IFRS 16 Leases Explained: Full Guide + Free Video & Checklist

Updated: May 2025

IFRS 16 changed lease accounting forever. Lessees now bring almost all leases onto the balance sheet — no more hiding operating lease liabilities in the footnotes.

In this guide, you’ll learn how IFRS 16 works in practice, including main rules, two free video lectures and practical checklist to download and use as your reference.

Jump to section:

1. Free VIDEO lecture: Overview of IFRS 16 Leases

2. Objective of IFRS 16

3. What is a lease under IFRS 16?

4. Accounting for leases by lessees

5. Free VIDEO lecture: Example of lease accounting step by step

6. Accounting for leases by lessors

- 6.1 Classification of leases

- 6.2 Finance lease: Initial measurement

- 6.3 Finance lease: Subsequent measurement

- 6.4 Operating lease

7. Sale & leaseback transactions

8. Presentation and disclosures in line with IFRS 16

9. DOWNLOAD IFRS 16 Practical Checklist

10. Further reading&learning

1. Overview of IFRS 16 Leases (free VIDEO lecture)

2. Objective of IFRS 16

The objective of the standard IFRS 16 Leases is to specify the rules for recognition, measurement, presentation and disclosure of leases.

But, why is there a new lease standard when we had an older IAS 17 Leases?

The main reason is that under IAS 17, lessees were still able to hide certain liabilities resulting from leases and simply not present them on the face of the financial statements.

I’m talking about operating leases, especially those with non-cancellable terms.

Under the new standard, lessees will need to show all the leases right in their statement of financial position instead of hiding them in the notes to the financial statements.

Note: IFRS 16 applies for the periods starting on or after 1 January 2019 (careful about the comparatives).

Return to top

3. What is a lease under IFRS 16?

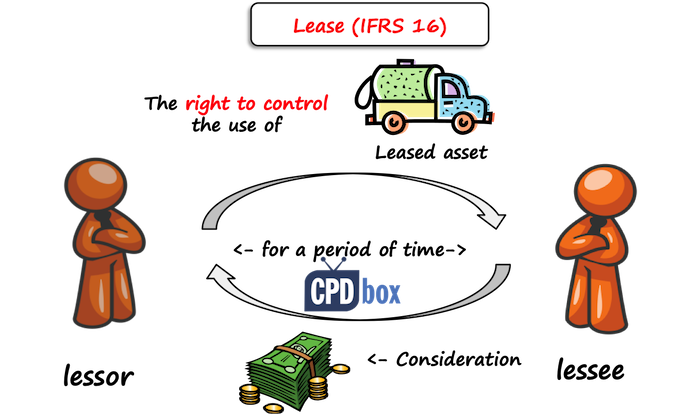

A contract is or contains a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration (IFRS16, par.9).

This definition of lease is much broader than under the old IAS 17 and you must assess all your contracts for potential lease elements.

You should carefully look at:

- Can the asset be identified? E.g. is it physically distinct?

- Can the customer decide about the asset’s use?

- Can the customer get the economic benefit from the use of that asset?

- Can the supplier substitute the asset during the period of use?

If the answer to these questions is YES, then it’s probable that your contract contains a lease.

As I wrote in my article about comparison of IFRS 16 and IAS 17, the impact of this new broader definition can be quite big, because some service contracts (with payments recognized directly in profit or loss) can now be considered as lease contracts (with necessity to recognize right-of-use asset and lease liability).

Under IFRS 16, you need to separate lease and non-lease components in the contract.

For example, if you rent a warehouse and rental payments include the fees for cleaning services, then you should separate these payments between the lease payments and service payments and account for these elements separately.

However, lessee can optionally choose not to separate these elements, but account for the whole contract as a lease (this applies for the whole class of assets).

Return to top

4. Accounting for leases by lessees

Warning: Lessees do NOT classify the leases as finance or operating anymore!

No classification!

Instead, lessees account for all the leases in the same way.

4.1 Initial measurement

At lease commencement, a lessee accounts for two elements:

- Right-of-use asset Initially, a right-of-use asset is measured in the amount of the lease liability and initial direct costs.Then it is adjusted by the lease payments made before or on commencement date, lease incentives received, and any estimate of dismantling and restoration costs (remember IAS 37).

- Lease liability The lease liability is in fact all payments not paid at the commencement date discounted to present value using the interest rate implicit in the lease (or incremental borrowing rate if the previous one cannot be set).These payments may include fixed payments, variable payments, payments under residual value guarantees, purchase price if purchase option will be exercised, etc.

