How to Account for Decommissioning Provision under IFRS

When a company acquires certain types of long-term assets, it sometimes has an obligation to remove these assets after the end of their useful lives and restore the site.

Typical example of such an asset is an oil rig or a nuclear power plant.

When an oil rig, a power plant or similar construction fulfills its purpose and comes to the end of its useful life, it’s only fair to our environment and people to remove it and restore the site as much as it can be.

In my own country, the legislation requires a company to remove the plant and restore the site after the end of its useful life.

And, in many other countries, the legislation is similar and therefore, the company operating similar assets will incur the inevitable expenses to decommission its assets some time in the future.

Now, here’s the problem:

When and how should you account for these expenses?

It would be clearly unfair to account for these expenses as they arise.

The reason is that the obligation to remove and restore the site arose right when the related assets were built and therefore, the company knew about these costs right from the start.

Users of the financial statements have the same right to know about such an obligation and the related expenses.

Therefore, IFRS contain several rules about so-called “decommissioning provisions”.

What do the rules say?

The standard IAS 37 Provisions, Contingent Liabilities and Contingent Assets requires recognizing a provision when there is a liability – i.e. present obligation arising from past events.

As I explained above, when you build an asset that requires removal after the end of its useful life and restoration of the site, then a present obligation arises at the time of its construction.

The obligation can result either from legislation (“legal obligation”) or from valid expectations of the third parties created by the company (“constructive obligation”).

Except for IAS 37, there’s the standard IAS 16 Property, Plant and Equipment that requires including the initial estimate of the costs of dismantling and removing the item and restoring the site into the cost of an asset.

It means that you do NOT recognize a decommissioning provision in profit or loss, but in your assets as a part of an item of PPE.

Finally, there’s a pronunciation IFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities dealing with subsequent measurement of a provision and recognition of its changes.

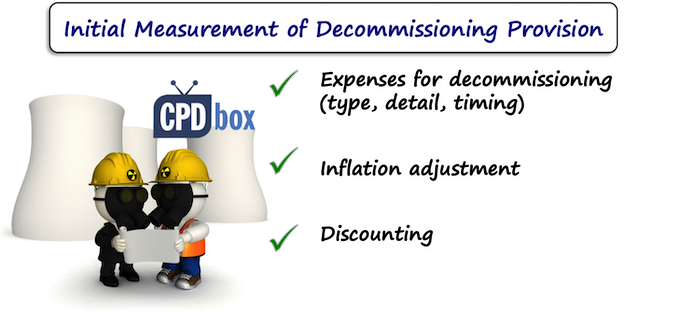

How to measure decommissioning provision

Measurement of decommissioning provision is extremely demanding, difficult and there are a lot of uncertainties involved.

Why?

The main reason is that you try to measure the expenses to be incurred after the end of your asset’s useful life. That can happen 30, 40 or 50 years later (maybe even more).

It’s quite difficult to estimate what happens within the next 5 years… and what about 50 years?

I could write a separate article about measurement of provisions, but let me give you just a few points that you should bear in mind when measuring decommissioning provisions:

- Involve experts to estimate future costs.

We, accountants, are very smart people, but we do not know everything. Therefore, technical experts in your business should be able to do the job. Please make sure that their report contains at least:

- What types of processes and operations are necessary to remove/restore;

- What their estimated cost with sufficient details is;

- What the timing of estimated costs is (no, we can’t assume that a nuclear power plant or an oil rig will be removed within 1 year – it can take even 10 years to complete the job fully).

- Study the report and adjust it.

Technical experts are great, but they are not accountants. We are and therefore, we need to understand how the experts estimated costs (i.e. what they put in their report). You should ask questions like:- Are individual expenses estimated in today’s prices? Or, did experts include some inflation?

You should not include the same risk twice into your calculation and therefore, when your estimates are in current prices, then you should a real discount rate (excluding the effect of general inflation).

When the estimates are inflated, then use a nominal discount rate.When I was dealing with my client’s decommissioning provision, our team selected a different approach.

We asked our experts to use the current year’s prices and then we adjusted them for the effect of inflation. The reason is that the cash flows are not centered in 1 year, but spread over more years and the estimate of inflation can be different for different years.

