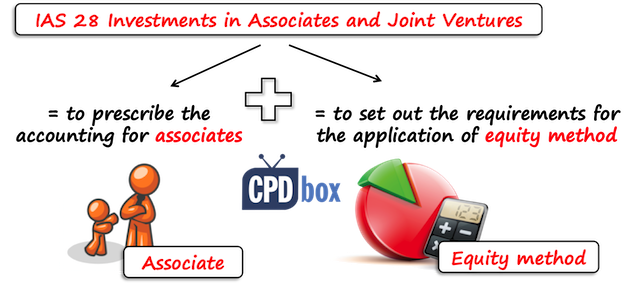

IAS 28 Investments in Associates and Joint Ventures

Let’s focus on associates, joint ventures, significant influence and equity method today.

You have already learned various aspects of having control over some investment: how to identify it, how to account for it and we also learned basic consolidation procedures step by step.

It was all covered by IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements.

Another very frequent type of investment is an associate over which an entity has significant influence. It is all arranged by the standard IAS 28 Investments in Associates and Joint Ventures, so let’s take a look.

What is the objective of IAS 28?

The objective of IAS 28 Investments in Associates and Joint Ventures is:

- To prescribe the accounting for investments in associates, and

- To set out the requirements for the application of the equity method when accounting for investments in associates and joint ventures.

Let me remind you a couple of terms:

An associate is an entity over which an investor has significant influence.

A joint venture is a joint arrangement whereby the parties having joint control of the arrangement have rights to the net assets of the joint arrangement.

What is significant influence and how to detect it?

Standard IAS 28 defines significant influence as the power to participate in the financial and operating policy decisions of the investee, but is NOT a control or joint control of those policies.

Sometimes, it can be quite difficult to determine whether we deal with control or significant influence – and we can’t make a mistake, because the whole accounting treatment and reporting depends on this classification.

How can significant influence be evidenced?

The main indicator of significant influence is holding (directly or indirectly) more than 20% of the voting power of the investee.

BUT!

It’s not the rule of thumb and often, the truth is different.

Sometimes, when an investor holds more than 20% of the voting power (but less than 50), it can still control the investee.

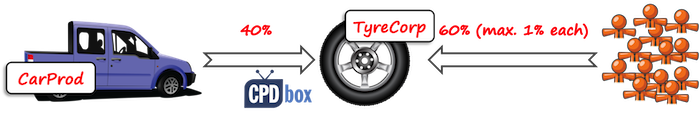

Let me show you an illustration (taken from my IFRS Kit):

Here, CarProd does not own the majority (over 50%), but it’s still more than 20% – that would indicate significant influence.

But, as other investors own max. 1% each, the probability of outvoting CarProd in major decisions is very low, so CarProd may in fact exercise control over TyreCorp, rather than significant influence. Of course, you would need to examine it further.

The other ways of evidencing significant influence are as follows:

- Investor has a representation on the board of directors (or other equivalent governing body) of the investee.

- Investor participates in policy-making processes (including dividend decisions).

- There are material transactions between the investor and its investee.

- There’s interchange of managerial personnel.

- Provision of essential technical information.

When you assess the presence of significant influence, you should not forget to examine potential voting rights (in form of some options to buy shares, or convertible debt instruments, etc).

Apply the equity method

Once the investor acquires significant influence, or joint control of a joint venture, then it must apply equity method.

The basic principles of equity method are:

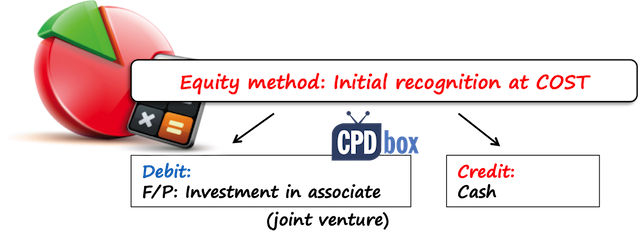

On initial recognition:

- The investment in an associate or joint venture is recognized at cost. The journal entry is:

- Debit investments in the statement of financial position,

- Credit cash (bank account, or whatever applies).

