How to Account for Artwork under IFRS

A few weeks ago I visited our dentist together with my little 4-year old girl just to check up everything’s OK with her little teeth.

While we were sitting in the waiting room, my little one playing with the small teeth replicas (OMG!), I looked around myself noting that there were beautiful wall paintings around, evoking soothing feelings before other scary things at dentist’s chair.

There’s always an accountant inside me and that little voice asked: How would you treat these paintings in your accounts under IFRS? I know, I suffer from a “job-related impact” or a “deformation by profession” 🙂

The truth is that I received fair amount of questions from my readers about this issue, because many professional offices contain at least some decorations.

IFRS do not contain any specific guidance applicable to “artwork” and therefore, we must stick with what’s in place.

In my opinion, the first thing to do before any attempts to account for your artwork, is to answer the following question:

What kind of artwork do you have?

Artwork itself is a very broad category and we just can’t lump everything together. You should consider a few aspects of your artwork, such as:

- Does your artwork have a determinable useful life?

- Is your artwork exposed to wear and tear?

- Does your artwork have some residual value? Can you sell it when you want to?

- Is your piece of art separable? Or is it attached to the other piece of property, for example – artistic painting on the wall?

- Does the value of your piece of art tend to increase with time rather than decrease? Does it have some historical or cultural value?

- Is the value of your artwork material for your financial statements?

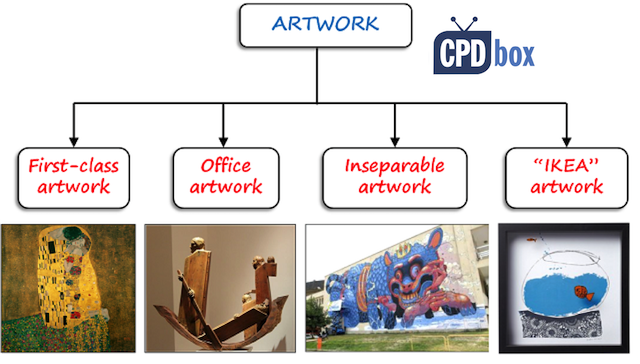

After answering all the above questions, we can come up with 4 basic classes of artwork (I named them up for easier reference):

Class 1: First-class artwork

All kinds of art collections or individual pieces may fall into this class, including various paintings, statues and sculptures, probably (but not solely) acquired in artistic auctions and held primarily as a store of wealth. These pieces usually do have some cultural or historical value.

Usually, the primary goal for acquiring artwork is exactly making an investment and many people acquire a piece of art rather than some financial instrument for the purpose of storing value.

Unfortunately, IFRS do not contain any guidance in relation to this type artwork. We can’t really apply IAS 16 Property, plant and equipment (PPE), because first-class artwork does not meet the definition of PPE (due to its purpose of capital appreciation). Neither can we apply IAS 40 Investment property, because IAS 40 limits its scope to land and buildings.

Therefore, I’d like to bring IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors to your attention. Indeed, this is what we should do:

Develop your own accounting policy

IAS 8 specifically says in paragraph 10 that in the absence of an IFRS that specifically applies to a transaction, other event or condition, management shall use its judgment in developing and applying an accounting policy that results in information that is both relevant and reliable.

Acquiring a piece of art with historical value for the purpose of storing the wealth is exactly the transaction not specifically addressed by IFRS, therefore you should develop your own accounting policy.

How?

You can’t simply develop accounting policy out of thin air, because there’s IAS 8 hierarchy you should follow.

IAS 8 says that when you develop your accounting policy, you should refer to and consider the following resources in descending order (hence the name “IAS 8 hierarchy”):

- The requirements in IFRSs dealing with similar and related issues;

- The definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in the Framework; and finally,

- The most recent pronouncements of other standard-setting bodies that use a similar conceptual framework to develop accounting standards, other accounting literature and accepted industries if they do not conflict with the sources in points 1 and 2.

For example, you can refer to IAS 40 Investment property dealing with property acquired for capital appreciation or rental income, because the purpose of your first-class artwork is very similar.

In fact, fair value model appears to be the most appropriate for these assets, as they often have indefinite useful life, their fair value tends to increase over time (although not always) and they are held as a wealth store.

I also recommend looking to guidance in other accounting principles, for example, to UK GAAP and their FRS 30 Heritage Assets that deals with the similar items. When you look there you’ll also find out that FRS 30 prescribes something like IAS 40 fair value model for these assets.

