Deferred Tax: The Only Way to Learn It

Deferred tax is neither deferred, nor tax: it is an accounting measure, more specifically an accrual for tax.

I’m very proud to publish the first guest post ever in this website, written by Professor Robin Joyce FCCA who will explain you, in a detail, how to understand deferred taxation and how to tackle it in a logical way.

This article reflects the opinions and explanations of Robin and I must say his approach is very fresh and maybe a bit unconventional. Here’s what he has to say about deferred tax:

Knowledge of accruals and tax are needed for timing differences (the main component). Tax losses and tax credits will be discussed later.

Note to accountants, auditors, bank examiners and supervisors

Failure to accrue for tax falsely inflates profits, equity and (for banks) prudential capital by including pre-tax profits, instead of post-tax profits.

This can inflate earnings per share in a public company.

Earnings per share (‘EPS’) is a key stock market indicator which feeds into the Price Earnings ratio. The Price Earnings (‘PE’) ratio directly impacts stocks market valuations.

Where this arises, the Earnings for the EPS and PE could be dramatically misleading, leading to unjustifiable stock market valuations and/or unearned executive bonuses being paid.

Basics of Accrual Accounting (some may surprise you)

- Accrual accounting is an economic presentation of financial statements.

The accrual presentation normally differs from a presentation based on cash accounting, to reflect timing differences between cash flows and economic events. - Standards (IFRS, National Standards, Central Bank Regulations) can only do two things:

- They can move profit (or loss) from period to period.

This is what happens when cash accounts are transformed to accrual accounts, in transformations from national accounts to IFRS and in consolidations. Standards can neither create, nor destroy, profit, as the ultimate profit (or loss) will be measured in a cash increase, or decrease. - Standards provide rules on format of presentation.

- They can move profit (or loss) from period to period.

- If income, or expense, is accrued (or reduced by prepayments) in the period, more (or less) profit (or loss) will be generated. If the additional profit (or loss) will be taxed immediately, the tax charge for the period will reflect this by increasing, or decreasing.

If the additional tax (or tax credit – the benefit of paying less tax) will be generated in a later period, an accrual for that tax is required in this current period to match the period of the economic activity. - Revaluations are accruals of profits/gains and losses that have yet to be realized.

The result may appear in the income statement, or reserves (via the Other Comprehensive Income statement). An impairment is an accrual for loss.

Such accruals for profits and losses will be matched with an accrual for tax, unless the profit (or loss) will never be subject to tax. - Accruals are created, sometimes changed and reversed. Invoices and charges are paid, not accruals.

Deferred tax – timing differences

If an income or expense (which creates a profit or loss) is taxed in the same period that it appears in the income statement, or equity (such as share issue costs) the tax charge for the year will reflect this and no further action is required.

If the income, or expense, is taxed wholly or partially in another period, an accrual for tax is needed in this period to reflect this.

This is a timing difference, between the economic event and the taxation.

Deferred Tax arises from the analysis of the differences between the taxable profit and the accounting profit. These differences arise from the treatment of a transaction differing within the financial and taxation accounts.

- The differences can be classed as permanent, or temporary timing differences.

- An example of a permanent difference is the receipt of a tax free government grant, or similar incentive. This is clearly part of the accounting profit, but it will never be part of the taxable profit. No further accounting is necessary in future periods for permanent differences.

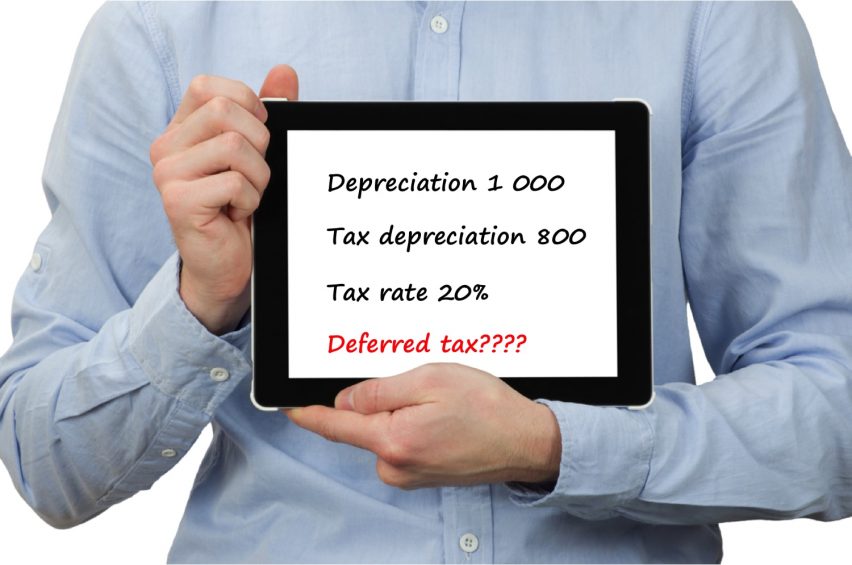

- An example of a temporary timing difference occurs when the tax and accounting depreciation of an asset differ. They can arise from differing useful lives, or differing depreciation methods, for example reducing balance and straight line.