- Did experts include any effect of technologies not yet available? Did they count on any technical development? Or, did they assume today’s technologies?

Hey, you should not count on any future developments that are not yet certain and available. - What portion of these expenses relates to the removal of the buildings and constructions? What portion relates to the rectification of environmental and other damages caused by the operations?

This is very important for decision on when and how to recognize your provision.

- Are individual expenses estimated in today’s prices? Or, did experts include some inflation?

- Select the discount rate and discount your cash flows.

IAS 37 requires to select a “pre-tax rate(s) that reflect(s) current market assessment of the time value of money and the risks specific to liability”.

There’s not much guidance in IFRS on selecting your discount rate in this particular case and indeed, there are many approaches to select your discount rate.

Let me describe just one of them.

You can select some publicly traded government bonds and plot them on the yield curve to extrapolate the yield for maturity in the period when your expenses for decommissioning are expected to arise.

Hmmm, sounds difficult, I know. But, decommissioning provisions are not easy! If you are interested, you can check out my IFRS Kit to learn how to do it.

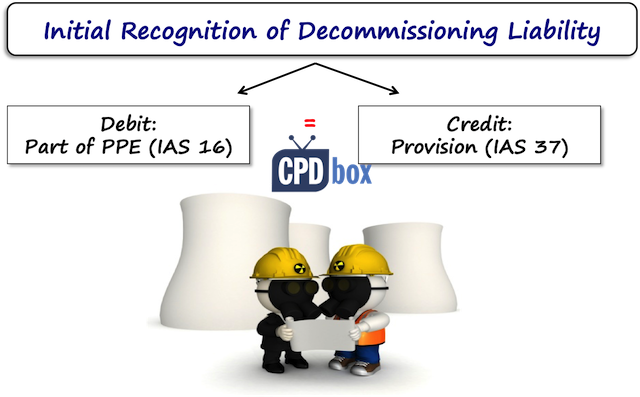

How to recognize the decommissioning provision initially

When you measured your provision successfully, now it’s time to recognize it.

As written above, the standard IAS 16 requires recognizing initial estimate of decommissioning costs to the cost of an asset.

The journal entry is therefore:

-

Debit Property, Plant and Equipment (nuclear power plant, oil rig, whatever)

-

Credit Provision for Decommissioning

The question is when to recognize such a provision, because the nuclear power plant or similar assets are built within several years.

Well, you should recognize a provision when there’s a past event creating a present obligation.

In most cases, your obligation builds up together with your asset. Of course, you will have smaller expenses to remove semi-finished reactor than to remove completed reactor.

Therefore, I recommend splitting the creation of your provision into the individual years of constructing your asset. The more you construct, the bigger obligation you have.

Let me also warn you about a provision to rectify damages caused by the operations.

The obligating event happens when the operations run. Therefore, you do NOT recognize any provision to rectify damages caused by operations at the time of constructing your asset.

Moreover, this provision relates to the operations and not to an asset itself and therefore, it is recognized in profit or loss (not to the cost of an asset).

For example, take nuclear power plant. When you build reactors, then you have to remove them after the end of their useful life and therefore, the provision for their removal is recognized at the time of their construction in the cost of a plant.

But, when you operate a nuclear power plant, then radioactive waste is produced. Of course, you need to remove the waste and it’s quite expensive, because you need to store it in concrete cooling units and then in permanent storage. The provision for these expenses is recognized when the waste is produced (i.e. when you operate the plant).