Fair value model under IAS 40

Under fair value model, the property is measured initially at cost including the transaction cost. Subsequently, the property is remeasured at fair value determined in accordance with the standard IFRS 13 Fair Value Measurement.

Gains or losses arising from changes in the fair value of investment property must be included in net profit or loss for the period in which it arises. That’s it. There’s no depreciation.

I think applying the fair value model to really valuable artwork that appreciates with the time is wise and appropriate selection of an accounting policy.

Class 2: Office artwork

What can we include here: all kinds of paintings, sculptures, replicas and other items held primarily for decorating your office or workplace in general.

These items may have non-negligible acquisition cost, they might be produced specifically for you by the artist or purchased in galleries. In other words, these are not small items – I write about these in class 4.

These pieces of art really make your workplace or office a pleasant and comfortable place and they create an atmosphere that you want and need in your business. Thus we can say that they meet the PPE in line with IAS 16, as they are used either in a production of goods or services (e.g. decorations in Thai wellness center creating calming place for massages) or for administrative purposes (e.g. paintings in CEO office).

How to account for office artwork

As we may classify office artwork as an item of PPE in line with IAS 16, you have 2 models to choose from:

- Cost model, under which you hold your assets at cost less depreciation less impairment loss; or

- Revaluation model, under which you hold your assets at fair value at the date of revaluation less subsequent depreciation less subsequent impairment loss.

Which model to select?

If there’s a market for these items and fair value can be obtained, then you can opt for revaluation model and revalue these items regularly. Otherwise, just stick with cost model.

What about depreciation?

I can hear you saying: but we can’t book depreciation on our artwork as we can’t determine its useful life and it will always have some value!

OK, I got you.

Some items have a useful life as businesses know in advance when they are going to replace interiors. Also, some items simply wear and tear by inconsiderate treatment or just because. In this case, it should not be a problem to make an estimate of asset’s useful life and residual value.

For items with indefinite useful life that you can sell whenever you want, it’s OK not to depreciate when the residual value is the same or even higher than the acquisition cost (you should prove that).

So when you acquired some high value paintings from a famous artist and display them in your CFO’s office, you don’t depreciate them as long as you can support the residual value of that painting equal or higher than the cost or fair value (depending on the model you apply).

Class 3: Inseparable artwork

Personally I like this smoking monster because it’s a kind of mad and terrific at the same time, but you would not believe how much excitement and debates it raised among honorable men sitting in the municipal board!!!

Back to the point: In this case, treat the artwork as a subsequent expenditure related to an item of PPE in line with IAS 16. If the artwork brings some future economic benefits and its cost is reliably measurable, then you should capitalize it (not as a separate asset, but to the cost of the related PPE).

For example, above mentioned municipal swimming pool argued that this crazy painting raised much more interest among people and the number of pool’s visitors rapidly increased. As a result, pool’s turnover increased, too.

You definitely need to depreciate this artwork over its useful life. If you plan to remove or replace the artwork after few years, then depreciate it over these few years (artwork’s useful life is not necessarily the same as the useful life of the related building). If you plan to leave it there until the building is destroyed or until the end of your lease, then depreciate it over the remaining useful life of the property. You get the idea.

However, if the painting does not bring future economic benefit and is seen just as some servicing or maintenance, then you should expense it in profit or loss. Although, you would rarely hire an artist for maintenance works, would you?

Class 4: “IKEA” artwork

Here, I would classify all kinds of posters, framed and unframed replicas, little statues, vases and other small things that can be acquired easily anywhere, including the famous furniture chain IKEA (hence the name “IKEA”).

This is an artwork, too and it should be treated in line with IAS 16 exactly as the class n. 2. However, these items are rarely material and although they will be used mostly for more than 1 year and IAS 16 says nothing about the value threshold of PPE, it’s OK to expense them right to profit or loss as some office supplies.

Just be careful, because in some circumstances, these items can be material, if acquired in high amounts.

For example, one local company running a building with about 100 apartments for rentals acquired about 100 pieces of framed posters from IKEA. Sure, they were going to use it for decoration purposes in the apartments. One poster cost about 100 EUR, but total cost climbed to about 10 000 EUR which was quite material for that particular company.

What to do in this case?