Let me outline the journal entries for you:

- Lessee takes an asset under the lease:

-

Debit Right-of-use asset

-

Credit Lease liability (in the amount of the lease liability)

-

- Lessee pays the legal fees for negotiating the contract:

-

Debit Right-of-use asset

-

Credit Suppliers (Bank account, Cash, whatever is applicable)

-

- The estimated cost of removal, discounted to present value (lessee will need to remove an asset and restore the site after the end of the lease term):

-

Debit Right-of-use asset

-

Credit Provision for asset removal (under IAS 37)

-

4.2 Subsequent measurement

After commencement date, lessee needs to take care about both elements recognized initially:

- Right-of-use asset

Normally, a lessee needs to measure the right-of-use asset using a cost model under IAS 16 Property, Plant and Equipment.It basically means to depreciate the asset over the lease term:-

Debit Profit or loss – Depreciation charge

-

Credit Accumulated depreciation of right-of-use asset

However, the lessee can apply also IAS 40 Investment Property (if the right-of –use asset is an investment property and fair value model is applied), or using revaluation model under IAS 16 (if right-of-use asset relates to the class of PPE accounted for by revaluation model).

-

- Lease liability

A lessee needs to recognize an interest on the lease liability:-

Debit Profit or loss – Interest expense

-

Credit Lease liability

Also, the lease payments are recognized as a reduction of the lease liability:

-

Debit Lease liability

-

Credit Bank account (cash)

If there is a change in the lease term, lease payments, discount rate or anything else, then the lease liability must be re-measured to reflect all the changes.

-

4.3 Is this too complicated? Exemptions exist!

If you got this far in reading this article, maybe you find it overcomplicated, especially for “small” operating leases.

Here’s the good news:

You do NOT need to account for all leases like described above.

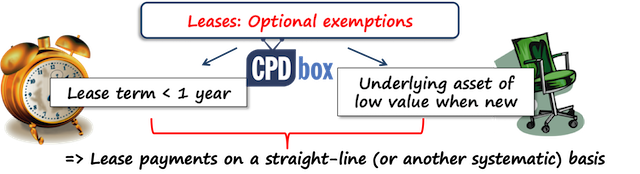

IFRS 16 permits two exemptions (IFRS 16, par. 5 and following):

- Leases with the lease term of 12 months or less with no purchase option (applied to the whole class of assets)

- Leases where underlying asset has a low value when new (applied on one-by-one basis)

So, if you enter into the contract for the lease of PC, or you rent a car for 4 months, then you don’t need to bother with accounting for the right-of-use asset and the lease liability.

You can simply account for all payments made directly in profit or loss on a straight-line (or other systematic) basis.

Return to top

5. Example: Lease Accounting by the Lessee (free video lecture)

6. Accounting for leases by lessors

Nothing much changed in accounting for leases by lessors, so I guess you already are familiar with what follows.

6.1 Classification of leases

Unlike lessees, lessors need to classify the lease first, before they start accounting.

There are 2 types of leases defined in IFRS 16:

- A finance lease is a lease that transfers substantially all the risks and rewards incidental to ownership of an underlying asset.

- An operating lease is a lease other than a finance lease.

IFRS 16 (IFRS 16, par. 63) outlines examples of situations that would normally lead to a lease being classified as a finance lease (and they are almost carbon copy from older IAS 17):

- The lease transfers ownership of the asset to the lessee by the end of the lease term.

- The lessee has the option to purchase the asset at a price that is expected to be sufficiently lower than the fair value at the date of the option exercisability. It is reasonably certain, at the inception of the lease, that the option will be exercised.

- The lease term is for the major part of the economic life of the asset even if the title is not transferred.

- At the inception of the lease the present value of the lease payments amounts to at least substantially all of the fair value of the leased asset.

- The leased assets are of such a specialized nature that only the lessee can use them without major modifications.

6.2 Finance lease: Initial measurement

At the commencement of the lease term, lessor should recognize lease receivable in his statement of financial position. The amount of the receivable should be equal to the net investment in the lease.

Net investment in the lease equals to the payments not paid at the commencement date discounted to present value (exactly the same as described in lessee’s accounting) plus the initial direct costs.