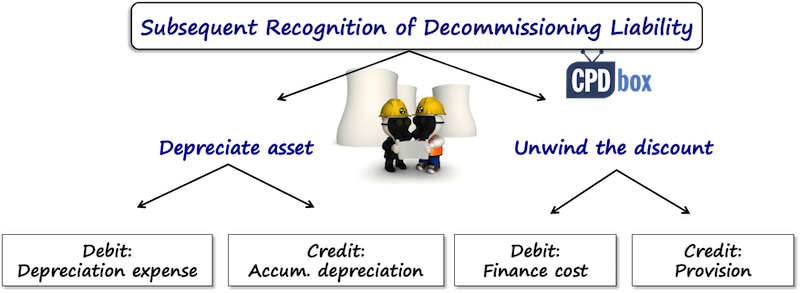

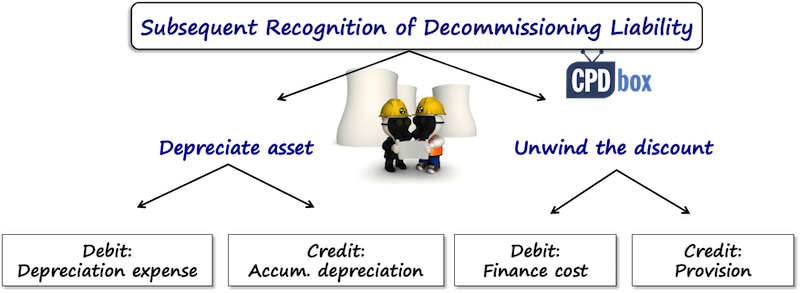

How to recognize a decommissioning provision subsequently

First of all, you need to unwind the discount each year. It means charging an interest on your provision to build up your discounted liability to its future value.

Secondly, don’t forget to charge depreciation on your asset.

Lastly, you should revise your provision at the end of each reporting period and recognize its changes in line with the pronunciation IFRIC 1.

It depends on the model you apply to your asset:

- If you keep your asset under the cost model, then you recognize a change in your provision in the cost of your asset;

- If you keep your asset under revaluation model, then you recognize a change in your provision in the revaluation surplus or deficit.

Accounting for decommissioning provision – example

Let me give you a brief, simple example to illustrate this extremely complex topic.

Question

Let’s say your experts estimated the expenses to decommission the plant.

Their estimate is in the following table:

| Year | Expenses |

| 20X31 | 400 |

| 20X32 | 500 |

| 20X33 | 600 |

| 20X34 | 550 |

| 20X35 | 250 |

On top of that, the experts estimate the annual expenses of CU 100 to remove the radioactive waste caused by the plant’s operations during its useful life.

All expenses are stated in the real prices (20X1).

Based on recent economic development, you assume that the inflation rate will be 1.5% p.a. and the appropriate discount rate is 2%.

Calculate a provision to decommission the plant and recognize it in the financial statements.

Solution

Once we have our experts’ report, estimates of inflation and discount rate, we verified everything, etc., we need to:

- Inflate the cash flows, because they are stated in the current prices; and

- Discount them to a present value

Be careful, because you should not include the estimated expenses for removal of radioactive waste into the initial provision.

The reason is that the obligation arises when the plant is in operation and therefore, you need to recognize a relevant provision needs when a plant operates and produces radioactive waste (in profit or loss).

The initial measurement of a provision for decommissioning the plant is shown in the following table:

| Year | N. of years from 20X1 (A) | Expenses (B) | Expenses inflated at 1.5% p.a. (C) | Discount factor at 2% p.a. (D) | Present value (E) |

| 20X31 | 30 | 400 | 625 | 0.552 | 345 |

| 20X32 | 31 | 500 | 793 | 0.541 | 429 |

| 20X33 | 32 | 600 | 966 | 0.531 | 513 |

| 20X34 | 33 | 550 | 899 | 0.520 | 468 |

| 20X35 | 34 | 250 | 415 | 0.510 | 212 |

| Total | n/a | 2 300 | 3 698 | n/a | 1 967 |

Notes:

- Expenses inflated at 1.5% p.a. (C) = B * 1.015 to the power of (A)

- Discount factor at 2% (D) = 1/(1.02 to the power of (A))

- Present value (E) = (C)*(D)

The journal entry is:

-

Debit Property, Plant and Equipment (nuclear power plant): CU 1 967

-

Credit Provision for Decommissioning: CU 1 967

When there’s no change in estimates in the subsequent reporting period, you need to unwind the discount. Therefore, journal entry in 20X2 is:

-

Debit P/L – Finance Expenses: CU 39 (1 967*2%)

-

Credit Provision for Decommissioning: CU 39

Now, let’s say that in 20X3, your estimate of the discount rate changes to 1.8% and all the other estimates (cash flows) remain unchanged.

You need to recalculate the provision and account for its changes under IFRIC 1.

Just be careful, because now you are in 20X3, not in 20X1 and therefore, the number of years for discounting change (not for inflating the costs, as you still inflate from the date of your report).

