the exercise! Worse than the stock count, believe me.

I understood one point: if I don’t make it right, Jess would give me very bad feedback and it can have bad impact on my future career in that company. After all – that was her goal.

Speaking in a really vulgar slang (please pardon me), I was working my butt off. I worked so hard to understand the tax reconciliation and to make it right for the client, but after the whole night staring at the worksheets, it was done – to the big surprise and dislike of Jess.

You know the old saying – when life gives you lemons, make lemonade.

Why did I tell you the story?

The reason is that based on my own experience I realized I could have saved a lot of time, if I would have taken the right sources of information and the right approach for tackling the tax reconciliation.

In this article, I’d like you to learn from my mistake, learn the right approach on the example and save the sleepless night ☺

What is the tax reconciliation?

The standard IAS 12 Income Taxes requires many disclosures, including the tax reconciliation.

It is the explanation of the relationship between the tax expense (income) and your accounting profit.

What’s the meaning of that?

Theoretically, you could calculate the tax expense as your accounting profit before tax multiplied with the tax rate applicable in your country.

In reality it does not work this way due to many different things, for example:

- Non-deductible expenses:

These are all items that you incurred, but you cannot deduct them for the tax purposes. In other words, you need to add them back for the purpose of your tax calculation. The examples are expenses for lunch with potential clients (in most countries), excessive petrol consumption, etc. Of course, it depends on your specific legislation. - Change in the tax rate during the period:

If the tax rates changed, then it affects the future periods and as a result, the deferred tax originated in the previous periods must be adjusted to reflect the new tax rate. - Adjustments related to previous periods

- Adjustments related to tax losses, etc.

- Adjustments related to changes in tax bases

- Adjustments related to changes in the manner of settlement or recovery

- Effect of foreign tax rates, etc.

Due to these differences you have to explain why your income tax expense is NOT equal to the accounting profit multiplied with the tax rate.

How to present the tax reconciliation?

The standard IAS 12 gives you the 2 options:

- Tax expense (income) reconciliation:

Here, you try to explain the differences between:- Your tax expense or income, and

- Your theoretical tax expense or income, which is your accounting profit multiplied with the tax rate.

- Tax rate reconciliation:

In this case, you explain the differences between:- The tax rate applied, and

- The average effective tax rate, sometimes called “theoretical tax rate”, which is your tax expense or income divided by your accounting profit.

Maybe it looks simple and easy and indeed it is in many cases.

Sometimes, the company has too many transactions with temporary differences that it’s really hard to prepare.

To illustrate it, let me show you the numerical example with a few tips on how to proceed.

Example: Tax reconciliation

Question

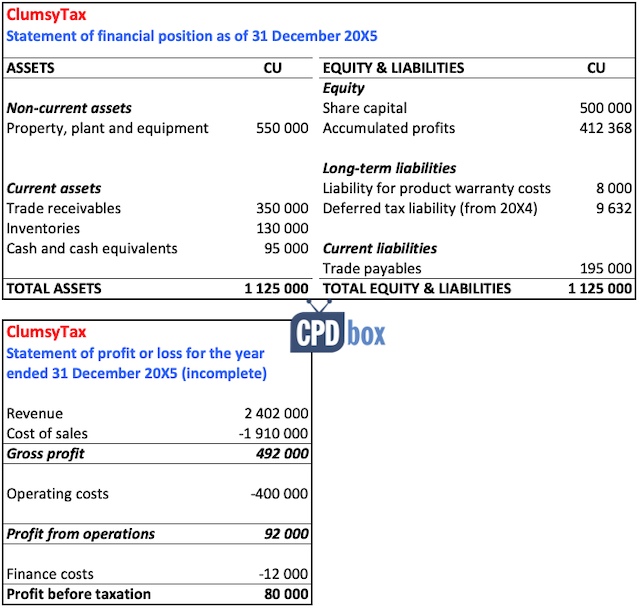

ClumsyTax is a manufacturing company preparing its tax information for the year ended 31 December 20X5. You have the following information:

- Depreciation expense for the year 20X5 allowable in line with tax legislation is CU 103 000. Accounting depreciation included in operating costs is CU 85 000. Cost of property, plant and equipment is CU 800 000 EUR and ClumsyTax deducted depreciation expenses of CU 208 000 in its tax returns prior the year 20X5.

