Top IFRS Changes for 2016 and Later

The guys in the IASB (International Accounting Standards Board) are working very hard – it’s evident from lots of new standards, interpretations and amendments produced every year.

In today’s article, I’d like to sum up the main changes in IFRS adopted in the past years so that you can keep them in mind and prepare.

I divided the article into 3 main parts:

- The “Big3” changes effective from 1 January 2018 or later

- Other changes effective from 1 January 2018 or later

- Changes effective from 1 January 2016

Before you scroll down and jump right to the third part, I’d like to stress that the changes effective from 1 January 2016 (NOW) are not that significant and relatively easy to adopt.

In other words, you just need to be aware of them and you’ll be able to apply most of these changes immediately without great effort.

However, “Big3” changes require lots of money and time to prepare and in my opinion, this is the urgent part.

Let’s dive in.

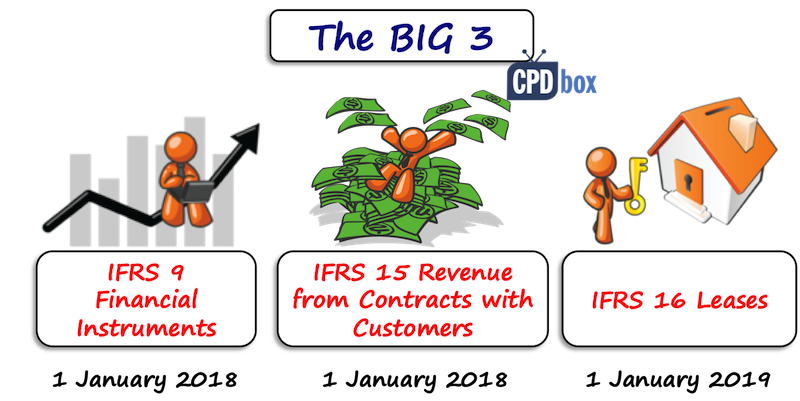

1. “Big3” changes applicable from 1 January 2018 or later

I’ve written about the “Big3” in a few articles so far and if you follow this website, you are already aware of them.

Just to recap, the Big3 are:

- IFRS 9 Financial Instruments – effective for the periods starting on or after 1 January 2018

- IFRS 15 Revenue from Contracts with Customers – effective for the periods starting on or after 1 January 2018

- IFRS 16 Leases – effective for the periods starting on or after 1 January 2019.

All of these standards affect almost every single company in some way.

Some companies will not be affected that much, but some of them will suffer a lot and need a plan and budget to implement the changes.

Why am I pointing these changes now?

Yes, they are not mandatorily applicable right now (in 2017), but please be aware that you need to present comparative amounts, too.

When you prepare your financial statements for the year ended 31 December 2018, you will have to show comparative amounts for the year ended 31 December 2017 restated under the new rules.

It means that the “transition date” or the application date will be 1 January 2017.

In other words, when you recalculate your contracts or transactions under the new rules, you compare your calculations with the amounts stated under the older rules and you need to recognize a difference as one-off adjustment at 1 January 2017.

For this purpose, please look to the standard IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors for guidance.

Also, all of these standards contain transitional provisions that specify some exceptions and guidance for the first-time adoption.

Let me give you one small advice.

Although IFRS 16 applies from 2019, I would strongly recommend dedicating more effort and work now and apply IFRS 16 earlier, together with other 2 standards.

Why?

Because, this way you only need to restate your financial statements once.

If you apply IFRS 9 and IFRS 15 from 2018 and IFRS 16 from 2019, you will need to restate twice.

2. Other changes applicable from 1 January 2018 or later

Besides Big3, other smaller or bigger changes are coming, too, but they will not affect all companies.

As it’s always good to know, let me sum up:

IFRS 17 Insurance Contracts

It is expected in the first half of 2017.

Yes, we do have an insurance standard – IFRS 4 Insurance Contract, but it is very criticized because it does not contain unified model of accounting for insurance contracts and also, it does not provide transparent information in the financial statements.

Therefore, IASB worked hard on the new insurance standard – IFRS 17.

So, if you work for the insurance company, then be aware of this forthcoming change.

IASB agreed that the new IFRS 17 would be effective for the periods starting on or after 1 January 2021.

Amendment in IFRS 2 Share-based Payment

As a result, the newest amendment in IFRS 2 clarifies and amends the following transactions:

- Cash-settled share-based payment transactions that include a performance condition (vesting conditions)

- Share-based payment transactions with net settlement features (mostly classified as equity-settled)

- Modifications of share-based payment transactions from cash-settled to equity- settled.

This amendment is effective from 1 January 2018, with earlier application permitted.

