Top 5 IFRS 2014 and 2013 Changes

The year 2013 started off with some really significant IFRS amendments that you need to take into account when preparing your IFRS financial statements as at 31 December 2013.

Although these changes should be applied in the year 2013 for the first time, you also need to restate your comparative figures for the previous reporting period.

It means that you need to apply all the changes to your 2012 IFRS financial statements and present the comparative figures with the changes already in place.

So not only do you need to be careful in your 2013 accounts; you also need to restate 2012 accounts.

But let’s see what IFRS 2014 changes are in place.

Before you start reading, you can download the handouts of the video summarizing all the changes here.

#1: Changes in IAS 19 Employee benefits

#1.1 New accounting treatment of defined benefit plans

Accounting for defined benefit plans in line with IAS 19 belongs to one of the most complex issues in IFRS because it involves:

- Application of actuarial method,

- Selection of the appropriate discount rate,

- Incorporating actuarial assumptions,

And other things, just to name a few complications. If you want to read more about it, please read our summary of IAS 19 Employee benefits here:

Summary of IAS 19 Employee Benefits

However, the change of IAS 19 applicable in 2013 simplified an accounting treatment of defined benefit plans a bit.

You probably know that actuarial assumptions might change time to time. Or, the reality might come up pretty different from what you have expected and incorporated in your calculations.

As a result, certain differences might arise.

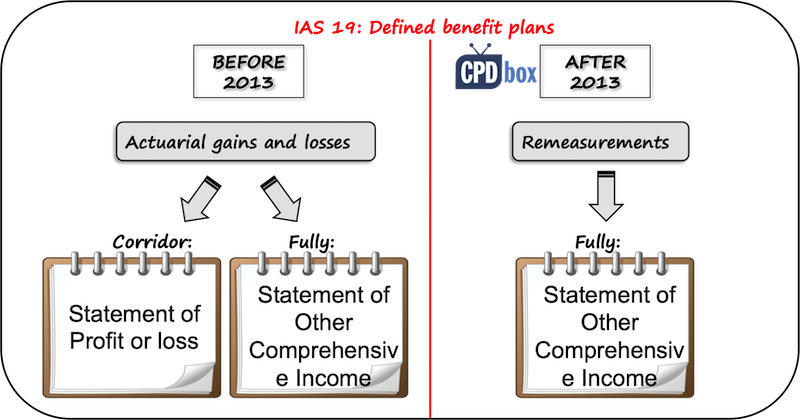

Before the change

These differences were called “actuarial gains or losses” and you could apply so-called corridor method.

It means that if the accumulated unrecognized actuarial gains or losses exceed 10% of the greater of the defined benefit obligation or the fair value of plan assets, a portion of that net gain or loss is required to be recognized immediately as income or expense.

And you needed to calculate this portion as the excess divided by the expected average working lives of the participating employees.

Later, the option to recognize actuarial gains and losses to other comprehensive income in full was added.

After the changes

These differences are called “remeasurements” now and they include the bigger group of various differences:

- Actuarial gains and losses on the defined benefit obligation,

- The difference between actual investment returns and the return implied by the net interest cost; and,

- The effect of asset ceiling.

The good news is that you don’t need to worry about corridors, because amended IAS 19 requires posting all these remeasurements directly to other comprehensive income. Corridor method is no longer permitted.

What does it effectively mean?

The most positive effect of this change is increased simplicity of the accounting treatment. It’s good for us, accountants, isn’t it?

But, the negative part is that you might need to explain it to your shareholders clearly, because after this change, you are more likely to see bigger fluctuations in equity than before.

Well, nothing is perfect.

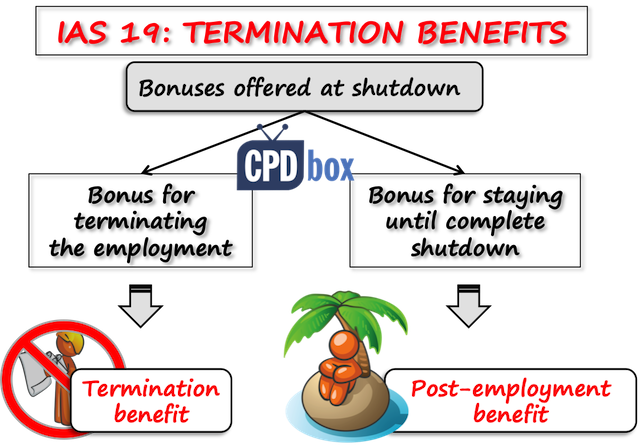

#1.2 Accounting treatment of termination benefits

Termination benefit is simply a benefit received for terminating the employment before the normal retirement date (given certain conditions are met).

Here, nothing much changed, but the standard IAS 19 now makes it clearer that when employees need to provide future service in order to get the benefit, then it is NOT a termination benefit.