Well, IAS 16 does not describe the unit of account, or what constitutes an item of PPE. Therefore, you may need to apply judgment. Maybe it would be appropriate to aggregate individually insignificant items and apply the criteria to the aggregate value. Or maybe not – I leave it to you and your decision.

So, did I answer some of your question? Please, say your word by making comment below this article and if you liked it, share it with your friends and help me spread the word about this website. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

60 Comments

Leave a Reply Cancel reply

Recent Comments

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Great analysis. Very helpful

Dear Silvia,

How do you account for trees or flowers that are for decorative purposes only. Is it biological asset or PPE ?

Thanks in advance

You can expense it off because it is merely a decoration purposes.

Thank you so much for the informative read. The article is interesting as it combines two of my interests, Art and accounting.

HI Sylvia,

I use GAAP accounting and am writing a similar article where I compare GAAP to IFRS. I know very little about IFRS. My question to you is ” In IFRS is there something actually called “First-Class Art Work”? Or is this what you are just calling “Fine Art”. If IFRS uses the word “First-Class Artwork” then I would want to research that more. But if it is just fine art compared to Ikea art, then I can continue to use the word “fine art” in my article. I am going to define my fine art as being art such as the Mona Lisa.

Loved your article, it is superb!

Hi Teri, no, IFRS do not use any word for “artwork” whatsoever – they are completely silent. This article is just an insight into the approach that can be taken when accounting for artwork under IFRS. S.

Great! An accountant thinking mind!!

😀

Hi Silvia

I would love to hear your thoughts on the methodology for valuation of artwork adopted by a Government Department. The Department has items of artwork of cultural significance (Aboriginal artwork) and artifacts on its asset register (capitalization threshold of $5,000).

The Department’s policy on artwork is not to depreciate it as they have long and indeterminate useful lives. Subsequent to initial recognition as an asset, the valuation model is used for the measurement of artwork. The valuations are undertaken by an independent professional valuer every 3 years.

The recent valuation has shown that some assets that were previously valued in excess of $10,000 is now valued at $4,000 which is below the asset threshold. My question is whether these items of artwork should be decommissioned from the asset register as it is now below the capitalization threshold or if it should remain on the asset register in case it appreciates in value in the future? There are other items of artwork below the capitalization threshold that is maintained on a Portable and Attractive Register for insurance and accountability purposes.

Thanks

Hi Ella, I would keep them capitalized, just because their initial value exceeded the capitalization threshhold. By the way – I would absolutely love to see them!

Hi Sylvia,

Great article. I cannot find your reply on Dean’s question above and repost same.

Could you please assist with the disclosure of the asset.

I am presently faced with such a situation where I feel the application of IAS40 will best represent the particular artwork. My question however relates to the disclosure of said asset(s). Would you disclose it as a separate line-item with a comprehensive note, describing the artwork and detailing how one arrived at the accounting policy etc? I assume it would be incorrect to include it under Investment Property?

Many thanks

OK Glodean and Dean, let me respond.

I think that Dean has responded himself quite well. I would not include artwork within investment property, because it is simply NOT the investment property – you only developed a specific accounting policy similar to investment property for artwork. If it is material, include as a separate line item on the face of your statement of financial position and of course, the note would be required. S.

If I may add, it can also be accounted for as inventory under IAS 2 if acquired for short-term investment purposes and traded in the ordinary course of business and depending on the facts & circumstances, can be either measured at (1) lower of cost or NRV or (2) treated as commodities measured at fair value less cost to sell.

Your analytical words on the topic amazed me Silvia. Thanks.

Hi Silvia,

Well elaborated article and an unusual topic dealt so well and in such depth is highly appreciated. However, recently our management has thought about placing some additional artworks in the terminal buildings of airports for those” WOW “factors and feel good factor with passengers. I don’t see any Probable future economic benefits due to these artworks (such as statues from local sculptors, paintings with local cultural flavours). Hence I intend to expense them off. It may be noted that some of the statues do costs $5000 and when few such statues are to be placed in different airports of the said airports authority. When these are added up it becomes material to company. How do I deal the auditors? Looking forward for clarity.

Thanks in anticipation.

Hi jnti,

I think that there are future economic benefits of these artworks. If passengers feel better in the buildings due to more pleasant environment, then it adds value to the airport, doesn’t it? I would definitely capitalize these statues and artworks. S.