Amendment in IAS 40 Investment Property

Such a transfer is possible only when there is a change in use of the property and that happens only if that property meets or ceases to meet the definition of investment property.

Therefore, a mere change in management’s intentions is not sufficient evidence of change in use.

This amendment is effective from 1 January 2018, with earlier application permitted.

3. Changes applicable from 1 January 2016

The rest of this article contains the list of IFRS changes applicable from 1 January 2016.

Therefore, you have to adopt these changes NOW, when you prepare your IFRS closings of 2016.

The good news is, as I’ve stated above, that these changes are not so material or hard to adopt in most cases.

“Disclosure Initiative” changes (IAS 1, IAS 7)

It is a document published by IASB and in fact, it represents amendments to IAS 1 Presentation of Financial Statements.

The Disclosure Initiative should help you, people preparing the IFRS financial statements, to use your judgement when making your reports.

Namely, the amendments relate to:

- Materiality

Setting materiality is a difficult task for many preparers of IFRS financial statements and IASB has a special “materiality project” that should contain detailed guidance about materiality.For now, IAS 1 clarifies that you should not hide any useful information under the materiality cover and you should NOT obscure the financial statements by stating lots of information about immaterial amounts.

- Statement of financial position and statement of profit or loss and other comprehensive income

You can aggregate or disaggregate the line items as relevant. Also, IAS 1 contains certain considerations about subtotals and presenting entity’s share of OCI of associates and joint ventures. - Notes to the financial statements

You should consider understandability and comparability when deciding on the order of the notes. You can decide on your own order (not necessarily the same as listed in IAS 1).

This amendment is applicable from 1 January 2016.

Under the new amendment, you need to show disclosures about certain changes of liabilities from financing activities separately, namely:

- Changes from financing cash flows,

- Changes arising from obtaining / losing control of subsidiaries or other businesses,

- Effect of changes in foreign exchange rates,

- Changes in fair values and

- Other changes.

This amendment applies from 1 January 2017 (so not for 2016).

Consolidation and investment entities

However, as some companies asked how to apply this exemption, IASB issued clarifications in this amendment.

These clarifications relate to:

- Intermediate parent who is a subsidiary of an investment entity does not need to consolidate;

- A subsidiary who is an investment entity and provides services to the parent’s investment activities should NOT be consolidated;

- Non-investment entity investor holding a share in an associate or joint venture who is an investment entity can retain the fair value measurement applied by the associate or joint venture to its subsidiaries

- Disclosures are required under IFRS 12

This amendment is applicable from 1 January 2016.

IFRS 11 Joint Arrangements

That was unclear until this amendment was issued.

It classifies that when you acquire an interest in a joint operation constituting a business, then you need to apply all principles of business combinations accounting under IFRS 3 Business Combinations and other IFRS standards.

IAS 27 Separate Financial Statements

The amendment permits using the equity method for measuring investment in subsidiaries, joint ventures and associates in investor’s separate financial statements.

You can read more about it here (point n. 4).

Few changes within “Annual Improvements 2012-2014” cycle

Annual improvement cycles are special projects of IASB that should improve the quality of IFRSs, their readability and understandability.

Therefore, these changes are not that significant and in most cases, they clarify guidance or correct the wording to be more understandable.

The summary of changes applicable from 1 January 2016:

- IFRS 5 Non-current Assets Held for Sale and Discontinued Operations: the change adds the guidance for reclassifications from “held for sale” to “held for distribution” (or the opposite way).

- IFRS 7 Financial Instruments: Disclosures: the amendment adds clarifications about servicing contracts and how IFRS 7 applies to condensed interim financial statements.

- IAS 19 Employee Benefits: The amendment clarifies that you should use the high quality corporate bonds denominated in the SAME CURRENCY as benefits to be paid, in order to determine the discount rate for post-employment benefits.

- IAS 34 Interim Financial Reporting: The amendment explains “elsewhere” term and cross-referencing is required.

Amendments related to long-term assets (IAS 16, IAS 38 and IAS 41)

In 2014, IASB issued minor changes related to IAS 16, IAS 38 and IAS 41.

These changes are mandatorily applicable from 1 January 2016 and they relate to:

- Bearer plants: yes, they are living organisms, but you should treat them as any other property, plant and equipment – i.e. at cost less accumulated depreciation rather than at fair value, and

- Depreciation and amortization methods: revenue-based methods are not acceptable and permitted anymore, because they do not reflect the consumption of an asset.

Please read more about these changes here (point 3).

IFRS 14 Regulatory Deferral Accounts

The good news is that unless you prepare the IFRS financial statements for the first time and you work in a company selling goods or services at prices regulated by some regulator, you can forget everything about IFRS 14.

Please read more about it here (point 5).

Finally…

As you can see, the changes applicable immediately are really not that frightening, but Big 3 are coming closer and closer, so that should be your focus right now.