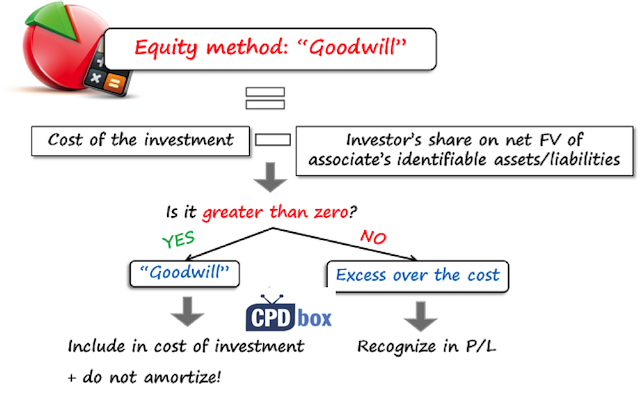

- If there’s a difference between cost and investor’s share on investee’s net fair value of identifiable assets and liabilities, then it depends, whether this difference is positive or negative:

- When the difference is positive (cost is higher than the share on net assets), then there’s a goodwill and you don’t recognize it separately. It is included in the cost of an investment and NOT amortized.

- When the difference is negative (cost is lower than the share on net assets), then it’s recognized as an income in profit or loss in the period when the investment is acquired.

Subsequently, after the initial recognition:

- The carrying amount of the investment is increased or decreased by the investor’s share on investee’s net profit or loss after the acquisition date. The journal entry is:

- Debit Investment in the statement of financial position, and

- Credit Income from associate in profit or loss.

Or vice versa when an associate made loss.

When an associate or joint venture make losses and these losses exceed the carrying amount of the investment, investor cannot bring down the carrying amount of the investment below zero. Investor simply stops bringing in further losses.

- When an investee distributes some dividends to the investor, then such a distribution decreases the carrying amount of the investment. The journal entry is:

- Debit Cash (or whatever applies here) and

- Credit Investment in the statement of financial position.

Learn the equity method procedures

The procedures in equity method are very similar to consolidation procedures under the standard IFRS 10 Consolidated Financial Statements:

- Both investor and investee shall apply uniform accounting policies for the similar transactions.

- The same reporting date shall be used, unless it’s impracticable.

- Investor’s share on gain or loss from mutual „upstream“ and „downstream“ transactions is eliminated.So here, you don’t eliminate mutual balances (receivables or payables) outstanding at the end of the reporting period, but you eliminate just investor’s share on trading profit and similar items.

Exemptions from applying the equity method

Investor does not need to apply the equity method in one of the following circumstances:

- Investor is a parent that is exempt from preparing consolidated financial statements by the scope exception of paragraph 4(a) of IFRS 10 (it’s similar as below point); OR

- All of the following applies:

- The entity is a wholly owned subsidiary; or it’s a partially-owned subsidiary of another entity and its other owners have been informed about and do not object to not applying the equity method;

- The entity’s debit or equity Instruments are not traded in a public market;

- The entity did not file, nor is in the process of filing, its financial statements with a securities commission or other body for the purpose of issuing any class of Instruments in a public market;

- The ultimate or any intermediate parent of the entity produces consolidated financial statements available for public use that comply with IFRS.

- When an investment in an associate or a joint venture is held by in entity that is a venture capital organization, mutual fund, unit trust or similar entity, then investor might opt to measure investments at fair value through profit or loss under IFRS 9 (and thus not apply equity method).The same applies for the situation when an investor has an investment in an associate a portion of which is held by these organizations.

Here, I’d like to add that when an investment meets the criteria in IFRS 5 and is classified as held for sale, then an investor shall apply IFRS 5 to that investment and not equity method (even when it relates to a portion of investment, then IFRS 5 is applied to that portion).

When to discontinue equity method

An investor stops applying the equity method when its investment ceases to be an associate or a joint venture.

The way of discontinuing depends on specific circumstances, for example if the investment becomes a subsidiary, then an investor stops equity method and starts full consolidation in line with IFRS 10/IFRS 3.