- In order to normalize the earnings, we need to normalize the tax charge. This is done by adding a deferred tax charge to the mainstream tax charge. The deferred tax charge is the value of the temporary timing differences at the current rate of tax enacted for the future periods.

Permanent differences are no longer referred to in IAS 12, but have been included here to clarify when not to make an accrual for tax (as no further tax is payable, nor receivable).

Temporary timing difference – revenue/revaluation

(Debits are shown as +, credits shown as -, tax is 20%)

Example: Revaluation Gain

| Description | 2XX3 | 2XX4 |

| Revaluation gain | -100 | 0 |

| Tax | 0 | 20 |

| Net effect on P/L | -100 | 20 |

In this example, our revaluation may be for any asset: IAS 40, IFRS 9 in the Income Statement, IAS 16 or IAS 38 in Other Comprehensive Income (logic identical).

The gain is booked in 2XX3, but no tax is levied until the following period, when the asset is sold for its revalued carrying value.

Is there a problem with this presentation? Yes, as at the end of 2XX3, shareholders will be presented with the following financial statement:

| Description | 2XX3 |

| Revaluation gain | -100 |

| Tax | 0 |

| Net effect on P/L | -100 |

Shareholders will want a dividend of 100. If paid, then there will be no cash to pay the tax bill of 20 the following year.

In practice, our apparent gain of 100 is only 80 after tax. Our presentation has overstated the profit.

An accrual for tax is needed in 2XX3, which will be reversed in 2XX4 when the tax is levied:

| Description | 2XX3 | 2XX4 |

| Revaluation gain | -100 | 0 |

| Tax | 0 | 20 |

| Net effect on P/L before tax accrual | -100 | 20 |

| Tax accrual | 20 | -20 | Net effect on P/L | 80 | 0 |

This is the full accrual presentation. The revaluation is an accrual for profit/gain, which is matched by an accrual for tax.

(The accrual for tax is wrongly called ‘deferred tax’. It is not: the tax is next to the line labeled tax and nothing is deferred. It is not tax: it is an accrual for tax.)

Example: Revaluation Loss

A revaluation loss and accrued tax credit would be shown as:

| Description | 2XX3 | 2XX4 |

| Revaluation loss | 200 | 0 |

| Tax credit | 0 | -40 |

| Net effect on P/L before tax accrual | 200 | -40 |

| Tax accrual | -40 | 40 | Net effect on P/L | 160 | 0 |

Timing difference – expense including depreciation

Expenses generally follow a similar treatment to the revaluation loss above, if the timing difference is between two consecutive years.

In the case of non-current assets (IAS 16, 38, 40), if the economic life used in the financial books is the same as the life used for tax purposes, depreciation/amortization is charged each year and fully allowed for tax: there is no timing difference and no accrual for tax.

Correct application of IAS 16, 38, 40 (and 17) requires the economic life to be used, even if it differs from the life used by tax authorities.

Where it differs, accruals for tax (debits or credits) are required. They are required for presentation purposes (that is what accrual accounting is) but do not change any tax benefit, as they are not tax components, only accruals.

After being created, they may change from period to period. On disposal or expiry of the asset, any remaining accrual will be reversed.

Example: Non-Current Asset 1

| Balance Sheet | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 |

| Cost | 3 000 | ||||

| Depreciation | -1 000 | -1 000 | -1 000 |

We buy an Automatic Teller Machine (‘ATM’, ‘bankomat’) for our bank.

The cost is 3 000. It is expected to last only 3 years as it will be used in a busy city center. We depreciate the cost over 3 years.

The tax benefit (‘tax depreciation’) will only be given over 4 years in this example, as there is one ‘tax life’ for all of the country’s ATM’s.

This creates a timing difference between the commercial depreciation (3 years) and the tax depreciation (4 years).