The journal entry is as follows:

-

Debit Lease receivable

-

Credit PPE (underlying asset)

6.3 Finance lease: Subsequent measurement

The lessor should recognize:

- A finance income on the lease receivable:

-

Debit Lease receivable

-

Credit Profit or loss – Finance income

-

- A reduction of the lease receivable by the cash received:

-

Debit Bank account (Cash)

-

Credit Lease receivable

-

Finance income shall be recognized based on a pattern reflecting constant periodic rate of return on the lessor’s net investment in the lease.

IFRS 16 then also specifies accounting for manufacturer or dealer lessors.

Return to top

6.4 Operating lease

Lessor keeps recognizing the leased asset in his statement of financial position.

Lease income from operating leases shall be recognized as an income on a straight-line basis over the lease term, unless another systematic basis is more appropriate.

Here you can see that the accounting for operating leases is asymmetrical: both lessees and lessors recognize an asset in their financial statements (it’s a bit controversial and there were huge debates around).

7. Sale and Leaseback transactions

A sale and leaseback transaction involves the sale of an asset and the leasing the same asset back.

In this situation, a seller becomes a lessee and a buyer becomes a lessor. This is illustrated in the following scheme:

Accounting treatment of sale and leaseback transactions depends on the whether the transfer of an asset is a sale under IFRS 15 Revenue from contracts with customers.

- If a transfer is a sale:

- The seller (lessee) accounts for the right-of-use asset at the proportion of the previous carrying amount related to the right-of-use retained. Gain or loss is recognized only to the extend related to the rights transferred. (IFRS 16, par.100)

- The buyer (lessor) accounts for a purchase of an asset under applicable standards and for the lease under IFRS 16.

- If a transfer is NOT a sale:

- The seller (lessee) keeps recognizing transferred asset and accounts for the cash received as for a financial liability under IFRS 9 Financial Instruments.

- The buyer recognizes a financial asset under IFRS 9 amounting to the cash paid.

8. Presentation and disclosures in line with IFRS 16

Lessees must:

- Present right-of-use assets either separately or within the same line item as similar assets.

- Show lease liabilities separately or as part of other financial liabilities.

- Disclose:

- Maturity analysis of lease liabilities

- Expense from short-term and low-value leases

- Cash outflows for leases

- Additions and carrying amounts of right-of-use assets

- Significant judgments (e.g., lease term, discount rate)

Lessors must disclose:

- Risk exposure from residual value guarantees

- Selling profit or loss for manufacturer/dealer lessors

- Income from variable lease payments

9. DOWNLOAD IFRS 15 Practical Checklist

10. Further reading and learning

Explore more on IFRS 16: Visit this page to access the full library of all IFRS 16-related articles, videos, and examples published by CPDbox.

Learn IFRS with real examples – not just theory.

Any questions? Please let me know below, thank you!

Return to top

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Can you please share information of accounting entries at lease modification level ? what entries would be in general when we extend the period of lease as if the lease yet classified as operating lease. either the accrued rent receivables entries would be write at lease modification or simply it would be adjust in subsequent payments ?

Thanks in Advance

Hi Silvia

Thanks for your article

would like to clarify with you a simple things

Assets obtained through customer finance facility (loan) which are paid in monthly installment later (Entity direct own the title of the asset, but at the same time pledge it for finance facility), whether under this arrangement can be considered as finance lease assets (under previous IAS) which now (reclassed) are ROU under IFRS 16 lease?

Hi Budi, I can’t really say from this short description, but it seems it would be rather financing agreement (loan pledged with assets) under IFRS 9, and your assets would be shown rather as PPE, not ROU.

Hi Silvi

thanks a lot your sharing.

Hi Silva,

We fully run the service for another company and this includes the use of our fleet. We ultimately charge one fixed price for the entire service. Do they need to record the use of our fleet at all on their balance sheet?

Hi Silva, thank you for your articles on IFRS 16, very useful. Looking for some information about subleases and was hoping you might do something on this. Looking to see how you would account for a sublease of 7 years if head lease is for 10 years. Would like to sublease for the 10 remaining years but unable to, so there is 3 years remaining. During 7 year sublease (finance lease) do you fully derecognise ROU asset or part of it? Thanks

Thank you Silvia

Please i need some clarity,

What is the accounting treatment to give to a vehicle that is on lease but was given out as gift 10 months into the 48months leases period. Lease payments due on vehicle is still been paid by lessee even after gifting car out.

Hello Silva,

Very helpful information.