Thanks Silvia for your valuable article.

I have one question. My company has purchased and installed some picture frames during this year, at different timings.Our accounting policy is to capitalise the fixed assets which exceeds Usd500. The purchase in the beginning of the year is less than Usd500, so I didn’t recognize the expense as PPE. But in aug 17, around five picture frames were purchased and installed, total expense was usd 1000. So should I capitalise the expense for 5picture frames as fixed assets?

In SEP, we installed a few more picture frames but it was less than 500, so I didn’t not recognise it as fixed assets also.

Looking forward to your reply!

Thanks.

Hi Cindy,

the question is whether the total value of picture frames is material for your company or not. If yes, then technically speaking, you should treat it as a set of picture frames and each purchase is addition to this set.

Kind regards

Silvia

Thanks Sylva for these valuable notifications.

I have a question regarding the wood piece that contains the name of the manager/doctor/engineer..etc and placed on the officer’s table. This piece of wood might be materialand reliably measured. Is it likely to be classified as a PPE under IAS 16, or to be expensed in the statement of profit & loss.

Technically speaking, it’s a PPE because you assume that the sign will be on display for more than 1 period. If you run a hospital and have lots of these signs, then as a set they might be material. S.

Thanks for these valuable notes Sylvia.

I have a question about wood piece that contains the name of the dr./engineer/..etc. It is likely to be material. Can we consider it as an asset in accordance with IAS 16 or a marketing promotion to be expensed in statement of p&l?

Thanks

Hi Silvia,

Very insightful article. Question: How will you treat POP materials/posters/banners that you will use over a 2 – 3 years period? Since they are classified as marketing expenses they were expense.

Please advise.

Hi Brian, correct, you expense them. S.

in fact very interesting I have gained a lot and can attempt IFRS examination and also can handle some issues not treated by IFRS In the office .thank you Silvia but how can I be getting more ? I am a student of MSC accounting and finance pls assists me

Hi Levi,

thank you, I’m happy to help. Not able what you mean by “getting more” 🙂 You can still browse the other articles, or even sign up for my premium training where I teach some advanced accounting techniques, too. 🙂

Firstly thank you for the well written article… much appreciated. Couple of questions around the treatment of assets that may have been recognized wrongly at the outset.

If in a situation artwork that should have been rightly accounted for under categories 1 or 2 (separate class without depreciation unless apparent) had been recognized as any other general fixed asset and depreciated on a straight line basis how should the accounting treatment be corrected? Keeping in mind that in the books the artwork is now at near zero NBV as a result of being depreriated over time?

Opens the door to the wonderful world of fundamental error / restatement???

Dear Jethika,

well, it seems that you have selected an incorrect accounting policy for these assets, but this must be very carefully assessed. If this is the case, then yes, you need to apply IAS 8 and restate. S.

Thanks Silvia I feared as much. Appreciated

Hi Silvia,

Just would like to check with you. If we got the artwork/painting for free from artists and display them either in the general office area or CEO’s office, is it correct to consider them as “IKEA” artwork as well? FYI, currently these artwork in my company are recorded at $1 each purely for administrative and tracking purposes. However, they were valued by professional valuers in 2013 and they are insured.

So, which principle or category should be used? IKEA/class 4 artwork or class 2 and consider it as PPE as per IAS 16? Looking forward to your reply.

Dear Azim,

in my opinion, it’s clearly Class 2 as I named it. The reason is that IKEA artwork does not have much resale value and you would not normally insure it. It’s only for decoration.

However, free artwork from artists that actually does have some fair value or market resale value (as they were valued and valuers put some value on them) would classify for PPE. I would apply revaluation model in this case, probably with zero depreciation charges as it seems that paintings would not lose their value over time. It’s also totally fair to show these paintings in their fair value in your balance sheet (not at 0 or $1). S.

Just a few line in my reading of the above article I was

convinced that your a great learner and teacher. Please

keep it up. GREAT WORK.

Hi Silvia,

Thanks for the useful document. However can you advise which guideline to take as a base for this to enable management and auditor to take a call? Is it IAS 16/ IFRS 13.

Regards,

Monty

Well, it depends on what you are assessing – just look above. This area is not guided specifically in IFRS, so the aim of this article is to provide you some reference. I can’t say it’s IAS 16 or IFRS 13 – depends on the situation. S.