We record the tax depreciation off-balance sheet:

| Off-Balance Sheet | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 |

| Tax | -3 000 | ||||

| Tax depreciation | -750 | -750 | -750 | -750 | |

| Tax base | -3 000 | -2 250 | -1 500 | -750 | 0 |

(This identifies ‘tax base’ as some people use this in such calculations. We do not use it here.)

The tax rate is 20% in our examples, so the tax benefit will be a total of 3 000 * 20% = 600.

This will be spread over years 1-4: a benefit of 150 each year.

Our income statements (extract) will appear as:

| Income Statement | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 |

| Depreciation | 1 000 | 1 000 | 1 000 | ||

| Tax at 20% | -150 | -150 | -150 | -150 | |

| Net effect on P/L | 850 | 850 | 850 | -150 |

Is there a problem?

Yes: not only does year 4 show a tax credit without a depreciation expense, but years 1-3 show an effective tax rate of 15% (150/1000) rather than 20%.

To improve the economic presentation (the purpose of accrual accounting), we need to create a tax accrual in year 1, change it in years 2 and 3 and reverse it in year 4:

| Income Statement | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 |

| Depreciation | 1 000 | 1 000 | 1 000 | ||

| Tax at 20% | -150 | -150 | -150 | -150 | |

| Net effect on P/L before tax accrual | 850 | 850 | 850 | -150 | |

| Tax accrual | -50 | -50 | -50 | 150 | |

| Net effect on P/L | 800 | 800 | 800 | 0 |

You calculate the expected result (800) first, then calculate the difference for the tax accrual (-50). The sign must be correct for the tax accrual.

The tax accrual improves the economic presentation, but has no impact whatsoever on when the tax is credited.

The bookkeeping of the tax accrual in the balance sheet is the same amount, but opposite sign:

| Balance Sheet | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 |

| Tax accrual | 50 | 50 | 50 | -150 |

The cumulative numbers in the balance sheet (as this year’s number is added to the amount from last year) are:

| Balance Sheet | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 |

| Tax accrual | 50 | 50 | 50 | -150 | |

| Tax accrual cummulative | 50 | 100 | 150 | 0 |

The final question is whether the tax accrual (cumulative) is a deferred tax asset or a deferred tax liability. We have used debits and credits accurately. We have a debit value. A debit value in the balance sheet is an asset.

Control number to eliminate error

If the cumulative figure in the final year (year 4 in this example) is zero (0), then the calculations are correct, if the sign of the tax accrual in the income statement is correct.

Changes in tax rates

If the national tax rate changes, the tax figures and the tax accrual figures for the relevant future periods will be updated.

Example: Non-Current Asset 2

We buy an Automatic Teller Machine (‘ATM’, bankomat) for our bank. The cost is 1 000. It is expected to last 5 years as it will be used in a quiet village. We depreciate the cost over 5 years.

| Balance Sheet | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Cost | 1 000 | |||||

| Depreciation | -200 | -200 | -200 | -200 | -200 |

The tax benefit (‘tax depreciation’) will be given over 4 years in this example, as there is one ‘tax life’ for all of the country’s ATM’s.

This creates a timing difference between the financial depreciation (5 years) and the tax depreciation (4 years).

We record the tax depreciation off-balance sheet:

| Off-Balance Sheet | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Tax | -1 000 | |||||

| Tax depreciation | -250 | -250 | -250 | -250 | 0 | |

| Tax base | -1 000 | -750 | -500 | -250 | 0 | 0 |

The tax rate is 20% in our examples, so the tax benefit will be a total of 1 000 * 20% = 200. This will be spread over years 1-4: a benefit of 50 each year.

Our income statements (extract) will appear as:

| Income Statement | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Depreciation | 200 | 200 | 200 | 200 | 200 | |

| Tax at 20% | -50 | -50 | -50 | -50 | 0 | |

| Net effect on P/L | 150 | 150 | 150 | 150 | 200 |

Is there a problem?

Yes: not only does year 5 show no tax credit, but years 1-4 show an effective tax rate of 25% (50/200) rather than 20%.

To improve the economic presentation (the purpose of accrual accounting), we need to create a tax accrual in year 1, change it in years 2, 3 and 4,then reverse it in year 5:

| Income Statement | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Depreciation | 200 | 200 | 200 | 200 | 200 | |

| Tax at 20% | -50 | -50 | -50 | -50 | 0 | |

| Net effect on P/L before tax accrual | 150 | 150 | 150 | 150 | 200 | |

| Tax accrual | 10 | 10 | 10 | -40 | ||

| Net effect on P/L | 160 | 160 | 160 | 160 | 160 |

You calculate the expected result (160) first, then calculate the difference for the tax accrual (10). The sign must be correct for the tax accrual.