The new table could look something like this:

| Year | N. of years from 20X3 (A) | Expenses (B) | Expenses inflated at 1.5% p.a. (C from previous table) | Discount factor at 1.80% p.a. (D) | Present value (E) |

| 20X31 | 28 | 400 | 625 | 0.607 | 379 |

| 20X32 | 29 | 500 | 793 | 0.596 | 473 |

| 20X33 | 30 | 600 | 966 | 0.586 | 566 |

| 20X34 | 31 | 550 | 899 | 0.575 | 517 |

| 20X35 | 32 | 250 | 415 | 0.565 | 234 |

| Total | n/a | 2 300 | 3 698 | n/a | 2 169 |

You can see that the revised provision of CU 2 169 is different from the currently recognized provision.

Assuming you use cost model for your power plant, you need to recognize the change in the cost of a plant.

Before we recognize this change in line with IFRIC 1, we must not forget to unwind the discount for 20X3, too:

-

Debit P/L – Finance Charges: CU 40 ((1967+39)*2%)

-

Credit Provision for Decommissioning: CU 40

Then, we can recognize the change in the provision:

-

Debit PPE (Nuclear power plant): CU 123 (2 169 – (1 967+39+40))

-

Credit Provision for Decommissioning: CU 123

Finally, when a company starts decommissioning – i.e. removing the plant and restoring the site, then all expenses are charged against the provision:

-

Debit Provision for Decommissioning: CU XXX

-

Credit Cash/Bank Account/Suppliers: CU XXX

The Final Word

Accounting for decommissioning is not an easy topic, because it involves a generous portion of uncertainty and estimates.

On top of that, accounting for something that will happen in the far future means lots of discounting and continuous re-estimation, reassessment and recalculation of a provision.

Therefore, this is NOT purely an accounting matter. You should involve your decommissioning experts to help you estimate the expenses.

Just one final remark: I described accounting for decommissioning provision under IFRS, but US GAAP rules are very similar. They call it “asset retirement obligation (ARO)”.

The principles are almost identical, but there are some differences – therefore, please be careful when preparing your financial statements under both standards.

If you find this article useful, please share it with your friends. And, if you have any questions, please comment below. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Suppose, due to change in estimates, a company reassessed its ARO provision and determined the ARO provision should be incresed by $100. What should be the journal entry?

In most cases, Debit PPE, Credit Provision.

Simply Awesome 😎

Estimada Silvia, lo revise el articulo sobre provision de desmantelamiento segun la NIC37 y otras normas, muy interesante, al respecto, te agradecería por favor me ayudes a resolver estas preguntas segun el siguiente planteamiento:

Una compañía contrata los servicios de una empresa especializada en el cálculo de los costos de remediación y taponamiento de pozos para el campo Iguembe X-01, cuyo estudio determina lo siguiente:

Costo de remediación y taponamiento con precios actuales (antes de inflación y riesgo de mercado) = US$ 2.200,000

Tasa de inflación a la fecha de origen 4,5%

Tasa de riesgo de mercado 3%

Años estimados hasta la fecha de remediación 20 años

Reservas probadas desarrolladas a la fecha de origen 3.500.000 BBL

Tasa de descuento 11.5%

Requerimiento:

1. Determine el importe del pasivo que la compañía debe tener al final de los 20 años

2. Determine el valor a ser contabilizado en origen.

3. Determine el valor neto amortizado al final del 4to año y la depreciación para el 5to año considerando una producción de 180.000 BBL y una reserva al final del año de 2.540.000 BBL.

4. Determine el Importe de la provisión para desmantelamiento al final del 5to año.

5. Contabilice la transacción de origen (capitalización y pasivo), la depreciación del 5to año y el importe acumulado del gasto operativo por la suma total de los 5 años.

Nota: Sin existe algun dato que no este claro, puedes complementar, gracias

atte. javier

I am sorry, we normally do not approve comments languages other than English. This is the exception to make it clear. Thanks.

Hello, if a partial payment is made towards the decommissioning liabilities. example: members of a JV are required to pay funds towards the decommissioning liabilities.

What are the double entry?

Do we need to split the provision between Short term portion and Long term portion?