For example, a nuclear power plant shuts down its operations and needs to lay off some employees. Some employees are offered the lump-sum payment of EUR 5 000 for voluntary acceptation of terminating the employment. Some employees are offered a bonus of EUR 10 000 for staying with the nuclear power plant until its complete shutdown after 3 years.

In this case, new IAS 19 makes clear that the bonus of 5 000 is termination benefit as it does not require future service.

However, bonus of 10 000 is NOT a termination benefit, because it requires future service until the closure of power plant. This bonus should be treated as defined benefit plan.

#1.3 Other changes to IAS 19 Employee benefits

Apart from the above mentioned changes, there are a few other things to watch out:

- Past-service cost related to unvested benefits is recognized immediately after plan amendment and is no longer spread over a future-service period.

- We shall be using pre-tax rate (not post-tax rate) in order to discount benefits to their present value.

- You need to present slightly more disclosures and the split of benefits than before.

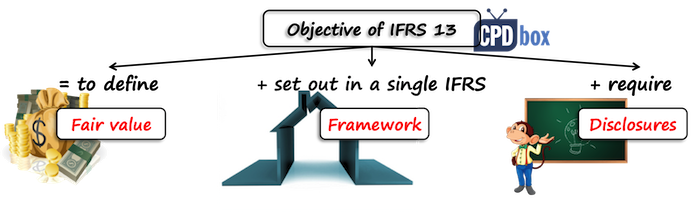

#2: New standard IFRS 13 Fair Value Measurement in place

Before IFRS 13, guidance on determining the fair value was all over the place: in IAS 39 for financial instruments, in IAS 40 for investment property, in IAS 2 for inventories, etc.

Often this guidance was very conflicting and therefore, we have a single standard for fair value measurement.

Now, if you see reference to fair value in any other standard, you should be heading to IFRS 13 Fair Value Measurement for its determination.

The main points of IFRS 13 are:

- Use of the principal market to measure fair value, if possible.

- Fair value is determined based on the unit of account.

- Fair value of non-financial assets is determined by reference to the highest and best use.

- IFRS 13 sets a few valuation techniques you should apply.

- Inputs to valuation techniques fall into 3 levels of the fair value hierarchy: Level 1, Level 2 and Level 3.

Please read more about IFRS 13 here (with the video at the end):

Summary of IFRS 13 Fair Value Measurement

Frankly speaking, applying IFRS 13 is not as simple as it seems and in some cases it might even require significant and costly changes to processes and systems of the related company.

As I wrote above – nothing is perfect.

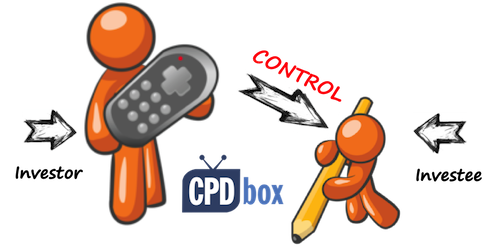

#3: New standard IFRS 10 Consolidated Financial Statements

IFRS 10 is a completely new standard dealing with the consolidation and it is applicable for the periods starting 1 January 2013 or later.

Before 2013, the standard IAS 27 dealt with these issues, but IFRS 10 replaces this part of IAS 27. Currently, you should apply IAS 27 only for the separate financial statements.

The main change of IFRS 10 is the new definition of a control:

“Control” exists when an investor has all of the following:

- Power over the investee.

- Exposure, or rights, to variable returns from its involvement with the investee, and

- The ability to use its power over the investee to affect the amount of the investor’s returns.

Therefore, the composition of the group may significantly change because as a result, you might need to consolidate more of fewer entities than before this change. Standard IFRS 10 gives a whole guidance about the new definition of control.

Mechanics of the consolidation procedures remains the same as in the old IAS 27.

2014 change: New concept of investment entities

This is the change applicable for annual periods beginning on or after 1 January 2014, so you will deal with that at your 2014 closing.

However, this change might be so huge and significant for many companies that I decided to bring it here.

IFRS 10 introduces a concept of an “investment entity”. It is an entity that:

- Obtains funds from one or more investors for the purpose of providing those investor(s) with investment management services,

- Commits to its investor(s) that its business purpose is to invest funds solely for returns from capital appreciation, investment income, or both, and

- Measures and evaluates the performance of substantially all of its investments on a fair value basis.

An entity must carefully assess whether it meets the definition of an investment entity or not.

So if an entity meets the definition of an investment entity, it DOES NOT consolidate its subsidiaries in line with IFRS 3 when it obtains control of another entity.

Instead, an investment entity measures an investment in subsidiary at fair value through profit or loss in line with IAS 39 / IFRS 9. That’s the basic rule, but some exceptions may apply, too.