The tax accrual improves the economic presentation, but has no impact whatsoever on when the tax is credited.

The bookkeeping of the tax accrual in the balance sheet is the same amount, but opposite sign:

| Balance Sheet | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Tax accrual | -10 | -10 | -10 | -10 | 40 |

The cumulative numbers in the balance sheet (as this year’s number is added to the amount from last year) are:

| Balance Sheet | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Tax accrual | -10 | -10 | -10 | -10 | 40 | |

| Tax accrual cumulative | -10 | -20 | -30 | -40 | 0 |

The final question is whether the tax accrual (cumulative) is a deferred tax asset, or a deferred tax liability.

We have used debits and credits accurately. We have a credit value. A credit value in the balance sheet is a liability.

The model has the past, present and future income statement and balance sheet numbers and a control number to ensure accuracy. It is a perfect record to use and audit.

The model can be used for revenue and costs, if the debits and credits are accurate. The model can be reduced in size for any accrual used for only 2 years to one similar to that used above for revenue.

Tax losses and tax credits

In the bucket marked ‘deferred tax’ are timing differences, tax losses and tax credits.

In most countries, if you made a loss last year, you can pay less tax this year on your profits. Similarly, a tax credit (to pay less tax) may be given by the government as an incentive, rather than a cash grant.

Both tax losses and tax credits are components of tax. They will reduce your tax bill.

Timing differences are accruals for tax. In contrast, they will not have any impact on your tax bill whatsoever. They are not tax. They are accruals for tax. By throwing them in the same bucket as tax losses and tax credits and calling them ‘deferred tax’, confusion is allowed to reign.

Tax knowledge required

If there is an accrual, or revaluation, which increases (or decreases) profit, but has no impact on the current period’s tax bill, you need to assess whether there will be a tax charge (or credit) when the profit (or loss) is realized. If so, an accrual for tax is needed.

If in doubt, accrue the tax.

You need to identify if there are timing differences for non-current assets.

If you move profit from one period to another, accrue the tax so that a movement of profit of 100 has a net impact of 80, after the accrual for tax at 20%. (Adjust the number to your tax rate, if different.)

Conclusion

Timing differences are the most common part of what is called ‘deferred tax’. If you can accrue for tax, in the same way that you make other accruals, the job will be done.

You do not need to use ‘tax base’, or worry whether it is based on the ‘balance sheet’ or ‘income statement’ methods. Just make the tax accruals.

Deferred tax is neither deferred, nor tax: it is an accrual for tax.

Acknowledgement:

I would like to express my thanks to Silvia Mahutova FCCA for hosting this article.

About the Author

Professor Robin Joyce runs IFRS courses in Russian and English in Moscow at the Association of Russian Banks.

Did you like the article?

If you liked this article, please share it with your friends or colleagues and leave a comment below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

61 Comments

Leave a Reply Cancel reply

Recent Comments

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Very comprehensive and interesting. Vertical presentation of amounts of CU in the examples at first created confusion for me, but then understood.

How do you manage to answer so many questions?

🙂 The truth is I answer only some questions – those that are not too specific and can help many users, because otherwise I would not have time to do anything else. I appreciate all comments and questions, though. Have a nice day!

Thanks Silvia, That’s Very helpful and I really appreciate your effort,

This is really very interesting insight and helpful for accountants who are struggling in the area. Keep it up !.

Thank your so much !.

Thank you for your efforts I really appreciate it

Since I discovered your site it became my reference in terms of IFRS IAS standards, and I’m learning

Thanks again.

Thanks a lot very informative

There seems to be a typo.

“An accrual for tax is needed in 2XX3, which will be reversed in 2XX4 when the tax is levied:”

For 2XX3, the “Net effect on P/L” should be -80 instead of 80.

Thank you for your efforts I really appreciate it

Since I discovered your site it became my reference in terms of IFRS IAS standards, and I’m learning

Thanks again

Excellent explanation – simplicity works best.

Wow Silvia,I don’t have words to thank you. you made this complex issue very simple! Thanks

Hi Silvia,

Thank you so much for all these videos and articles. They are really useful.

I am currently looking for some examples of accounting of deferred tax on share based payments. Could you please help me with that? I am basically looking for some understanding of situations when DTA is taken to equity rather than to profit and loss.