You can watch a video with the summary of IAS 28 here:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello Sylvia, Let’s see the investor invest in an associate (A parent of group of companies) how should investor value the investee? is it through the investee’s standalone FS or the investee’s consolidated FS? if it’s through standalone FS, are there instances that the investor will value it at consolidated basis? (Kindly site IAS i could site to defend the argument) Thank you in advance for noticing my queries.

Dear Silvia, Could you tell me whether an investment in a subsidiary can be measured at fair value in the parent company’s financial statements and then consolidated? So, the Company will fair value this investment at each financial year.

In individual parent’s financial statement – yes, there is that choice in line with IAS 27. However, in consolidated financial statements: no, generally not, the subsidiary must be consolidated. The exception is when the parent is investment entity according to IFRS 10 – in such a case, a subsidiary is not consolidated, but shown in its fair value.

Thank you Silvia. So, indeed a parent company that is not classified as an investment entity, the ability to present investments at fair value is limited. If such a parent were to lose control of a subsidiary, it could then account for any retained interest at fair value, but this would not apply if the parent continues to hold controlling interest in the subsidiary. In this case, the parent must continue to use the cost method unless it decides to change its accounting policy, which would need to be applied retrospectively. So, only the investment in associate and using the equity method could be fair valued but this with amendments to IAS 28. And here is allow non-investment entity investors to retain the fair value measurement applied by their investment entity associates and joint ventures to their subsidiaries when applying the equity method. This means that if a non-investment entity holds an investment in an associate that is itself an investment entity, it can measure that investment at fair value, aligning with the measurement approach of the investment entity.

Hi Silvia,

If Company A owns 40% shares in Company X and Company B owns 60% shares in Company X , but both Company And B have equal voting rights. How Company X is accounted for in Company A and B?

Hi Silvia,

I have one confusion. As per IAS 27 (Separate financial statements), it is allowed to account for investment in associate under

1. equity method, or

2. cost model, or

3. as per IFRS 9.

However, in IAS 28, it is requiring to account under equity method. Does this mean in separate FS it can be shown at cost and in consolidated FS it will be accounted under equity method?

Hi Waqas, yes, exactly.

How do we treat impairment loss in investment in associate?

we are group of companies and we have investment in an associate “X” through our group Companies A and B. Companies A and B both have common directorship and one of directors is also a director of X. I owes 25% in X through A and 2% through B. Is X is associate for both A and B?

Yes. In this case, both A and B have common directorship (of the same director of X), which essentially means that A and B have significant influence over X (plus consider ownership).

Hi Silvia,

For the illustration (taken from IFRS Kit), if another 60% shareholder of Tyrecorp is held by 1 entity/person instead, does Carprod still remain appropriate to recognise the investment in Tyrecorp as an Associate or Financial Instrument as per IFRS 9?

Hi Liew, if we assume that % of ownership equals to % of voting rights, that would mean that the other shareholder would most likely be able to exercise control and Carprod would be able to exercise significant influence – that points to the equity method.

Hi Silvia,

What is the accounting treatment of Tyrecop in Carprod and other shareholder if % of voting rights not equal % of voting rights?

Hi Silvia, If the investor or parent company sells a piece of equipment to the investee, how is this transaction treated under the equity method?

Hi Silvia thank you so much.I have a question:

How do we account for an error whereby a person has treated a joint operation as an associate and vice versa.What sort of journal entries do we process

Hi Sylvia. I would like to ask if in previous year the associate was accounted for using equity method. However in this year the holding company fulfils the exemption from applying equity method due to change in group structure. As such, on its financial statements the associate will be stated at cost. Then how to treat the previous year’s share of profit.

Some simple calculations of Investments in Associates are needed.

Hi Sylvia, I have a question, for a company that has only an investment in an associate. does it need to prepare consolidated accounts or would it just need to account for the investment using equity method ? i.e. recording share of profits

I also need answer to this question.

No need to prepare consolidated financial statements here. These are mandatory only when there is a subsidiary, and no exception applies.