- In 20X5, ClumsyTax increased a liability for product warranty costs by CU 2 500. Product warranty costs are not tax deductible until the company pays claims. Claims paid in 20X5 amounted to CU 3 100.

- Expenses for promotion included in operating expenses amount to CU 900. These are not deductible for tax purposes.

- Tax rate for 20X5 is 30% (28% in 20X4).

- The statements of financial position (before tax expenses) and profit or loss are below:

Calculate current tax expense, deferred tax expense and prepare the tax reconciliation.

Solution:

This example is a bit more complex, because you need to understand the tax reconciliation in the context of the financial statements, tax returns and other information.

It would not be very wise to show you purely this aspect without showing the full picture.

So, before any attempts to work on tax reconciliation, make sure you have the following information ready:

- The statement of financial position

- The statement of profit or loss and other comprehensive income

- The income tax return (or detailed calculation of current income tax)

- The detailed calculation of the deferred tax asset or liability as of the end of the previous reporting period

- The detailed calculation of the deferred tax asset or liability as of the end of the current reporting period.

Without having these 5 papers or worksheets in your hands, don’t waste your time and don’t start working on the tax reconciliation.

Step 1: Prepare all the necessary documents and calculations

We have n. 1 and n.2 in our hands, but we don’t have tax return and deferred tax calculations.

Let’s prepare the tax return first.

- Current income tax calculationWe will start with the accounting profit and then we will make all the necessary adjustments.

Deduct – total (C)-106 100Taxable profit (A+B+C)62 300Tax rate30%Current income tax18 690

Description CU at 31/12/20X5 Accounting profit (A) 80 000 Add back: Accounting depreciation 85 000 Provision for warranty costs (20X5) 2 500 Promotion expenses 900 Add back – total (B) 88 400 Deduct: Tax depreciation -103 000 Warranty claims paid -3 100 Note: You may well see that instead of deducting the positive difference between tax depreciation and accounting depreciation in one single number, I’d rather split this adjustment to 2 numbers. It’s much better for understanding how the temporary differences reverse.

- Deferred tax calculation – current yearThe best way is to put all the assets, liabilities and any other potential items (like tax loss) in the table and calculate the temporary differences and deferred tax there.

Item Carrying amount (A) Tax base (B) Temporary difference (C=A-B) Deferred tax (-30%*C) PPE 550 000 489 000 61 000 -18 300 Trade receivables 350 000 350 000 0 0 Inventories 130 000 130 000 0 0 Cash & cash equivalents 90 000 90 000 0 0 Warranty cost liability -8 000 0 -8 000 2 400 Trade payables -195 000 -195 000 0 0 Total -15 900 Notes:

- Insert assets with + and liabilities with –

- The tax base of PPE is its cost of CU 800 000 less tax depreciation prior 20X5 of CU 208 000 less tax depreciation in 20X5 of CU 103 000

- We applied the tax rate of 30% (applicable in 20X5)

- Deferred tax calculation – previous yearThis is also very important, because you need to reconcile how your temporary differences moved.

The method is the same as before, just use the previous year’s numbers and rate.

In this example, we do not have the financial statements from the previous year, so let’s focus only on the 2 temporary differences there:

Item Carrying amount (A) Tax base (B) Temporary difference (C=A-B) Deferred tax (-28%*C) PPE 635 000 592 000 43 000 -12 040 Warranty cost liability -8 600 0 -8 600 2 408 Total -9 632 Notes:

- Your deferred tax figure should be show in your balance sheet in the same amount (9 632)

- Carrying amount of PPE is the carrying amount as of 31-Dec-20X5 of CU 550 000 plus add back the depreciation expense in 20X5 of CU 85 000 = CU 635 000

- The tax base of PPE is its cost of CU 800 000 less tax depreciation prior 20X5 of CU 208 000

- Carrying amount of warranty cost liability is its carrying amount as of 31-Dec-20X5 of CU 8 000 plus add back the claims paid of CU 3 100 less deduct the amount newly created of CU 2 500

- We applied the tax rate of 28% (applicable in 20X4)

Step 2: Calculate the total income tax expense

The total tax expense consists of:

- Current income tax expense: CU 18 690 (from the calculation 1 above)

- Deferred income tax expense: CU 6 268 (see below)

Total income tax expense in 20X5 = CU 18 690 + CU 6 268 = CU 24 958.