Thank you again

Dear Silvia, I am writing to discuss particular fact pattern in which the Jurisdiction levy an income tax based on shareholding structure of the Company. In such jurisdiction, the income tax is levied to the extent of profit attributable to non-resident shareholder. The net profit is determined as per applicable tax regulation. The Company is required to pay such tax irrespective when such profit is distributed to the shareholder. As per the arrangement b/w the Company and non-resident shareholder, the Company will be reimbursed by the shareholder, the amount of tax it has paid to taxation authority. Since the tax base and accounting base of the financial statement item differ; whether the Company accounts for DTA / DTL on differences and also the income tax in its books or such tax be considered applicable to shareholder and Company is not required to recognize any tax charge in its book rather create receivable from non-resident shareholder as and when the related tax is paid to taxation authorities on behalf of shareholder. It is also pertinent to mention that Company is also required to withhold tax on distribution of profit to non resident shareholder which is not adjustable in the hand of said shareholder. Thanks for your valuable comments.

Hi Silvia: I am writing to discuss particular fact pattern in which the Jurisdiction levy an income tax based on shareholding structure of the Company. In such jurisdiction, the income tax is levied to the extent of profit attributable to non-resident shareholder. The net profit is determined as per applicable tax regulation. The Company is required to pay such tax irrespective when such profit is distributed to the shareholder. As per the arrangement b/w the Company and non-resident shareholder, the Company will be reimbursed by the shareholder, the amount of tax it has paid to taxation authority. Since the tax base and accounting base of the financial statement item differ; whether the Company accounts for DTA / DTL on differences and also the income tax in its books or such tax be considered applicable to shareholder and Company is not required to recognize any tax charge in its book rather create receivable from non-resident shareholder as and when the related tax is paid to taxation authorities on behalf of shareholder. It is also pertinent to mention that Company is also required to withhold tax on distribution of profit to non resident shareholder which is not adjustable in the hand of said shareholder. Thanks for your valuable comments.

Hi Silvia

Is the DT treatment on finance lease assets same as PPE ?.

Just brilliant!!!

Hi Silvia, thanks for the article,very useful for students. Can i ask you when do you treat DTA as short term

Hi Ahmed, DTA is always non-current, it’s the requirement of the standard.

That’s an excellent article for any IFRS Reader. It may help you to get the vision of IAS12.

Congrats on your project!

Adrian.

Hi! Thank you for this article. Could you do an explanation on deferred tax using balance sheet method?

Im quite confused on the difference between Income statement method (which is not allowed) VS balance sheet method…

Thanks and appreciate your help!

Hi Cheryl, this article does not speak about the income statement method – it only explains the effects of deferred tax on profit or loss. I teach the balance sheet method in the IFRS Kit. S.

Can we add deferred tax liabilty balance in to deferred tax calculations???

Hi Silvia

IAS 12 requires a DTL to be established on revaluation reserve…let’s say the asset is depreciable and has different tax rates as per books / tax.

IAS 16 perhaps permits an entity:

– to allow a proportionate transfer of RR to RE over the life of the asset or

– a complete transfer from RR to RE only at the end of the useful life / disposal.

Will DTL be reversed if RR is transferred only on asset disposal, especially since the income statement will have the impact of excess depreciation?

Secondly, would the reversal of DTL be effected through Statement of income or OCI?

This is a very good explanation of deferred tax. The simple method used is very useful helps a lot in understanding the theory and the basis

Nice explanation. I require one clarification for IFRS accounts. Company has recorded a gain on revaluation from its investment property, however over all the company is in loss. This is the first year of the company accounts. So now the company has to book a deferred tax expense under the heading of tax expense for current year? Based on my knowledge it is not like deferred tax asset where you check future taxable profits availability, so losses need to go up by the DTL amount for C/yr.

If in prior period, we had both a deferred tax asset and a deferred tax liability in the books and in current year, the movement during the year reveals a tax credit. Where is the tax credit applied?

a) to the existing deferred tax asset to increase it

or

b) to the existing deferred tax liability to reduce it?

Dear Ada,

In general, you need to recognize the deferred tax asset for unused tax credits (if probable they will be used). But still, why do you have both DTA and DTL? Why did you not offset? Is it in the consolidated financial statements, or what’s the reason? If it’s in the consolidated financial statements, then you need to assess the tax credit with the deferred tax of the same entity (i.e. you can’t offset DTA of a parent with DTL of a subsidiary in most cases). S.