If that is material, then according to IAS 1 you should.

Hi there, thank you for this explanation and example it has been extremely useful. I have two questions if you could help please –

1) In your example, the discount rate changed from 2% to 1.8%. So from 20X31 onwards, wat rate would you use to calculate Accretion expense in P&L? I think it should be 1.80%, but others say it should be original discount rate which is 2%. The difference, others say, would be taken to PPE Cost.

2) What happens when your adjustment due to changes in estimate requires a reduction in Assets which is greater than the NBV of the Asset? Should the excess be recognised in the P&L? If so, where? Offset against Finance charges?

Many thanks in advance for your help!

Hi Sylvia, just want to have something clear:

we have an asset with a value of US$ 1000, a decommissioning cost related to this asset of US$ 400 and a decommissioning liability of US700. Due to changes in discount rate the provision should be decreased with US$500.

what is the journal entry for this?

I assume that “decommissioning cost of US 400” is a part of a provision that is capitalized in PPE. If this is the case, then in line with IFRIC 1 the entry would be Debit Provision / Credit PPE of USD 200.

Hi Sylvia, Nice article.

Due to the declining interest rate environment, we move from using a nominal rate to the real rate. Using the nominal rate, we were inflating and then discounting to the present value. As such, accretion would be calculated using the nominal rate.

When switching to the real rate, we now unwind the discount at the reduced real rate because that is ultimately what resulted in the present value of the liability.

Should we continue to unwind the discount at the nominal rate or the real rate?

Hi PRD, you can use real rate, sure, but don’t forget to adjust your cash flows, too – because, either you use nominal rate and adjust future cash flows by inflation; or you use real rate and your cash flows ignore inflation. That’s for #1 – otherwise, if you just use real rate for discounting and then your cash flows contain inflation, you are inconsistent. N 2, let’s say you adjusted your future cash flows and discounted them by the real rate – now of course, you need to stay consistent and unwind the discount by real rate, too. I hope it helps. All the best, S.

Hi – I have a question, what if the lease agreement is for the use of Land under operating lease? Is there still a recognition of Asset? and would there still be a depreciation over lease term? Thank you !

@Silvia, any answer to this one?

Hi Silvia, thanks for a very informative article. You have been doing some great work.

I have one question regarding the ‘sale of scrap’. While calculating the estimated decommissioning liability to be paid after the usage of the site, should we deduct the sale of scrap from that liability? For example, it’s estimated that after 20 years, the decommissioning liability would be $100,000 and the scrap value would be $10,000. So should we recognise the liability (undiscounted) as $100,000 or $90,000?

Hi, when Dismantling the provision entry is DR Provision and Cr Cash or Vendor, I need the clarification for the PPE what we have recognized initially, do we pass any Journal entries for that cost of PPE at the end of the period or it will remain as same in the book?

Hi Silvia

How do we account for replacement obligation under IAS 37,

Very lucid and clear article. I suppose when a plant is decommissioned for disposal and site restoration, the “cashflows” will also lead to realisation from scrap sales. Should such credit for scrap sales be considered in the “cashflow” measure of the obligation. Will its inclusion violate any other standard

I don’t think this would violate anything, as soon as you are reasonably sure you will incur such income. S.

Thank you so much for this informative article, Silvia! Could you also explain the accounting of this decommissioning liability under IFRS 16, considering the various transition approaches IFRS 16 has?

This is a very good article Silvia. Thank you for sharing. May I ask if the Interest/Finance Charges on Provision of Decommissioning should be an operating or non-operating expense?

Hey Silvia, this was very infromative. Could you please also clarify that how the changes in decommissioning estimates arising from exchange rate fluctuations are dealt with. is it capitalized or charged to profit and loss account.

To avoid this, the accountant may be tempted to make some provisions for some potential future expenses of $, with the impact of making the profit seem lower in the current period. As the double entry for a provision is to debit an expense and credit the liability, this would potentially reduce the profit down to $. Then in the next year, the chief accountant could reverse this provision, by debiting the liability and crediting the profit or loss. This is effectively an attempt to move $ profit from the current year into the next period.

Sure, that’s why IAS 37 aims at strong rules for making provisions as I explained somewhere else.