I have a question. The low value assets exemption you mentioned at the beginning of the video, is it applicable to the lessee, lessor or both of them?

Lessee. It is irrelevant for the lessor as the lessor has a different accounting model.

Dear Silva,

You are doing a great work here, keep it up. A question for you.

For finance lease, will the lessor still recognise depreciation expense on the PPE?

Thank you! No, because under the finance lease, the lessor does not have an item of PPE, but the net investment in the lease (receivable).

Many thanks

Dear Silvia Mam

Can you please explain me on IFRS 16 as we are going to take equipments on rent from our mother company which worth about USD 1 million and we have to pay monthly rent USD 15000/- upto 8 years. Please tell me how this IFRS 16 effect us and what journal entries we have to pass??

Hi, May I clarify something. If you sublet a building for the remainder of the lease (to be classified as a finance lease), how do you treat fixtures & fittings that you hold as an asset on your balance sheet? Do they stay on the balance sheet and depreciate or are they impaired? Thanks

Thank you Silvia, nicely explained.

I have 1 query. Suppose vendor has deferred the lease payments by more than 1 year then the same will be considered as a lease modification? (assuming Company doesnt want to exercise the recent amendment of IFRS 16 relating to COVID 19

Yes.

Hi, may I clarify if the financial report covers 18 months period from July 2018 to December 2019, can we don’t take rental payment under IFRS 16, I know that this standard is effective beginning on or January 2019, Early adopt is allowed, can we treat this rental expense throughout this 18 months since our financial report started from 1 Jul 2018? Because our auditor insists want to pass the ROU at beginning of 2019.

Hi Dennis, according to IAS 1, you should present your financial statements at least annually. Hence I doubt that your financial report for 18 months is fully in line with IFRS – just as a technical note. So I am not able to express my opinion on this. Also, the standard IFRS 16 is mandatory for all periods starting on or after 1 January 2019. Thus, if your ANNUAL period started on 1 July 2018, you do not have to apply IFRS 16. If you are still presenting 18 months… well… if I omit the fact that you do not comply with IAS 1 regarding the frequency of reporting… presenting 6 months under IAS 17 and remaining 12 months under IFRS 16 is simply not acceptable under IAS 8 and IAS 1 (remember, consistent accounting policies throughout the period). As a result, I would apply IFRS 16 right on 1 July 2018.

Thank you Silvia, this was great article to get the first touch to the standard.

We have faced couple of things about IFRS 16 about which our auditors don’t agree. So we have a big factory building leases with two kind of lease terms:

1) open end contracts, which we are going to renew every year. I understand that in these cases, the management of our company should evaluate those and give best possible prediction on how long they are going to rent this building. But how often should we revaluate the asset and liability values? If we evaluate that we will stay there for 3 years, do we depreciate it fully or do we revaluate it every year back to 3 years?

2) This is slightly different scenario, but about the same topic. We have 5 year lease, with 5 year extension option. What kind of process we should have, when we decide when to calculate the extension in our numbers? So if we use first 5 year lease term, and then in year 3 we are sure enough to add extension. Is there any rule or suggestion on how to handle these evaluations of the lease terms? In the bigger picture, if we have quite stable big rents, should their BSvalues go down near to 0 through depreciation, and then suddenly they go back to full value when the new contract starts?

Hi Eric, well, I am aware of the fact that there is too many estimates and forecasts to use when applying IFRS, and leases is one area of them. What can I say? The standards do not really tell you how you should evaluate or assess, because each situation is specific, but in your assessment, you need to be in line with IFRS 16. And I know, it is judgemental. See, if this is really burning question, you can sign up for my Helpline service and our consultants can give you the clear advice based on assessing your situation.

Hi Sylvia,

I hope you are well. What if we just started a tenancy agreement with our landlord for 12 months but they gave us 1 month free, so in total, 13 months for the price of 12 months. Will it still be included under IFRS 16? If yes, how will be the accounting entries? Because we are paying in two payments. first payment from the commencement (50%) and remaining (50 %) in the middle of our contract. I can’t seem to understand the interest expense as this agreement does not include any interest rates. Thank you so much for your help.

How do I:

– account for the disposal or write-off of the asset and de-recognition of the leasee’s lease laibility.

– What are my journal entries?

– The lease did not run to the end of the period.

Could you kindly elaborate more on sale and leaseback maybe with the use of an example.

Hi Silvia

Thank you for your clarifications. Please assist me in the following case.