HI Silvia

We calculate deferred tax at the time revaluation of PPE. Say it was a depreciable asset (building). Here the liability is created by debiting the revaluation surplus. As per para 41 of IAS 16 an entity may transfer the depreciation net of taxes to the retained earnings from the revaluation reserve. Should we transfer the related deferred tax liability to the P&L (SCI) or retained earnings?

Yes, you should 🙂 Good point!

Hi Silvia,

if a company was adopting p&L approach all thru last 10 years and now when it adopts balance sheet approach will that lead to huge difference ? if yes why ? please give few examples.

Will Land value is an item of difference causing Def tax? permanent diff cannot lead to Def tax..

Hi Silvia,

You are doing great job.

Could you share an article that explain deferred tax through balance sheet approach.

Thanks

Can you please explain on approaches for computation of Deferred Tax i.e. Profit & Loss / Balance Sheet and please also explain why….

Hmhm, I will do it, but not in the comment – this question deserves more attention 🙂

Hi Silvia,

Thank you very much.

I have a question regarding the deferred tax impact of provisioning for trade receivables.

In most jurisdictions provisions for doubtful debts are not recognized by tax regulators but write-offs are allowed. IN a given year where there are no write-offs, the tax balance and the carrying value will be different. Should an entity be recognizing deferred tax assets or liabilities based on this difference?

Thanking you in advance…

Regards,

Ahamed

Dear Ahamed,

it seems we have a temporary difference here if you assume that one day in the future, you will write the receivable off. In this case, as write-offs are deductible, deferred tax arises. S.

Dear Silvia, I work in financial services company engaged in trading business. There are significant amount of unrealised gain/loss recognised as at reporting date on derivatives and held for trading investments. As intention is to make short term gains, there is uncertainty relating to realisation of this gain/loss in next year. Still is there need to recognise deferred tax asset/liability on unrealised loss/gain arising on derivatives and held for trading assets.

Hi Amit,

what do you mean by unrealized gains/losses? Does it mean that you revalue your assets to their fair value at the reporting date and you put these FV gains/losses in profit or loss?

In this case, the carrying amount of your assets or derivatives is certainly different from their tax base (as I assume that in your country, you don’t tax FV gains/losses, just when assets/derivatives are sold). So yes, you need to recognise deferred taxation on all temporary differences existing at the reporting date (although they will reverse short time after the year-end).

S.

Hi Silvia

Deferred Tax is expected to reverse after the asset is written down.

Using DTL for example, the expense is initially booked through P or L in the respective years.

In the year of reversal, when debiting the liability, what ledger will be credited?

Do we restate or account for it in the current year?

BR

Hi,

I’m quite blur about the “deferred tax does not affect the tax payable part”

If i have DTA b/f, then i have profit during the year, i need to reverse the DTA out, then this will cause my tax payable to decrease isn’t?

Please assist on this. Thank you very much!

Regards,

Xue Shan

Hi,

no, it will not cause your tax payable to decrease. Reversal of DTA is charged in deferred tax expense and this expense does NOT affect your current income tax payable (when you calculate your current income tax payable, you take profit before taxes including deferred taxes). S.

Thanks S! You are so helpful!! <3

great article, thank you

This has always been a challenging topic.

Thanks for making it easier to understand and apply.

very knowledgeable piece. Thanks and keep it up.

very useful and conceptual

thanks a million its been a challenge and its good to know.

thank you very much. this has been a big challenge to me. i now know

Good and simple explanation on the subject.

Well done and God bless for a wonderful job.

Wow! That was a brilliant outline, simple and easier to understand.

Thank you Robin.

To you Madam Silvia,We appreciate your efforts to help us comprehend IFRSs and allowing Professor Robin Joyce to further enlighten us on the IFRSs.

We’re all proud of you, Keep up excellent job you are doing.

thank for articles,they have been helpful.however i request for the group consolidations,becourse i did not receive all notes

This is great.I needed some additional material for IAS 12 as I will be attempting ACCA P2 Corporate Reporting in December.

Many thanks

This is very helpful. Thanks to the both of you!

thank you very much the article is of great importance and helpful

Thanks Silvia for the job well-done! Never been so equipped and cleared on Tax accrual than today! Thumbs up to the Prof and best regards!

It’s really encouraging me that in future I will be good accountant, i am still gaining

Thank you Silvia and Robin

Thanks Silvia for the lesson!

Please help me with deffered tax

Thanks Silvia for the lesson

Thanks to Robin this time 🙂

Good presentation