Very insightful presentation . A question please : in a circumstance where there is no record of cost at acquisition , or cost was minor and some time ago, is it reasonable to record the current value and take the surplus to a reserve, that ie follow the “revaluation model” ?

Hi Garry, yes, that would be a reasonable choice of your own accounting policy, of course – depending on what kind of artwork you have. S.

Hi Silvia

Great article on an unusual topic that does not appear to have received much coverage.

I am presently faced with such a situation where I feel the application of IAS40 will best represent the particular artwork. My question however relates to the disclosure of said asset(s). Would you disclose it as a separate line-item with a comprehensive note, describing the artwork and detailing how one arrived at the accounting policy etc? I assume it would be incorrect to include it under Investment Property?

Many thanks

Hi Sylvia,

I found this very interesting and insightful. Your logic is also very clear and precise.

I only have one question though? Why did you not take GRAP 103: Heritage assets into account?

This is the framework we use in local government (in South Africa as issued by the ASB) and it is very detailed in terms of which types of assets would be considered to have historical or cultural value. Perhaps the users could also be referred to this as it has some examples as well.

It also speaks to when an asset would be depreciable and when not. In essense, the asset would not need to be depreciated in instances where there are adequate measures in place to preserve the asset. These measures are mostly in place at museums etc., but an avid art collector would have the same measures. The requirements of what would be classified as a heritage asset is however very strict and the actual standard should be evaluated before such a treatment is considered appropriate.

Thank you for the ensightful read.

Great and valuable omment, Riaan, thank you! It will definitely help users to make their own opinion. Of course, you can take GRAP 103 Heritage assets into account. If you note above, I took FRS 30 Heritage assets as a guide for “First-class artwork” and I’m sure you would find similar 1-2 standards.

I think that treatment of high-value historical assets is not that problematic. However, people are often unsure how to treat cheaper artwork, that was for example constructed/painted on demand, or directly on the wall etc. I just wanted to point people in the right direction, to give them arguments and support for their decision.

Thanks again! S.

Dear Silva,

AS per IASB Framework (recognition principle for any elements of financial statements), IAS 1(definition of asset) and IAS 16 (PPE), you can recognize an asset, when [IAS 16.7]

• it is probable that the future economic benefits associated with the asset will flow to the entity, and

• the cost of the asset can be measured reliably.

You can never recognize artwork as asset, since you will never know the exact future benefits (in financial term) you would generate because of displaying the artwork.

Recognition criteria. IAS 38 requires an entity to recognise an intangible asset, whether purchased or self-created (at cost) if, and only if: [IAS 38.21]

it is probable that the future economic benefits that are attributable to the asset will flow to the entity; and

the cost of the asset can be measured reliably.

This requirement applies whether an intangible asset is acquired externally or generated internally.

The probability of future economic benefits must be based on reasonable and supportable assumptions about conditions that will exist over the life of the asset. [IAS 38.22] The probability recognition criterion is always considered to be satisfied for intangible assets that are acquired separately or in a business combination. [IAS 38.33]

If recognition criteria not met. If an intangible item does not meet both the definition of and the criteria for recognition as an intangible asset, IAS 38 requires the expenditure on this item to be recognised as an expense when it is incurred. [IAS 38.68]

The following items must be charged to expense when incurred:

internally generated goodwill [IAS 38.48]

start-up, pre-opening, and pre-operating costs [IAS 38.69]

training cost [IAS 38.69]

advertising and promotional cost, including mail order catalogues [IAS 38.69]

relocation costs [IAS 38.69]

For this purpose, ‘when incurred’ means when the entity receives the related goods or services. If

the entity has made a prepayment for the above items, that prepayment is recognised as an asset

until the entity receives the related goods or services. [IAS 38.70]

The above recognition principle – to expense, is applicable for all sorts of advertisement, promotional, or for ‘feel good’ items, no matter whether they are billboard or TV ad, whatever amount they are for, such as million dollar, etc.

Hi Mohammad, thank you for your comment. However, I don’t understand why you’re writing about intangible assets here – I clearly explained in my article what I refer to and it was NOTHING intangible. Also, I never refer to something promotional or advertising, I simply meant some art painting on the wall. I fully agree that you should recognize promotional expenses in profit or loss – please see my comment under the article.

I don’t know what you understand under the term “artwork”. It seems my understanding is a bit different and I explained it in my article, too.