This is really a huge change, because instead of eliminating all those intercompany balances, calculating goodwill or accumulated reserves, you just remeasure the fair value of your subsidiary and book the change to profit or loss.

Well, if you are an investment entity. Nice and simple.

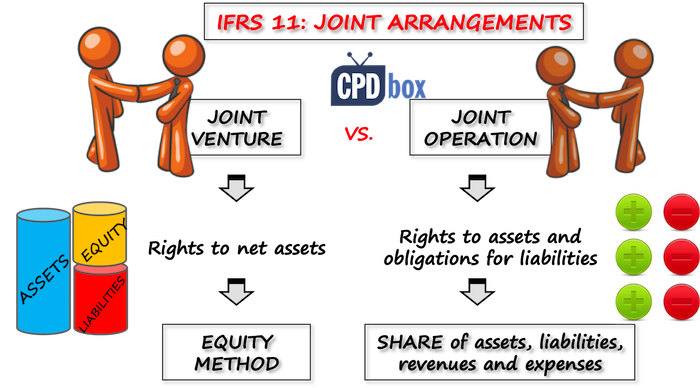

#4: New standard IFRS 11 Joint arrangements

Before IFRS 11, there was the standard IAS 31 Interests in Joint Ventures arranging joint control. IAS 31 classified joint arrangements into 3 main categories:

- Jointly controlled operations,

- Jointly controlled assets and

- Jointly controlled entities.

IFRS 11 effectively replaces IAS 31 and brings completely new definition of joint control:

“Joint control” is a contractually agreed sharing of control of an arrangement, which exists only when the decisions about the relevant activities require the unanimous consent of the parties sharing control.

Also, IFRS 11 removes 3 categories of joint arrangements and sets only 2 of them:

- Joint operation – here, the parties with joint control have rights to the assets and obligations for the liabilities.

- Joint venture – here, the separate vehicle is usually established and IFRS 11 requires accounting for joint venture using the equity method.

Here’s the biggest change: proportionate consolidation method permitted by IAS 31 for accounting joint ventures is no longer permitted.

Also, new definitions of joint venture and joint operation might result in a different classification than before and it may significantly affect the accounting treatment applied in the past.

#5: New standard IFRS 12 Disclosure of interests in other entities

Now, if you have some interest in entities other than subsidiaries, associates or joint ventures, for example some unconsolidated structured entities, then this one is for you.

In addition to disclosures about your subsidiaries, associates or joint ventures, you need to disclose lots of information about your interest in other entities too.

Required disclosures are for example:

- Summarized financial information for each subsidiary that has non-controlling interests that are material to the reporting entity

- Significant judgments used by management in determining control, joint control and significant influence, and the type of joint arrangement (i.e., joint operation or joint venture), if applicable.

- Summarized financial information for each individually material joint venture and associate.

- Nature of the risks associated with an entity’s interests in unconsolidated structured entities, and changes to those risks.

Please watch the following video with the summary of IFRS 2013/2014 changes.

And you can download the handouts of this video HERE.

Want to dive deeper into IFRS? I’ve created the free report “Top 7 IFRS mistakes that you should avoid”. Sign up for email updates, right here, and you’ll get this report as well as free IFRS mini-course.

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

16 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Doing my assignment basing on changes in IFRS. Thanks for valuable information!

hi

may you please highlight me of the changes that particularly took place in the year 2014 which will have to be mostly applied to the financial year end 2015?

I’d really appreciate your help.

regards.

As a CPA reviewee from the Philippines, I really appreciate you doing the best you can to impart IFRS in simplest way possible the we-all-know complicated and so technical pronouncements/changes in IFRS. Keep it up! 😉

Thank you so much! 🙂

Very helpful. Thank you. Waiting for more lecture on each IAS/IFRS.

Many thanks

Sorry, simplify employee benefits and deferred tax

Hi Patrick, I did 🙂 In the IFRS Kit 🙂 S.

Thanks Silvia, Your explanations flow very well such that before one realizes have already gone deep into understanding the IFRS you are discussing.

That’s great! I’m happy to help, David 🙂

Many thanks Silivia, really it’s very nice , claer , simple and precious explanations, all the best.

Thank you, Hemdan 😉

I really appreciate your work, you are a rear gem,even though I have attended different IFRS training in here Nigeria yours is wonderful.

Hi Abideen, thank you so much for this feedback. I really appreciate it especially from you as you know what’s inside the IFRS Kit. I’m very happy to help. Take care! S.

I am very much impressed with the way you are explain the standards. We are getting the latest news immediately through e-mails. I am also interested to join your course.

Best Regards

Abraham K Mathew

Dear Abraham, thank you for your feedback – I really like reading that my work helps someone 🙂 Of course, you’re welcome to join us anytime.

Have a nice day! S.