A 5 years lease contract has a term to pay 3 years rent in advance and the rest amount (2 years rent) at the end of the first three years. At the beginning of the contract the lease liability is the discounted amount of the unpaid 2 years rent amount.

But at the end of the first three years the actual payment is only one year rent amount and the lease liability extends up to the beginning of the fifth year to be settled by the last payment.

Should I re discount the lease liability and adjust the ROUA and lease liability at the end of the first three years in my books?

If so doesn’t it affect previous fiscal periods?

Thank You

Hi Silvia, thanks so much for your article. Quite insightful. I do however want to ask, if the lease period is, say 5 years but the lease makes a prepayment. He debits the “right of use assets”, right but what will be the corresponding credit entry since he has no lease liability.

Very good presentation , Great work.

Hello Silvia, Thanks very much for the valuable insights into the standards, If we have some rights to use the parent company’s assets – we are an advertising company we place digital signage and posters in the assets of the parent company (playground and spaces) and we are generating revenue. But we don’t pay anything to our parent company. please advice, the impact of IFRS-16 on us

Thanks in advance.

Hello Silvia, assuming i have leashold land for 49 years at $2m. After 5 years, its revalued to $3M. What journal entries should be passed in the accounts?

Hello Silvia

It is always great to follow you, and thanks for the best class we are getting .

Adding to the same, I have a doubt regarding the current scenario that I am facing. I working in UAE and we are having warehouses on lease. As per the signed contract the term of the lease is only one year and we can renew for the upcoming years. Each year we need to renew the contracts. Does it come under purview of ifrs 16. Or can we treat the same as rental as usual

Your expertise in this matter is highly appreciated

Thank you So Much , Great Work

Hi Silvia

I have a question about a lease agreement signed by a holding company with landlord of office premises. From the agreement, the landlord allows the office premises can be used by the holding company and its three subsidiaries but each subsidiary has to sign a deed of indemnity to the landlord individually, i.e. if the holding company default in lease payment, each subsidiary will be liable to any loss to the landlord. May I know how to treat the right-of-use asset and lease liability under IFRS 16? Can the ROU be split between all four companies? Does all four companies have obligation on lease liability?

Hi Silvia,

Should I translate lease liability ( recognized based on IFRS16) into the functional currency at every reporting date using the closing rate? I`m not sure since it seems to be non-monetary (let`s say virtual) item.

Your assistance will be much appreciated.

Thank you in advance for your prompt answer.

Hello, yes, it is a monetary item. After all, you need to give out some cash in order to derecognize that liability (although yes, I see your point).

Hi, please assist

Company X Rents a handset to a customer on a contract basis with an option to renew the lease or purchase the assets at a cost of 3 months installments. What will the Journal entries be for the initial recognition on Company X books?

Hi Silvia, we have a rental lease from a landlord for his wharehouse, it is a 4 year lease but paid monthly. Do we still need to do ROU of asset and lease libility ? The lease started in January 2018, will we need to restate 2018 financials ?

Hi Silvia, for accounting sublease as a lessor finance lease under FRS 116, i would have derecognised the ROU against the net investment of the lease. Please advise how is the head lease rental expenses is recorded subsequently. It can’t be depreciation since the ROU is no longer there. stating as rental expense also looks weird.

Hai. here is a query.please do respond

if there is a lease period of 50years but from this year on remaing period is 45years. how to calculate PV ,depreciation and interest? on basis of 50 or 45 years? and how to adjust the 5 yr diff?

Hi, I understood you are adopting IFRS 16 for the first time, so in this case please check out this article describing different options that you have, with examples. S.

Thanks. This was very helpful

Hi. On first applying the IFRS 16 to create ROU & finance lease liability we were not made aware of an addendum to the lease period. That is we computed the lease over 60 years but it should have been over 70 years. This year we made the new calculation to reflect the 70 years but we do not know how to show these adjustment on the statement of income. For example the amortisation has decreased since in previous calculation we over amortise. Where should we show this on the statement of income? Should it be reflected in the normal line for amortisation or is there some other way to show it?

Hi Juliette, was the amendment in place on the first application and you forgot to include it? If this is the case, you made an error and you should correct it retrospectively as written in this article. If the error is not material, then you don’t have to touch equity, but all entries that would be correcting equity can be done in profit or loss.

