Example: Leases under IFRS 16 during COVID-19

The pandemics of coronavirus, or COVID-19 has been here for a while and after the first shock of its quick spread and effect on people’s health, we are all seeing its economic consequences. In order to stop the spread, governments in many countries ordered complete…

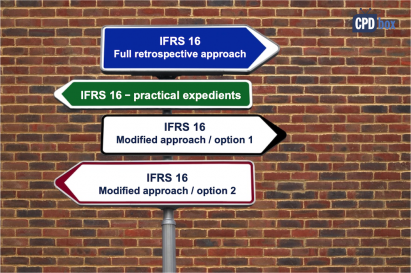

Adopting IFRS 16 – What Is The Best Option For You?

Let’s compare different transition options that you have when adopting IFRS 16 in your company. Let’s see what they are, which one is easier and which one has the smallest impact on your equity.

IFRS 2 – How to Calculate Fair Value for Share Based Payments

Note: This article is a guest post and its author asked me not to reveal his name, so he stays anonymous. IFRS 2 Share-based Payment (the “Standard”) is the financial reporting standard dealing with share based payments. It was first introduced in 2005, and is…

IFRS 2019 Update: Major changes you should be aware of

Here we go again – another year has started and a number of changes or amendments of IFRS came into effect. I am pretty sure that you are aware of the biggest ones like new IFRS 16, but let me sum up all the new…

Tax Reconciliation under IAS 12 + Example

When I was an audit freshman, my least favorite task was to prepare the income tax reconciliation. I frankly hated it. Why? The main reason was that I did not understand the purpose of it. For me, it seemed like a bunch of numbers and…

Example: How to Adopt IFRS 16 Leases

In my last article I tried to outline the strategy and your choices when implementing the new lease standard IFRS 16 Leases. I am grateful for many responses and comments I got from you. Almost all e-mails I received from you asked me to publish…

How to Implement IFRS 16 Leases

The new lease standard IFRS 16 is exactly one of these earthshaking things that can make your head spin around. Well, especially if your company uses the operating lease as an effective tool of getting your assets quickly with relatively low risk. I wrote a…

Troubles with IFRS 16 Leases

The new lease standard IFRS 16 can initially cause some troubles to the affected companies, because it introduces huge changes in the lessee’s accounting for leases. It was issued in January 2016 and we have to apply it for the periods starting 1 January 2019…

IFRS 16 Leases Explained: Full Guide + Free Video & Checklist

Updated: May 2025 IFRS 16 changed lease accounting forever. Lessees now bring almost all leases onto the balance sheet — no more hiding operating lease liabilities in the footnotes. In this guide, you’ll learn how IFRS 16 works in practice, including main rules, two free…

How to Account for Decommissioning Provision under IFRS

When a company acquires certain types of long-term assets, it sometimes has an obligation to remove these assets after the end of their useful lives and restore the site. Typical example of such an asset is an oil rig or a nuclear power plant. When…

Recent Comments

- Stephan on How to Account for Spare Parts under IFRS

- Bamikole Sikiru on IFRS 10 Consolidated Financial Statements

- Yamkela on How to Account for Decommissioning Provision under IFRS

- mohamed on How to Account for Spare Parts under IFRS

- KAREEM IBRAHEEM on Lease term when contract is for indefinite period

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)