The deferred income tax expense is calculated as a difference between:

- The deferred tax liability as of 31 December 20X5: CU 15 900 (calculation 2 above)

- The deferred tax liability as of 31 December 20X4: CU 9 632 (calculation 3 above)

Anyway, this is very important: It is necessary to understand how that deferred tax expense arose, just in case your tax reconciliation does not balance:

| Item | CU |

| Deferred tax expense related to PPE | 5 400 |

| Deferred tax expense related to warranty cost liability | 180 |

| Increase in DTL resulting from the increase in the tax rate | 688 |

| Total deferred tax expense | 6 268 |

Where did I get these numbers?

Let me explain:

- Deferred tax expense related to PPE is coming from your actual current income tax calculation:

- Accounting depreciation of 85 000; less

- Tax depreciation of 103 000;

- Multiplied with 30%.

- Deferred tax expense related to warranty liability is coming from your actual current income tax calculation:

- New provision in 20X5 of CU 2 500; less

- Claims paid in 20X5 of 3 100;

- Multiplied with 30%.

- Increase in DTL resulting from the increase in the tax rate is calculated as

- Opening balance of DTL of CU 9 632;

- Adjusted from 28% to 30%: CU 9 632/28*2 = CU 688.

Step 3: Perform tax reconciliation

We are almost done!

The only thing is to explain the relationship between:

- The accounting profit of CU 80 000 multiplied with the tax rate of 30% = CU 24 000, and

- The income tax expense of CU 24 958.

I’ve done that in the following table:

| Item | CU |

| Accounting profit | 80 000 |

| Tax at the applicable rate of 30% | 24 000 |

| Tax effect of non-deductible promotional expenses (CU 900*30%) | 270 |

| Increase in DTL resulting from the increase in the tax rate (in step 2 above) | 688 |

| Total income tax expense | 24 958 |

Good piece of advice:

If your tax reconciliation does not make any sense, go back your current income tax calculation and make sure that you included all items either in the deferred tax calculation or added them as your outstanding items here in the reconciliation (such as promotional expenses for which no deferred tax was recognized).

Alternatively, we can explain the relationship between:

- The average effective tax rate calculated as the tax expense of CU 24 958 divided by the accounting profit of CU 80 000 = 31,20%, and

- The applicable tax rate of 30%.

I’ve done that here:

| Item | % |

| Applicable tax rate | 30.00 |

| Tax effect of promotion expenses (270/80 000) | 0.34 |

| Tax effect of increase in DTL from the increase in the tax rate (688/80 000) | 0.86 |

| Average effective rate (same as 24 958/80 000) | 31.20 |

Finally…

Phew, that was an exercise!

It was very simple, but you can still see that there’s a lot of work in it and you can’t do it isolated from other things – you must prepare all your tax calculation while seeing the full picture and relationships.

My own experience tells me that the biggest troubles arise exactly in the deferred tax part.

Make sure that you have the clear deferred tax calculations from the current year and from the previous year and compare them with the current income tax return.

If you are sure that the reversals of temporary differences were correctly recognized in both your tax return and your books, then you’re on the best way to succeed.

Sleep well! ☺

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silva,

This lesson on tax reconciliation is one of the most difficult areas in our accounting profession and I am very much impressed at the manner and simplicity you have demonstrated this knowledge.

Thank you very much. It is sincerely appreciated.

Adjusted from 28% to 30%: CU 9 632/28*2 = CU 688.

Can you explain why you divided by 28*2 ?

This is bloody marvellous

You are the best !!!

I have imagine level of Grip you got over IFRS…….

Thank you for all efforts ….. Your presentations are concise & to be point.

Thank you 🙂

how did u get tax base ppe 489k

Hi Silvia,

You are doing a wonderful job of explaining these standards. You’re the Best !! I have two questions. 1) I find it easier for me to understand when the tax rule is given for each deferred tax calculation because the tax rules change per question as there are different according to each country’s laws. According to my text, some laws recognize items based on accruals and some based on when the cash is paid or received. Should I assume that the reason for the tax base of the accounts receivable being equal to the carrying value (under section 2 calculation of deferred taxes for the current year) is because the tax laws are based on accruals and not when the cash is received later? 2) If the law had recognized the cash receipt later, as opposed to using the accrual basis, then the tax base would be nil, correct?