Hi Silvia,

Thank you for your clarifications about IFRS 16. I have a question about restoration cost. If a restoration cost is incurred in the middle of the contract period say for example a cost incurred after 2 years of the commencement date for a 5 year lease contract should I adjust the ROUA on the month the cost is incurred?

Thank You

Hi Hanna, you should have provided for restoration cost at the contract commencement (I mean the cost for restoring the site). So, the acquisition cost of your ROU asset should have included the provision for the restoration cost. Once the cost is incurred, then it is recognized as Debit Provision/Credit Cash (bank, suppliers…). If you haven’t done that at the contract commencement, then this is the error and you need to correct it in line with IAS 8 (depending on its materiality – if immaterial, then yes, adjust ROU asset, if material – restate).

Thank You Silvia

what about the cost is for innovation (eg. building partitions) in the rented office for a better use?

Those are the leasehold improvements and are NOT a part of ROU asset. You can capitalize them as a separate item of PPE and depreciate over their useful life (which is max. rental period).

Hi,

Under the limited retrospective approach to applying IFRS 16 by lessees, does a lessee need to to determine a new discount rate on the date of initial application (Jan 1st, 2019) to subsequently remeasure the lease liability carried forward from 2018 for a lease previously accounted for a finance lease?

Hi Silvia,

How do we adjust straight lining figure that was held in the trial balance earlier

Hi Silvia – Great Article. Question on Restoration costs. How and when do they get added to the ROU Asset. Example at lease commencement I did work on the asset and knew I would incur 10K to undo or reinstate the asset to original condition at the end of the lease say 5 years. Do I include that at the end of year 5 with my last year payment and then discount that to get the liability which will form the basis for the ROU starting asset or does it get added to the ROU asset in another manner.

Thank you

Hi Paul, well, your own costs can be capitalized as a separate asset under IAS 16 PPE (“leasehold improvements”). They do not affect lease liability (unless there is such a term in the lease contract).S.

thank you Silvia. If the contract states i have to resinstate the asset to its original condition do i book that liability (the cost to reinstate the asset to original condition) as and IFRS 16 liability or do i provide for that separately under IAS 37?

Hello Sylivie. Thanks for this awesome article about IFRS 16. My question is what could be the conditions for an asset to qualify to be a low value asset. Thanks

Hi Kaplan,

well, IFRS do not define what “low-value when new” asset is, but IFRS 16 gives the examples, such as small furniture, computers, etc.

Hi Silvia,

We are renting a house for a CEO for a period of 3 years, The company is paying the full amount to the lessor but, CEO reimburse a half of to rent paid by deducting from his net pay. A lease was identified, but should we consider that reimbursement as lease incentive as it is a deduction to rent cost we are incurring on monthly basis?

Hi Jules,

the reimbursement by CEO is NOT a lease incentive – that would be the reduction offered by the lessor. If the transaction itself is not material, then you can net off the reimbursement and rental expense. S.

Hi Silvia,

i need your support to make journal entry for lessee (leaseback)

Asset: Land with book value 700,000

market value 1,000,000

interest rate 20% with zero DP 5 years monthly installments

thanks in advance and waiting for your cooperation

Amr

Hi, I have a question.

What if the contracts doesn’t state any useful life/term and the contract is renewable and cancellable.

Thank you

Hi Silvia,

Thank you for such a detailed explanation.

Regarding initial direct costs (IDC) for the lessee, should legal costs realted to a lease agreement be considered an IDC? or are there instances where legal costs incurred may be expensed rather than capitalized.

They should be capitalised as long as directly attributable rob the lease and are incured by the lessee. Thanks

Hi, I have a question.

X Company has a Business site under a finance lease. However Y Company entered in a contract with X for sharing their site. Contract term shows that they can end the contract anytime on 30 days’ notice period. What will be treatment in books of Y Company? Is this a finance or operating lease for Y Company?

Hello.

Could you please share your opinon on the acounting treatment of refundable purchase taxes (e.g. VAT) at initial measurement of right of use asset-ROA. I think that there is a small “consistency hole” in IFRS 16.

The “story blocks” are …

1. basic concept in accounting leases from lessee’s perspective is … ROA = Lease liability

2. the primary element of ROA is the amount of the initial measurement of the lease liability

3. as lease liability is present value of the lease payments that are not paid at the lease commencement date we get from 1. and 2. … ROA (= initial measurement of the lease liability) = Lease liability (=initial measurement of the lease liability) i

But! (the point):

> if lease payments include purchase taxes which the lesee can not refund it is “logical” that non refundable taxes are a cost part of ROA;

> if lease payments include purchase taxes which the lesee can! refund, then it is not “logical” that these refundable taxes should be a cost part of ROA – reminder: the IFRS 16 rule is “ROA (= initial measurement of the lease liability) = Lease liability (=initial measurement of the lease liability)«.

