IFRS 16 Leases vs. IAS 17 Leases: How the lease accounting changed

In January 2016, IASB issued another important and long-discussed standard: IFRS 16 Leases that will replace IAS 17. Ever since then I receive lots of e-mails asking me to sum up what’s new. OK, so here you go. In this article, you’ll learn about the…

Tax Incentives – IAS 12 or IAS 20?

In my previous article about accounting for government grants I asked you to give me some feedback and write me about some problems or issues in this area. Surprisingly, most of your responses asked one and the same question: How to account for tax incentives…

How to Account for Government Grants (IAS 20)

Almost every government supports certain companies or business by providing grants or other kind of assistance. As this is clear benefit and advantage comparing with other companies without such an assistance, it should be properly reported in the financial statements. How? Let’s explain the rules…

How to Account for Employee Loans (interest-free or below-market interest)

After I wrote an article about capitalizing borrowing cost, I got a lot of e-mails asking me actually HOW to account for loans that do not bear the interest rate reflecting market conditions. In other words, how to account for loans at below-market interest rate,…

How to Account for Provisions – Practical Questions

Today, let’s be practical. A couple of weeks ago, I published an article about IAS 37 Provisions, Contingent Liabilities and Contingent Assets. I received a lot of questions from you, so here I try to give you my answers to the issues that popped out…

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

Last update: March 2025 Free video lecture with the rules of IAS 37: Have you ever heard a joke about two accountants applying for a job? During their interview, they were given a task to calculate a net profit figure based on available data. After…

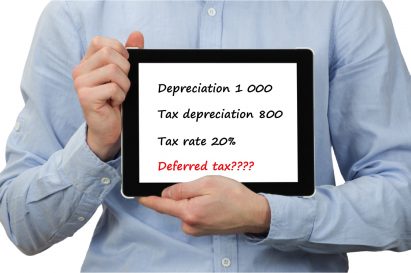

Deferred Tax: The Only Way to Learn It

Deferred tax is neither deferred, nor tax: it is an accounting measure, more specifically an accrual for tax. I’m very proud to publish the first guest post ever in this website, written by Professor Robin Joyce FCCA who will explain you, in a detail, how…

Top 5 IFRS 2014 and 2013 Changes

The year 2013 started off with some really significant IFRS amendments that you need to take into account when preparing your IFRS financial statements as at 31 December 2013. Although these changes should be applied in the year 2013 for the first time, you also…

IFRS 2 Share-Based Payment

Does your company remunerate its top management by granting them own shares? Or, do employees receive bonuses based on the increase of the company’s share price? Transactions whereby companies pay for the goods or services received by issuing shares or similar instruments are very…

The Unconventional Guide To IAS 12 Tax Bases

Last week I published an article with summary of the standard IAS 12 on Income taxes. It’s not an easy text to read and some definitions in IAS 12 are so obscure that many people grope in the fog unsure what to do. When it…

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)