Hi Silvia, I’m Daniel from Peru, I was checking the example, I do not agree with the deferred tax calculation for the current year, my question is, why the tax base of warranty costs liability is zero?

In the example, it’s mentioned that the product warranty costs are not deductible until the company pays claims, then says claims paid in 20X5 is 3,100, so, for me, the tax base is 3,100.

The carrying amount it’s ok, 8,000.

Thanks for your answer.

Please read more about the tax base here. Thanks.

tax base of asset is what you can deduct in future hence tax base for liability is the opposite of tax base for an asset ie what you cannot deduct. this means the 8000 will be deductible in full in future is paid hence there is no amount that will not be deductible. ie tax base of liability is Carrying amount less amount deductible=amount not deductible.

Hi Silvia,

please can you help how to prepare group’s effective income tax reconciliation. I have separate effective income tax reconciliation but I don’t know how to prepare it for the group (how to calculate the effect of foreign rates, changes in income tax rates, effect of consolidation adjustments on group’s profit). It is not enough just to sum individual add up individual reconciliations of effective tax rate).

Thank you very much in advance

thanx for differed taxation example as it elaborate and simplify the tax matters in real practice we dwell on our daily practices in Tanzania.

Hi Silvia

May God Bless you every time and every step of your life since you hv been promoting education without any materialistic expectation as everyone desires. Well i have to clear my one confusion that Def tax current and previous (-15900 & -9632) created liability so why did we net of them (6238), it was supposed to be aggregate of previous and current year liability please if u can clear this logic.thanks

very informative lesson & helpful to me.

Explained by covering all the areas. The main problem arises when you are doing it for the first time like first time adoption and if you are not well versed with your tax laws.

Hi Silvia

Thank you so much for sharing your story, it’s a message of hope I needed to hear.

Hi Silvia.

Excellent article on the Tax reconciliation.

Thank

Hii Miss,

I have no words to express how great you are.

it is not as easy to build understanding of the reader as you made it.

Dear Silvia, thanks a lot!!

I would like to double confirm if my understanding is correct. When you mention current year total tax expense = CU 18 690 + CU 6 268 = CU 24 958.

So we need to:

Dr. P&L – Income Tax Exp CU 18,690

Dr. P&L – Defer Tax Exp CU 6,268

Cr. Balance Sheet – Tax Payable (CU 18,690)

Cr. Balance Sheet – Defer Tax Liability (CU 6,268)

Right? Thanks a lot for your help on this in advance!

Yes you are correct, In Some countries we show separately both the deferred tax portion and absolute income tax portion separately

I am very grateful to have come across your write-up on this topic. I now have 100% confidence in dealing with tax reconciliation. Thanks soooooooooooooooooooooooooooooooooooooooooo much!!!

This is amazing. Thank you Silvia.

Well explained. i took my class 2 years back and couldn’t remember a single word of my teacher, so couldn’t figure out what exactly have a drawn on my notes. what exactly is this reconciliation all about. like usual, i browsed to ifrsbox and bingo, found a perfect exercise. thank you

Yeeessss, thank you – this is exactly what I wanted to reach – these “bingo” moments 🙂

Hi Sylvia, I have a situation where we had a capital gain of N$1000,000 which is currently not taxable in my country. How do I account for the capital gain, since my income tax rate reconciliation is not in balance?

Well, if it will be taxable in the future, thus the difference is temporary, you need to book the deferred tax. If the tax capital gain is not taxable at all, then no deferred tax is recognized and it is treated as a “permanent” difference in your reconciliation (similar as tax effect of non deductible promotional expenses above in the example).

Hi Silvia,

Thank you so much for the articles. It was really useful. I have one question if in previous year, the company has a carry tax loss forward and now it is profitable and will be able to utilize the tax loss. How could we incorporate these tax loss in the reconciliation ?

Many thanks

Bonnie

Hi Silvia, Nice article,one can get a clear understanding on Tax reconciliation.

Can you explain me what should be done in case of accounting loss in current year, where the current tax is also NIl.

and there is a loss in the previous year also.

Well, you would do the reconciliation in the similar way 🙂