Althought under IAS 16 (art. 16) non refundable purchase taxes are a part of cost of PPE, IAS 16 does not apply to initial measurment of leases as leases have to accounted for in accordance with IFRS 16 (IFRS 16 is “special law”), The problem with IFRS 16 is that it does not contain provisions about the impact/treatment of refundable purchase taxes on the initial measurement of ROA.

As it is not logical that two leased assets – one with refundable purchase taxes, one with non refundable pruchase taxes – that have the same lease payment schedule should have the same ROA-cost amount I think (my opinion) that IFRS 16 art. 24 a) should (must) be interpreted in the following way:

»The cost of the right-of-use asset shall comprise:

(a) the amount of the initial measurement of the lease liability, as described in paragraph 26 LESS REFUNDABLE PURCHASE TAXES;«

Thank you,

Matt

It’s simple, include the non refundable purchase taxes and exclude the refundable purchase taxes when computing the cost of right of use asset. IAS 16 makes it clear. Thanks

Hi Silvia, thank you for your very helpful detailed and as always insightful explanations.

I have a query regarding how we would adjust for rent accruals and prepayments existing at ye 31 dec 2018 under modified retrospective approach whereby we set the lease liability = right of use asset. I am getting confused would the journal entries on 1 jan 2019 be as simple as

Dr accrual

Cr right of use asset

Dr right of use asset

Cr prepayment

Hi Silvia,

Please guide on accounting treatment and disclosure for the property taken on lease for 30 years and lease payment made in one go on lease commencement.

Hi Palak,

well, you don’t have any lease liability here, only right-of-use asset and you will depreciate it over 30 years. S.

Thank you for such an effective presentation on summary of IFRS 16, which make it so easier to understand. Well done.

Hi Silvia.

Company A has a lease that increases 1st January each year based on a price index.

Should the Company remeasure the lease liability:

(A) on 31.12 the previous year, or

(B) on 1st January, the day the lease payments increased?

Should the 2019 Annual Report of the Company include the updated price change that happend on 01.01.2020?

Hi Silvia,

We have leased agreement for office and warehouse since past few year and we will use in future as well , but the lease agreement is renewed every year (12 month) with not right to purchase , In this case will IFRS16 applicable ? if yes then there is no definite future period mentioned in the agreement .

Please advice.

Hi Silvia, if a company as a lesse lease a car, and the least contract specifies that the lessee will pay salary for the driver on a periodical basis, which is provided by lessor; does the RoU should include the driver expense? Or it should not? Thank Youu

I don’t think so since the salary is paid rather for the driver’s service than for the right-of-use asset. This would be a service component of a contract and here you have 2 options as a lessee: either account for it separately, or account for the whole contract as for the lease.

Hi Silvia,

I just completed the IFRS 16 Course of the IFRS Kit. And I have some follow-up questions:

Incremental Borrowing Rate:

How often should we recalculate the IBR(lessee’s incremental borrowing rate) of a lease?

Should it be recalculated monthly, quarterly, yearly, or should we use the same IBR over the full lifetime of the lease?

If we implemented IFRS 16 on 01.01.2019 should we recalculate the IBR on 31.12.2019?

Sublease:

How should the ‘Finance Lease Receivable’ from a sublease be presented in the ‘Statement of Financial Position’? Under ‘Right-of-use Asset’ or ‘Other receivables’?

And should it be split between long-term and short-term?

Hi Alexander,

IBR – if there’s no change in a lease contract, then you keep it as it is.

Finance Lease Receivable in the lessor’s statement is not the same as right-of-use asset. Yes, split to current and non-current portion.

Thank you so much for the detail explanation. Please explain the treatment with the revaluation and double entries related to revaluation of ROU (Operating lease).

Hi Rizny, thank you – it is all explained in the IFRS Kit – this is too elaborate to explain it in the comment.

Hi Silvia,

Thank you very much.

Finally I was able to read this article. Great and clear explanation. Thank you so much Silvia for all your efforts. Your materials/articles are very impressive. At least I got some idea/knowledge about this new standard on lease.