I’ve published a few articles about these 3 standards to help you familiarize yourself with them – here’s the list of the most popular ones:

- IFRS 15 vs. IAS 18: Huge Change is Here!

- IFRS 15 Examples: How IFRS 15 Affects Your Company

- IFRS 15 Summary

- IFRS 16 vs. IAS 17: How the Lease Accounting Changed

- IFRS 16 Summary

- How New Impairment Rules in IFRS 9 Affect You

- How to Implement IFRS 9

- IFRS 9 Summary

and many more. Of course, the new articles will be published, too.

However, if you have a specific question about the forthcoming changes, please let me know in the comments below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

34 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

I need someone to teach me IFRS 9 with practical examples ; teaching approach should be for DUMMIES!

Hello Silvia,

Actually Im carrying out the audit for a power generating and distribution plant. The power stations have been built of State Lands, which the entity leases from the Government and pays yearly lease rentals. The Lease period are 60 years lease. The buildings are capitalised whereas the lands are not but rather expensed in the P&L as rentals.

In this case, how should we account for in the FS with new IFRS 16? Just to add that the entity has adopted a revaluation model for its assets and the exercise is carried out every 5 years. Please email me at kvish405@yahoo.com

Thanks and Regards

Vishal

Thanks Silvia for the updates. Got it all at one place – thanks to you!

Thanks for your update information.

Dear Respected SILVIA, thank you so much for the unbelievable effort to make all these things easy and keep us updated.

Thanks Silvia for these very helpful updates.

I have a question though. Does IFRS allow the preparation of the financial statements in both the presentation and functional currencies (that is side be side).

Akin.

Hi Akin,

in fact no. IAS 1 sets the requirements for preparing the financial statements and it does not say anything about presenting the same balance sheet in 2 currencies side by side. S.

Dear Silvia Miss,

Day by day You becoming my inspiration.

Thank you…

Thank you, my pleasure 🙂

thanks for the update

HI MRS SILVIA,

Thanks for your updates and hope that it will help us to be updated with ongoing developments related to IFRS.

Sure! 🙂

its great to read your articles, so informative and easy to learn,

brilliant

Dear Silvia

I pray for your healthy life. I humbly request you to help send (if have) IFRS/IAS summery in slide views or Videos or any other mode you think better that will help me to recap & continuous development.

Great idea. I’ll try to work that out and post on YouTube 🙂

Thanks a lot Silvia, great summary of what is coming soon!!!!! Look forward to keep checking your webpage.

Milton

Hi Ms. Silvia,

Thanks for updates. Really useful.

Dear Silvia,

Thank you Silvia.This is a real time response to IFRSs changes from you but majority of Professional Accountants,including my humble self, from my part of the world relied heavily on less effective and expensive-but-late books that are of no real time value!.

Dear Ganiu Alli, thank you 🙂 Just let me humbly remind you that the Internet is a wonderful place and most of time it’s updated 🙂 But, I love reading books, too! S.

Really wonderful work and very useful indeed. Thanks Silvia.

Thank you, Amm! 🙂

Thank You Silvia. pls. Tax implication on IFRS 15 and IFRS 16

Dear Nura, the tax implications depend on the legislation of the particular country, so I can’t really generalize here. However, if your own tax rules do not change and you change the accounting policy, then of course, there’s a deferred tax arising. S.

Wow Silvia – you dont let the grass grow under your feet – thanks a lot for this summary.

You’re welcome, Tim!

Thanks Silvia,

Looking to reading more of your work. Great work

I thank you, Samuel 🙂

Hi Sylvia

May a holding company prepare separate financial statements for the legal entity and consolidated financial statements for the holding company and all its subsidiaries?

Regards

Riaan

Hi Riaan,

who do you mean by the legal entity? Holding? Subsidiary? Anyway, if a holding company controls subsidiaries, then it must prepare consolidated financial statements (unless meets one of the exceptions listed in the standard). S.

Hi Silvia

Company A controls company B & company C. Company A has to prepare consolidated financial statements including the results of companies A, B & C. Must the consolidated AFS present company A’s stand alone results in separate columns in the consolidated AFS? Or may company A prepare separate AFS for its stand alone results?

Dear Riaan,

no, you present only the aggregated amounts, i.e. consolidated statements. Of course, a company A may need to prepare the separate financial statements under IAS 27 where the investments in B and C are shown in 1 line. S.

Hi Sylvia,

Thank you very much for this recap. I’m looking forward to reading more of your articles in the future years.

Godbless,

Benjie

Thank you, Benjie, I’ll do my best 🙂

Dear Respected SILVIA, thank you so much for the unbelievable effort to make all these things easy and keep us updated.