I really appreciate your passion towards accounting and we also get benefit of it. 😀

Thank you 🙂

Thank you, Ather, I really appreciate 🙂

Thanks for the artwork presentation. I really appreciated it.

Hi Sylvia

Interesting article..in fact a question came in my class when we were discussing PPE and I answered not in a similar fashion….but almost similar to Mr.Rajesh’s thoughts but treated as ‘ deferred expenditure’…your explanations seem more logical…all the best

Prof.Ranganathan Aiyar

Associate Dean

Faculty of Accounting and Finance

Botho University

Gaborone

Botswana

Thank you, Mr. Ranganathan, I really appreciate your feedback!

Indeed valuable Silvia. Thanks a lot for this.

Thank you for this wonderful piece, Silvia!

The elaborate explanations are well grasped.

Please permit me to take you away a bit from this topic of discourse: What is the appropriate treatment of cost of conversion from local GAAPs to IFRS? Outright expensing or can it be amortized?

HI Josh, thank you!

I would say to expense the cost of conversion from local GAAP to IFRS, as it’s a service and does not meet the definition of intangible asset.

S.

They are very useful, thanks Silvia!

Thanks for up date for knowledge sake. My organization do not have artwork. The knowledge could be useful tomorrow.

This piece is knowledgeable. It has clarified some confusion my team and I had. Thanks Silvia.

🙂

Valuable article. Keep up the good work…

Hi Silvia,

I have a question in relation to your above article. In case of “Inseparable Art Work” you advised to capitalize it as it will bring future economic benefits but from my view point all advertisements cost are incurred as they will bring future economic benefits. So why not we treat “Inseparable Art Work” as an expense as we do in case of advertisement expenses.

Please inform what criteria I should use to treat advertisement expenses separately from “Inseparable Art Work” and should not capitalize it.

Thanks & Regards

Rajesh Thakur

Hi Rajesh, that’s an interesting idea, but you should not compare advertising with artwork, as their purpose is different. Advertising is here to promote your business directly (in most cases) and artwork is here for making your premises pleasant (yes, it can attract more customers, but it’s more-less side effect, as artwork usually does not promote anything directly).

Also, you should expense advertising cost when the advertisement is in place. For example, when you pay fee for billboard displayed over 3 months, then you should expense these costs over 3 months (not immediately), as the billboard attracts these customers exactly for these 3 months. Once you put it down, it has no advertising effect.

However, I understand that sometimes it’s difficult to distinguish artwork from advertising – in such a case, use your professional judgment 🙂

S.

Thanx for the clarification.

Rgds

Rajesh

Hi Silvia…thank you for this analysis! Would you say that IFRS is also silent on how a museum might want to report the carrying value of their Exhibits? We all know that Museums generally don’t hold Exhibits to sell them again…they mostly look after them for as long as they can. Would you say IFRS is silent on how to report the value of Exhibits on the balance sheet? If so, would an accounting policy for museum Exhibits be fine under IFRS so long as reportable figures are relevant and reliable? For example would IFRS have any problem with a museum reporting their Exhibits (whether or not they purchased them or they were donated to the museum) at its replacement value (i.e. its insurable value)? I understand that under US GAAP museums can report their Exhibits at nil value if they really want to…would IFRS be okay with this too? I really appreciate your time and feedback!!!! Personally I think reporting Exhibits at their replacement value is a relevant value for readers of the FS. If someone donated an Exhibit that had a replacement value of say $10,000, I’m assuming it would be okay under IFRS to debit the Exhibit for $10k and credit donations for the same? Naturally any work done to preserve the Exhibit would be expensed. If the replacement value increased in later years to say $15k, then the Exhibit would be debited for $5k and the credit would either sit forever in a segregated account on the balance sheet…or would it be better to credit the income statement? I’m now beginning to see why many museums apply a nil value to all of their Exhibits!…with note disclosure mentioning what the replacement cost is. Thank you again for your time!!!!!

Well highlighted guidelines on the treatment of artworks as per IFRSs, simple and well explained for every individual to understand. Thank you very much Silvia and keep up good works. Your articles has been very helpful to us all. Kudos!

Dear Silvia,

once again excellent article. Structure and solutions for practicioners. Short and clear.

Thank you,

Silva

Great analysis there Silvia. Thanks for this update.