Hello Silvia, thanks for the article one question, how do you calculate the cost of an investment if the parent company used PPE instead of cash. Do you take the cost of ppe in parents book or do you need FV ? or something completely different ?

Thanks in advance

FV of PPE as it is a form of non-cash consideration.

Thanks for the answer, so the parent would include the gain/loss in PL ? or should it go directly to equity.

Hello Rati,

Yes the parent will include the other’s share of gain (if sold at gain). Conversely, if sold at a loss, then it will include entire loss in it’s books (ref. = para 28, 29 & 30 of IAS28).

@Ms Silvia,

Pl. correct if I’m mistaken.

As far as I understand – “cost” should be non-monetary >>> would use historical cost

-“share in Net assets” >>> perhaps monetary as once the associates pays dividend, parent com.. will credit share in associates so this represents cash settlement and should be subject to FX revaluation.

If we say that Equity method is = cost + share on Net assets

I would recalculate cost using historical FX rate as this is non-monetary item

and share on Net assets recalculated using Year-end FX rate as this is subject to future cash settlement once the Associates pays out the dividend.

Does it make sense?:)

Hm, but in the link you sent for mon/non-mon., I see that investment in associates is non-monetary item, so based on that logic, I should only use historical FX rate, both for cost and equity method.

I would use YE- FX rate, only in case that Fair value method would be applied.

Hello Silvia,

Sorry for a silly question:)

If parent company owns investment in associates which is denominated in foreign currency (e.g. foreign associates) and parent company uses equity method.

Would you recalculate total = (cost + share on associate’s Net assets) using Year-end FX rate or recalculate only share on Net assets using YE rate and cost using historical cost?

Hmhm, is this monetary or non-monetary? 🙂

Hi Silvia,

When I review the impairment of an investment in associate, should do I evaluate the impairment of the investment as whole, or its assets indivudually? An investment in associate is evaluated for impairment individually or can be part of an CGU? Thank you!!

As a whole since you have one asset in your books. However its individual assets will affect the value as a whole.

Thank you!

Dear Silvia,

I have an investment in associate at the end of the reporting period of lets say $20,000. The share of losses apportioned to my investment equal to $25,000. I have recognised a provision (liability) of $5,ooo because I have legal or constructive obligations to the associate. My entries are

What if next year, the associate incurs losses again? Will it increase my provision balance again?

Thank you in advance for your time.

Hi dear Eve

You recognise provision if your entity has incurred obligation. any amount your obligation should not recognise

exeed of your obligation

Hi Sylvia, thanks for this. It seems from the above that the value of an associate in an entity’s consolidated financials is not necessarily equal to their share of the net assets of that entity. I am being told this by a number of people in my organisation but I think they are wrong. For example, say we bought 25% of an entity for $5m, and that entity had net assets of $15m on acquisition. This transaction would generate goodwill of $1.25m ($5m – $15m*25%), which would be effectively included in the cost of the associate (and not separately disclosed). Assuming no impairment, the value of that associate would always be greater than the share of net assets because of the equity method.

Conversely, in the case of a bargain purchase, the carrying value of the investment in associate would actually be equal to the share of net assets. Using the same example, say we bought 25% of the company and only paid $3m. This results in $750k which would be accounted for: Dr Investment in associate Cr P&L. The value of the investment in associate on acquisition would then be $3.75m, equalling the share of net assets ($15m*25%). The associate value would then rise up and down by the change in net assets of the business.

Am I correct here or am I missing something?

Many thanks for your time.

Hi Sylvia, my question is related to initial recognition. If at initial recogntion, the fair value of the asset invested is diffent from its carrying amount, what cost are we going to consider? is it the fair value of the asset or its carrying amount or anything else?

I mean different, not diffent

Hi Ms Silivia

I need help with regards to accounting for unrealised losses from when an investor sells property to the associate for less than the carrying amount.

Thanks for the notes

Hello Linah,

The investor shall recognize whole of losses in thsi transaction (ref. = para 29 of IAS 28).

@Ms Silvia.

Pl. correct me if my understanding is in-correct.